Introduction

Bond ETFs are the exchange-traded products, which primarily invests in fixed income debt securities. Bonds or fixed income debt securities typically pay coupon, which is called interest payment. Bonds have a tenure, and completion of the tenure marks the day of repayment of the principal amount that was invested in the Bonds.

There are substantial capital gains & losses as well depending upon the price at which position it was entered, and the price at which the position was closed. Bonds are often considered as a less-risky investment due to a stream of income in interest payments.

In markets, Bond ETFs are both passively and actively managed, operating mainly as a closed-end product with liquidity deriving from trading in the stock exchange. Bond ETFs like every other ETFs that trade throughout the market hours, just like a stock.

Investors in the Bond ETFs are entitled to receive distribution amount paid by these funds. Income distribution in the bond funds is likely to be more frequent than equity ETFs. Investors having investments in Bond ETFs are likely to benefit from the diversification, and stream of income.

Bond ETFs are prone to interest rate movements, and as bonds, the price of Bond ETFs is also inversely correlated with the interest rates. Besides, there could be various types of Bond ETFs in the market depending upon the investment strategy.

Some of the main types of Bonds:

Investment Grade bonds are rated as or above Baa3, BBB-, BBB- by Moodyâs, Standard & Poor's, Fitch Ratings, respectively. Whereas, Non-Investment Grade/High-Yield bonds are rated below Baa3, BBB- and BBB- by the above-mentioned agencies.

Investment Grade

Investment Grade bonds are generally considered less risky due to the sound credit profile of the issuer. Every bond issuer, including sovereign debt issuer, is rated by rating agencies on the credibility of the issuer to pay interest and repayment.

Rating agencies conduct an in-depth analysis of the issuer, and a rating is assigned to the issuers of debt securities. Investment Grade bonds provide investors with exposure to the corporate debt of high credit quality.

These securities allow an investor to gain exposure into various sectors, including utilities, industrials, financials across the developed and developing markets in the world. Investment Grade bonds have been favoured by many investors due to better yields than sovereign debt and improving fundamentals of issuers.

A Bond ETF may choose to invest in investment-grade or other products depending upon the strategy followed by the ETF.

Non-Investment Grade

Non-Investment Grade/High-Yield bonds are relatively riskier than Investment Grade bonds due to the underlying issuer profile. Issuers of Non-Investment Grade bonds have a weaker credit profile, meaning fewer chances of recovery of debt if the default is triggered.

Historically, high yield debt has offered similar returns to the equity market, but with lower volatility. The ratings by credit rating agencies deems a bond as Investment Grade or Non-Investment Grade bonds. Any high-yield debt is rated below Baa3, BBB-, BBB- by Moodyâs, Standard & Poorâs, Fitch Ratings, respectively.

High Yield debt offers a better yield compared to the investment-grade bonds, resulting in higher coupon payments compared to investment-grade bonds. Prices of high yield debt are impacted by the performance of economy and performance of the company as well.

Other classification of Bonds:

Secured Bonds

A secured bond is a debt security issued by issuers, in which the issuers pledge specific assets as collateral in the case of default. Secured bonds are widely used by issuers with lower credit quality to make up for the risk that investors have to bear.

In the cases, where the issuer defaults on payment, the secured bondholders have the preferred right to claim the assets that have been used as collateral in the underlying secured bonds.

Unsecured Bonds

Unsecured Bond is a debt security issued by the issuer to raise capital in the borrowing like every other bond. Any bond with no underlying collateral as a pledge is said to be an unsecured bond, and this includes the majority of the bonds traded in the market.

In case of default by the issuer, Unsecured bondholders also have a right to claim assets, but these bonds are ranked after secured debt, implying that Secured Bonds would be prioritised over Unsecured Bonds while making the payment from the recovery of the defaulted debt.

Senior Notes

Senior Notes are also debt securities with the highest priority in a repayment following the liquidation of the company. The word âSeniorâ denotes the seniority of the bonds against other denominated debt, which could be secured or unsecured bond.

Bond ETFs trading on ASX

SPDR® S&P®/ASX Australian Bond Fund (ASX: BOND)

BOND is a fixed income ETF from SPDR® family, and it seeks to track the returns of S&P/ASX Australian Fixed Interest Index before fees & expenses. It provides a regular income stream via coupon payments while providing exposure to bond markets.

Besides, the ETF holds a majority of A-rated bonds, and nothing below investment-grade bonds. As of 16 September 2019, the assets under management was AUD 45.19 million.

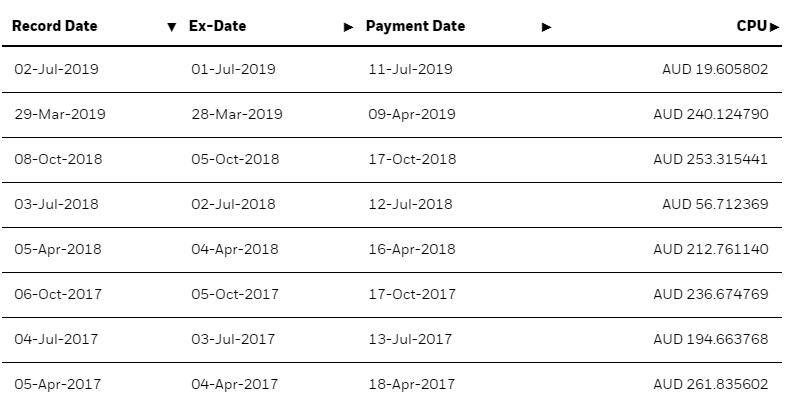

ETF distributes income on a quarterly basis, and some of the previous distributions are:

Distribution (Source: SSGA Website)

On 17 September 2019, BOND last traded at A$28.030, up by 0.215% relative to the previous close.

BetaShares Australian Investment Grade Corporate Bond ETF (ASX:CRED)

CRED seeks to track the performance of an index providing exposure to fixed-rate Australian corporate bonds, which are investment-grade bonds. Its strategy prefers securities offering better-expected returns than the Australian government bonds.

The Fund aims to provide attractive income distribution with monthly payment frequency along with portfolio diversification benefits. Its portfolio includes senior, fixed-rate investment-grade securities denominated in the local currency issued by ASX-listed companies.

In addition, the fund charges a management cost of 0.25% per annum, and senior bonds denominated portfolio allow the fund to rank itself above shareholders in the event of default.

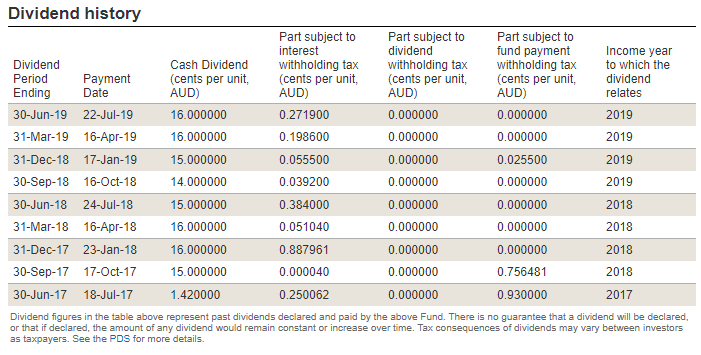

Distributions (Source: BetaShares Website)

On 17 September 2019, CRED last traded at A$27.640, up by 0.327% relative to the previous close.

VanEck Vectors Australian Corporate Bond Plus ETF (ASX: PLUS)

PLUS invests in a diversified portfolio of Australian Dollar-denominated bonds, which includes high-yielding investment- grade debt securities. It seeks to maintain a return that matches the performance of the Markit iBoxx AUD Corporates Yield Plus Index, before fees & costs.

The fund distributes income on a quarterly basis and charges a management cost of 0.32% per annum.

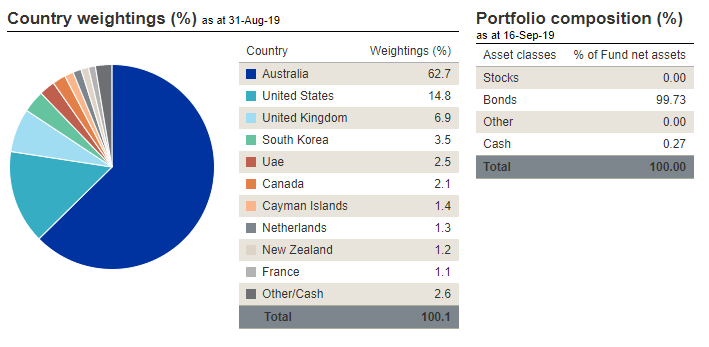

Portfolio Structure (Source: VanEck Website)

The underlying index is designed to reflect the performance of high-yielding AUD denominated corporate debt. Investment-grade bonds have an 80% composition in the index, and entry to the index requires Investment Grade credit rating with maturity between two to ten years.

Some of the previous distributions of the fund are below:

Distributions (Source: VanEck Website)

On 17 September 2019, PLUS last traded at A$18.61, up by 0.215% relative to the previous close.

iShares Global High Yield Bond (AUD Hedged) ETF (ASX: IHHY)

IHHY provides an investor with an exposure to high yield corporate credit across countries. It seeks to maintain a return similar to an index before fees and expenses, which includes globally developed, liquid and high yield corporate bonds.

The funds use Markit iBoxx Global Developed Markets Liquid High Yield Capped Index (AUD Hedged). Besides, IHHY distributes income tri-annually to the holders of the fund.

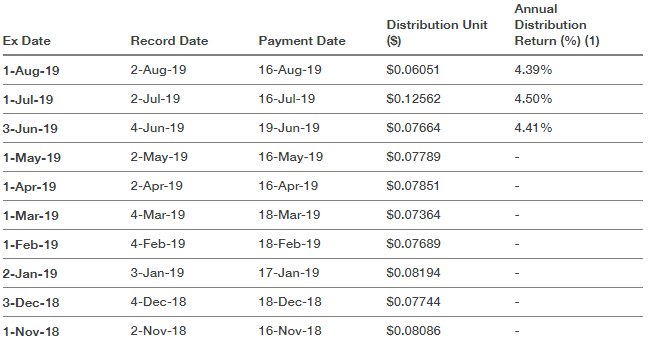

Distributions (Source: iShares Website)

On 17 September 2019, IHHY last traded at A$107.56, down by 0.647% relative to the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.