Gold prices are currently showing promising recovery in prices amid global cues, which are mostly circulating around the U.S-China trade war. Gold started a rally from the level of US$1183.04 (low in October 2018) over the U.S-China trade war, which created a pessimism among the market participants over the global economic conditions.

Gold Spot Monthly Chart (Source: Thomson Reuters)

The prices were soon supported by the supply and demand dynamics, and the prices made a high of US$1346.73 during the first quarter of the year 2019 (in February).

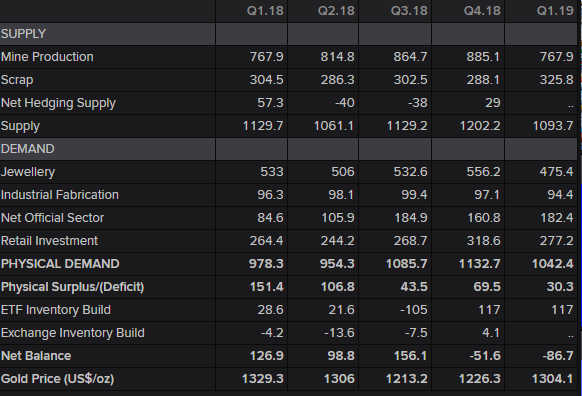

During the first quarter of the year 2019, the global mine production declined by almost 13.25 per cent, which in turn, created the supply concerns. On the other hand, the central bank buying along with net official buying to hedge against the U.S-China trade war inched UP the gold demand in the international market.

Source: Thomson Reuters

However, post rising to the level of US$1346.79, the gold prices descended in the international market over the U.S-China trade talks, but, in the recent status quo, no visible outcome of the discussions coupled with re-escalation in the U.S-China trade dispute has supported the gold prices.

The trade dispute further encircled Mexico and the trade tiff is still going on, which in turn, is supporting the prices in May 2019 and the prices are on an up-rise in the current month as well.

Gold on Charts:

Gold Spot Monthly Chart (Source: Thomson Reuters)

On a monthly chart, the gold prices are consolidating between the points marked as 0 and 1, and the current movement is in between the two yellow lines.

The prices are currently above its 200, 100, and 50-days exponential moving averages, which are presently at US$977.733, US$1226.51, and US$1270.95 respectively. The recovery in prices followed by a correction gives perfect points (0,1,2) to connect the Fibonacci series.

The outcome of Fibonacci suggests that the 23.6 per cent projection is at US$1315.2088; the 38.2 per cent projection is at US$1342.6395; the 50.0 per cent projection is at US$1342.6395; the 61.8 per cent projection is at US$1386.9795 and the 100 per cent projection is at US$1458.7501.

Gold Performance Profile:

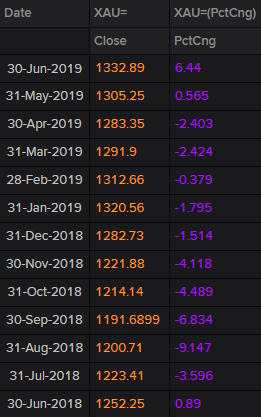

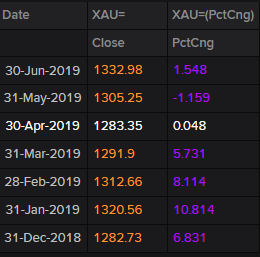

YTD Return Table from the closing of 30 June 2018 (Source: Thomson Reuters)

The gold prices have delivered a return of 6.44 per cent from its June 2018 close of US$1252.25 as per the current prices.

Monthly Return Table (Source: Thomson Reuters)

The six months return on gold stands at 3.92 per cent, with a monthly return of more than 10 per cent from December 2018 to January 2019, and a return of 1.548 per cent from May closing to the current prices.

With gold delivering promising returns, let us now look at how the gold miners performed on ASX

Gold Miners on ASX:

Gold Road Resources Limited (ASX: GOR)

General Outlook:

The company is significantly funded for its exploration and production operations. GOR is also into a 50:50 Joint Venture with Gold Fields- a proven global gold miner.

The current operative business portfolio contains Gruyere Gold Project JV, Attila and Alaric Trend (The golden highway). Besides, the exploration site of the Gold Road includes Yamarna, Northern Project Area, which includes Ibanez, Bloodwood, Stock Route. The Southern exploration project includes Gilmour-morello, Toppin Hill & Breelya, Smokebush, Tamerlane. In addition, the company also hosts various JVs and exploration sites.

The company has significant mineral and ore resources; the total Measured, Indicated and Inferred Mineral Resources of the company stands at 155 million tonnes with an average grade of 1.32 gram per tonne of gold, which would account for 6.61 million ounces of gold.

The Total Proven & Probable Ore Reserves of the company stands at 97 million tonnes with an average grade of 1.25 gram per tonne of gold, which would account for 3.92 million ounces of gold.

Performance Profile:

The shares of the company have delivered a return of 58.65 per cent on YTD basis, while the yearly return stands at 38.82 per cent; and the monthly return stands at 11.05 per cent (as per 5th June closing price).

Resolute Mining Limited (ASX: RSG)

General Outlook:

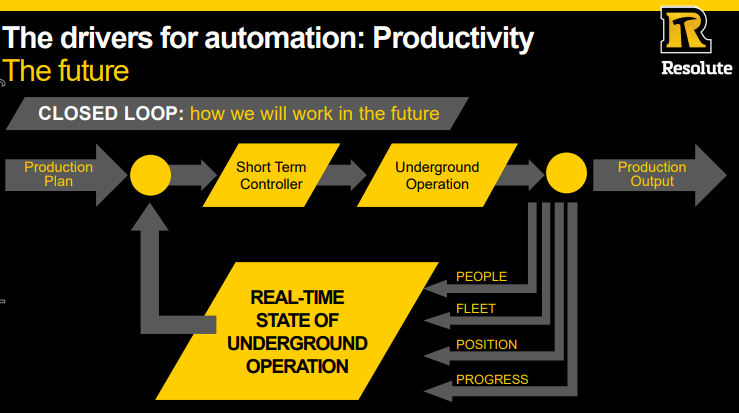

Resolute Mining is among the top pioneers to make the haulage and production level LHD automatic to increase the safety of its workers, who are usually exposed to safety hazards.

As per the company, the drivers of automation include efficiency, productivity, safety and people.

One of the main drivers of automation, i.e. the productivity represents increased operational efficiency, and the ability to control the production at a steady rate along with the optimisation of the production process.

Source: Companyâs Report

Performance Profile:

The shares of the company have delivered a YTD return of -2.18 per cent, and the yearly returns stands at - 9.68 per cent. However, the six months return on the stock is positive at 17.28 per cent, while the monthly return stands at 1.82 per cent.

ST Barbara Limited (ASX: SBM)

General Outlook:

The company recently raised equity capital for the acquisition of the Moose River prospect of Atlantic Gold in two stages and revised its production guidance for the financial year 2019.

The operating business portfolio of the company includes Leonora operations which host the companyâs significant Gwalia Mine, containing 1.9 million of Ore Reserves with an average grade of 7.5 gram a tonne of gold. The other operation of St Barbara is Simberi, where the company is currently conducting operations on the Mining Licence 136.

Performance Profile:

The Shares of SBM delivered a negative return of 46.23 per cent on a yearly basis, while the YTD return of the stock is at -44.38 per cent (as on 5th June closing price). The monthly return of the stock is also negative at 16.39 per cent.

Regis Resources Limited (ASX: RRL)

General Outlook:

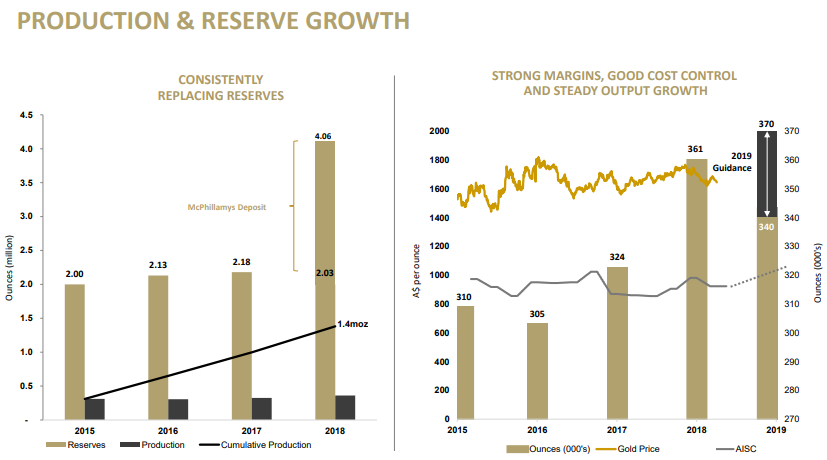

RRL is a A$2.5 billion company, which holds 7.9 million ounces of Mineral Resources and 4.1 million ounces of Ore Reserves. The company has distributed about A$367 million since 2013 as \dividend until the previous quarter.

The production guidance of Regis Resources of the financial year 2019 is in the range of 340,000 â 370,000 ounces of gold with an All-in sustaining cost of A$985 â A$1,055 per ounce.

The company operates at the position of number three in Australia in terms of AISC per ounce, right after Evolution Mining (ASX:EVN) and OceanaGold (ASX:OGC) .

To overcome the challenge of replacing mined ore, the company relies on high exploration and operates on strong margins.

Source: Companyâs Report

Performance Profile:

The shares delivered a yearly return of -7.05 per cent, while the YTD return stands at -5.68 per cent. However, six months return is positive and is at 8.47 per cent, while the monthly return stands at just 0.67 per cent.

Saracen Mineral Holdings Limited (ASX: SAR)

General Outlook:

The company holds 12.1 per cent interest in Van Eck Global, 8.2 per cent in Black Rock Group, 5.8 per cent in Vinva and 73.9 per cent in other subsidiaries.

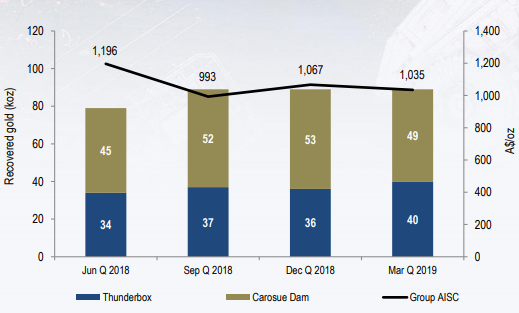

SAR intends to reach a production of 400-kilo ounces of gold per annum, and the company kept the production guidance in the range of 345-365,000 ounces for the financial year 2019, with an AISC of A$1,050 to A$1,100 per ounce.

The overall production of the company is consistent from previous three quarters.

Source: Companyâs Report

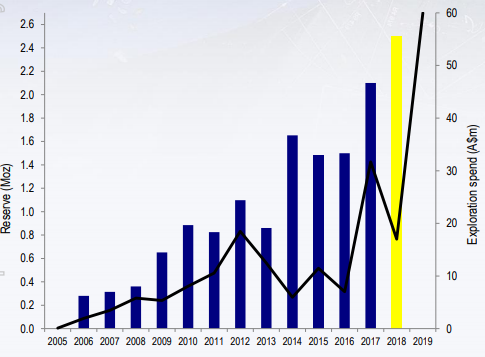

The Ore Reserves of the company are consistently building since the year 2014 and is on its way to reach the level of 4 million ounces.

Source: Companyâs Report

Performance Profile:

The shares of the company delivered a return of 12.03 per cent on YTD and a yearly return of 53.05 per cent. The six months return on the company stands at 29.37 per cent, while the monthly return is at 18.98 per cent.

Evolution Mining Limited (ASX: EVN)

General Outlook:

EVN kept the discovery guidance for the financial year 2019 in the range of A$40-A$55 million, while it kept the resource definition drilling guidance for the same period in the range of A$10 to A$20 million.

The company produced 942-kilo ounces of gold from the Cowal prospect since the acquisition in the year 2015 with a net cash flow of A$483 million. High exploration activities of the company increased the mine life in Cowal by eight years, and the life of mine inched up from the year 2024 to the year 2032.

Post-acquisition of the prospect, EVN increased its Ore Reserves by 2.3 million ounces to stand at 3.9 million ounces for Cowal and increased the throughput from 7.2 million tonnes per annum to 8.0 million tonnes per annum with a new ore body identification- Dalwhinnie lode.

Performance Profile:

EVN delivered a return of 6.59 per cent on a YTD basis and a return of 14.12 per cent on a yearly basis. The six months return stand at 21.25 per cent, while the monthly return is at 25.57 per cent.

Newcrest Mining Limited (ASX: NCM)

General Outlook:

NCM entirely holds one of Australiaâs most extensive gold operations- Cadia Valley in New South Wales, in which the Ore Reserves are recorded at 22 million ounces of gold and 4.3 million tonnes of copper.

The other operations in the companyâs business portfolio includes: Telfer, which contains an Ore Reserve of 2.0 million ounces of gold and 0.20 million tonnes of copper; Lihir, which contains an Ore Reserve of 24 million ounces of gold; Wafi-Golpu, which contains an Ore Reserve of 5.5 million ounces of gold and 2.5 million tonnes of copper.

Such a high Ore Reserve makes Newcrest a significant gold miner on ASX.

Performance Profile:

NCM delivered a return of 28.74 per cent on a YTD basis and a return of 32.84 per cent on a yearly basis. The six months return stand at 34.83 per cent, while the monthly return is at 13.07 per cent.

Ramelius Resources Limited (ASX: RMS)

General Outlook:

RMS is adding value for the shareholders by acquisition and efficient mining, which provides the company with an additional mine life. The company operates two significant Australian production centres- Mt Magnet and Edna May.

RMS kept the gold production guidance of 115,000 ounces of gold with an average AISC of A$1,150-A$1,200 per ounce for the financial year 2019 from Mt Magnet, while the company kept the production guidance of 82,000 ounces of gold with an AISC of A$1,200- A$1,250 per ounce from Edna May for the financial year 2019.

RMS acquired the Edna May mine from the Evolution Mining Limited (ASX: EVN) in the year 2017 for a consideration of A$38.4 million, and since the acquisition, the company has produced 137,700 ounces of gold with an average AISC of A$1,219 per ounce.

Performance Profile:

The shares of the company delivered a return of 81.63 per cent on YTD basis and a yearly return of 61.82 per cent. The six-month return on the company stands at 117.07 per cent, while the monthly return is at 14.84 per cent.

Tribune Resources Limited (ASX:TBR)

General Outlook:

TBR processed 253,065 tonnes of ore at the East Kundana Joint Venture at the Kanowna Plant and 1,03,865 tonnes of total ore at the Greenfields Mill.

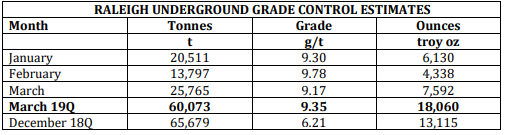

As per the companyâs estimation, the grades at the Raleigh Underground mine are as:

Source: Companyâs Report

And with a 37.5 per cent entitlements, the company controlled 22,527 tonnes of gold with an average grade of 9.35, accounted for 6,773 troy ounces at the March 2019 quarter.

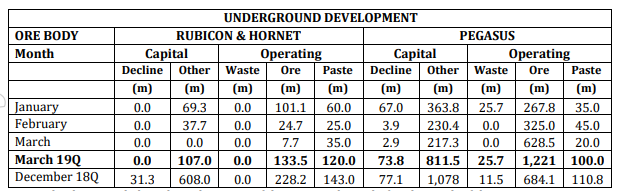

The company progressed over the underground mine development throughout the March 2019 quarter, and the figures of ore bodies are as:

Source: Companyâs Report

Performance Profile:

TBR delivered a return of 4.63 per cent on a YTD basis and a return of 7.24 per cent on a yearly basis. The six-month return stands at -8.14 per cent, while the monthly return is at -2.94 per cent.

West African Resources Limited (ASX:WAF)

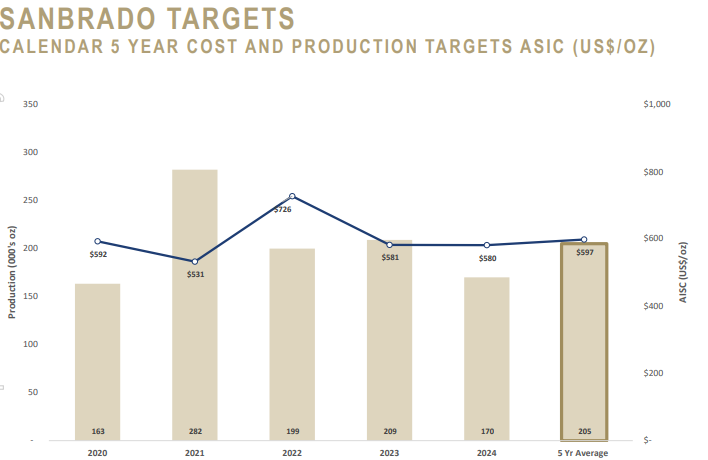

The companyâs highest margin gold project is still under construction, and the company intends to produce more than 300,000 ounces of gold in the first twelve months post the completion of the development. WAF is West Africaâs emerging gold producer, listed on ASX.

The companyâs business portfolio contains various projects such as Sanbrado Gold Project, which is 30 per cent completed and contains multiple deposits.

The figures of M1 south deposit are as:

Source: Companyâs Profile

The future plan for the underdevelopment project is as:

Source: Companyâs Profile

Performance Profile:

TBR delivered a return of 16.33 per cent on a YTD basis and a return of -9.52 per cent on a yearly basis. The six-month return stands at 14.00 per cent, while the monthly return is at -5.00 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)