Commodity markets around the globe have witnessed an erratic movement in 2019 so far, and while the prices of few commodities have underpinned strong growth, rally in few commodities has impacted the operating margins of the ASX-listed mining companies.

Gold and ASX-Listed Gold Miners:

Gold, the safe haven, observed a strong rally from the beginning of the year 2019 in the backdrop of global turmoil. Many global events, such as the U.S-China trade war, fears of No-deal Brexit, European Crisis, Tension in the Middle East, etc., have propelled the gold price in the international market.

Some of the ASX-listed gold miners coupled with strong fundamentals, have wrapped the rush for the safe-haven and provided massive returns to the shareholders.

Also Read: Safe Havens Back in Demand, Look at 10 ASX Gold Stocks

ASX-Listed Gold Miners with Bumper Returns:

ASX-listed gold miners such as Newcrest Mining Limited (ASX: NCM), Evolution Mining Limited (ASX: EVN), Resolute Mining Limited (ASX: RSG), Gold Road Resources Limited (ASX: GOR), etc., have matched the global as well as domestic indices and some have even outperformed the benchmarks.

S&P Commodity Producers Gold Index:

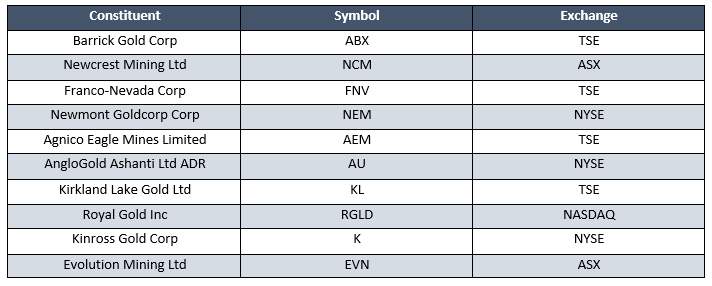

The S&P Commodity Producers Gold Index tracks the movement in global gold stocks listed on various exchanges.

The top ten constituents by weight of the index are as below:

Also Read: Barrick Gold to Offload its Kalgoorlie Superpit Stake; Cash Rich Australian Miners in Focus

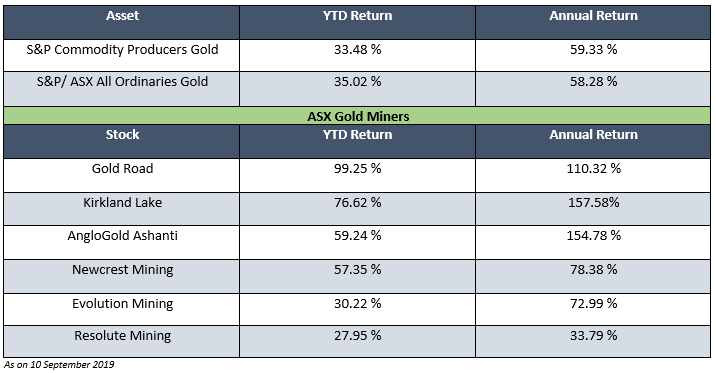

On a YTD basis, the S&P Commodity Producers Gold Index has delivered a total return of 33.48 per cent and a net total return of 33.33 per cent. The yearly return of the index is at 59.33 per cent (as on 10 September 2019).

Return Table:

The ASX-listed gold miners such as Gold Road (ASX: GOR), Kirkland Lake Gold (ASX: KLA), AngloGold Ashanti (ASX: AGG), Newcrest Mining (ASX: NCM), Evolution Mining (ASX: EVN) have outperformed the global as well as domestic gold stock indices.

The gold mining stock indices have outperformed the total return from gold, which stood at 16.22 per cent on the YTD basis and 24.41 per cent over the last one year.

While the mining indices outperformed gold returns, the ASX-listed gold mining stocks have dominated the return profiles; however, the higher return from the gold stocks is a compensation for the investors to bear additional equity-related risks in terms of higher beta as compared to gold.

Iron Ore and ASX-listed Iron Ore Miners:

While gold has been in a healthy bull rally until recently, the steelmaking raw material-iron ore, had witnessed a bull run till July 2019, and post reaching a multi-year high in July, the iron ore prices took a jab, after CISA adopted measures to crack down the price. With prices dropping more than 27 per cent in a matter of one month.

Also Read: CISA Crack Down on Iron Ore Prices kept RIO and BHP Under Duress

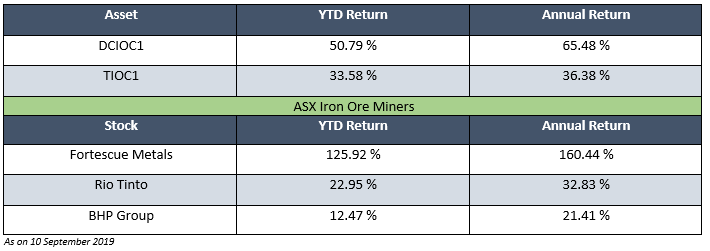

The fall in iron ore prices have affected the short-term returns of ASX-listed iron ore mining stocks; however, the ASX-listed iron ore miners have closely matched the returns from the iron ore.

ASX-Listed Iron Ore Miners with Decent Return:

The returns from iron ore have outperformed the returns of the ASX-listed iron ore miners; however, the other operations of the above-mentioned miners have also exerted pressure on the return profile.

Also Read: Twin Shocks of Copper and Iron Ore Set Rio and BHP Uptrend on a Detour

Other ASX-Listed Miners with Strong Returns:

Apart from gold and iron ore, other commodities such as nickel, silver, etc., have also witnessed a bull rally, in 2019 until now, which in turn, has fuelled many other miners on the Australian Securities Exchange.

Other miners such as Independence Group NL (ASX: IGO), Silver Mines Limited (ASX: SVL) have posted strong returns. The nickel major- Independence Group NL delivered a YTD return of 77.41 Per cent and a yearly return of 60.60 per cent.

Likewise, Silver Mines Limited delivered a YTD return of 84.21 per cent and a yearly return of 262.07 per cent.

Recently, silver outperformed gold in terms of percentage returns, which in turn, provided an additional advantage to the ASX-listed miners with exposure to silver.

Also Read: ASX-Listed Silver Miners- SVL And S32 Wrap The Bull Rush For The Precious Metals

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.