The benchmark index S&P/ASX 200 was down 0.3% to 6,590.3 on 13 August 2019 (AEST 01:19 PM), while the S&P/ASX 200 Information Technology Sector was up 0.53% to 1,274.2. In this article, we would discuss three IT stocks - Empired Limited, Nanoveu Limited and RPMGLOBAL Holdings Limited - along with their recent announcements.

Empired Limited

Established in 1999, Empired Limited (ASX: EPD) is a provider of diversified IT services, including digital and software solutions. The company got listed on the Australian Stock Exchange in October 2007. EPD has international reach with around 1,000 people in ANZ and the US. As a digital systems integrator, the company has a broad array of solution accelerators & industry-based IC, in addition to a proprietary cloud-based software IP.

FY19 Results

Recently on 12 August 2019, the company via a release updated the market about its performance during the fiscal year 2019. EPD secured a contract amounting to more than $ 12 million with the Department of Internal Affairs in New Zealand during the financial year 2019. Moreover, it reported a 65% increase its Cohesion SaaS user base to 11,500. In order to compete on opportunities amounting to $ 200 million, the company made investments in managed services in FY19.

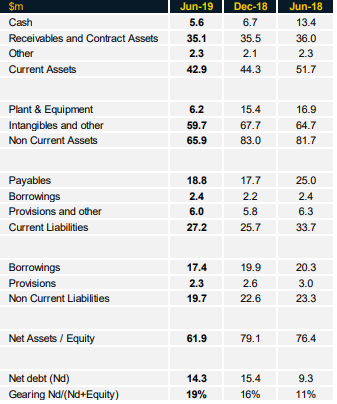

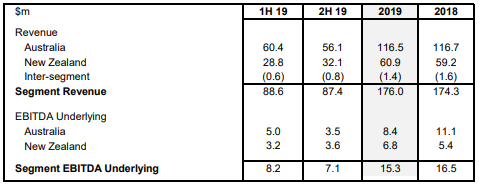

Underlying EBITDA of the company reached $ 15.29 million during the financial year 2019, down 10% year-on-year from $ 16.97 million in FY18. The company mentioned that 63% of revenue during the period was generated via multi-year contracts. Its total revenue stood at $ 176.0 million in FY19 as compared to $ 174.3 million in the same period a year ago. The company reported a slight improvement in receivables and contract assets; however, payables were down by $ 6.2 million from the year-ago period. Net debts also grew from $ 9.3 million in FY18 to $ 14.3 million in FY19. The financial position of the company is providing ability to return free cash flow to shareholders via either on-market share buyback or dividends.

Financial Position (Source: Companyâs Report)

When it comes to revenue by region, the company reported revenue of $ 116.5 million from Australia in FY19, down from $ 116.7 million in FY18. Revenue from Western Australia was impacted by Main Roads contract-renewal cycle and subdued market conditions. Growth in East Coast decreased predominately in VIC; however, directionally there was improvement in the second half of FY19 in Victoria. On the flip side, the company witnessed a rise of 3% year-on-year in revenue from the New Zealand region.

Operating Results by Segment (Source: Companyâs Report)

FY20 Outlook

Empired expects to make strong improvement in financial performance during FY20. The company is projecting to deliver a material rise in net profit after tax, a reduced capital expenditure and a strong positive cash flow. Growth trajectory in the New Zealand region is anticipated to expand, while a plan for improved growth in East Coast is likely to be implemented.

Stock Performance

At the time of writing on 13 Aug 2019 (AEST 01:25 PM), the stock of Empired Limited was trading at a price of $ 0.305 per share, with a market capitalisation of $ 48.84 million and approximately 160.13 million outstanding shares. As per ASX, Empired Limited produced returns of -10.29%, 1.67% and -38.38% in the last one month, three months and six months period, respectively.

Nanoveu Limited

Technology company, Nanoveu Limited (ASX: NVU) focuses on nanoimprint science to serve its clients with vision-based applications. Its award-winning product (using software + hardware) is EyeFly3Dâ¢. The company got listed on ASX in November 2018.

Securities Release from ASX Mandatory Escrow

On 13 August 2019, the company updated the market regarding the release of 635,713 fully paid ordinary shares from ASX mandatory escrow (4 August 2019). It reported that additional 193,478 fully paid ordinary shares are scheduled for release from ASX mandatory escrow on 22 August 2019.

Screen Protector Vending Machine Trial

The company made an ASX announcement on 12 August 2019, unveiling the wrap up of the trial of 1st stage of a patented vending machine, which installs screen protectors with precision and reduces installation wastage. It added that the use of the patented vending machine enables the company to work with established retailers for the distribution of NVUâs products. Established retailers are scheduled to conduct trials of the vending machines during late-2019.

The company also provided an overview of multi-channel sales and marketing strategy. It is pursuing a multi-channel strategy to diversify as well as grow revenue from the sale of screen protectors. With respect to the direct to consumer segment, the company would sell its vending machine through online platforms, like Amazon as well as via its own website. In terms of retail networks, the company would focus on direct sales through its existing base of electronics and telecommunications retailers.

NVU is in talks with potential partners to deploy screen protector vending machines in established retail locations. It was mentioned in the release that the vending machines would be able to apply various types of screen protectors, which include the companyâs own flagship product EyeFly3DTM, to numerous smartphone models and brands. Previously, the company had inked a research collaboration for EyeFyx.

In another update, the company reported that Alfred Chong has made a change in his holdings by acquiring 1,900,000 performance rights. The number of securities held with the director after change stood at 42,832,558 fully paid ordinary shares and 2,100,000 performance rights.

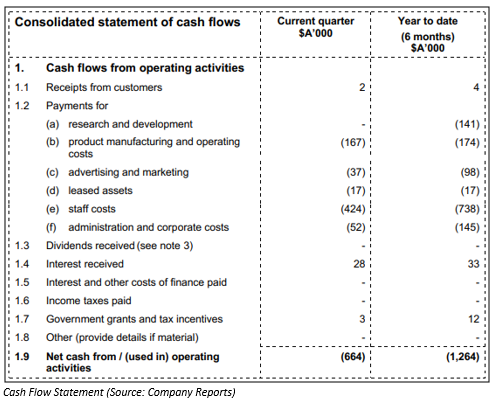

For the quarter ended 30 June 2019, the companyâs net cash outflow from operating activities stood at $ 0.664 million after settling major payments of $ 0.167 million and $ 0.424 million for product manufacturing and operating costs and staff costs, respectively.

Stock Performance

The stock of Nanoveu Limited last traded on 6 August 2019 at a price of $ 0.057 per share, with a market capitalisation of $ 7.55 million and approximately 132.53 million outstanding shares. The stock has provided returns of 29.55%, -29.63% and -34.48% in the last one month, three months and six months period, respectively.

RPMGLOBAL Holdings Limited

Information technology sector company, RPMGlobal Holdings Limited (ASX: RUL) is an Australia registered entity, which is involved into providing software solutions, advisory consulting and professional development solutions to the mining industry.

ARR from Software Subscriptions

Recently on 12 August 2019, the company released an update on annual recurring revenue, which was driven from software subscriptions. The company reported annual recurring revenue of more than $ 6.0 million per annum from software subscriptions in comparison to $ 5.0 million per annum as announced on 5 August 2019. This reflects a rise of $ 1.0 million. Previously, the company also updated the market with the intention of releasing a new product.

Initial Substantial Holders

Mitsubishi UFJ Financial Group Inc. became an initial substantial holder in the company with the voting power of 8.41% on 2 August 2019. Additionally, Carol Australia Holdings Pty Limited and its related bodies have also become an initial substantial holder in the company with the voting power of 7.35%.

A Look at Half Yearly Result

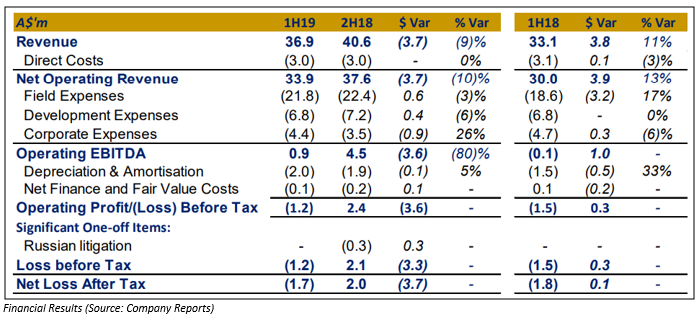

In 1H FY19, the company reported a rise of 13% in net revenue, which is historically skewed to the 2H of the financial year. However, revenue from the advisory division witnessed a rise of 3% on pcp. Adding to that, contribution from this division decreased by $ 0.9 million, owing to:

- higher than usual levels of leave taken in the first quarter after a very busy fourth quarter of FY 2018;

- appointment of new consultants who take time to become completely productive; and

- a doubtful debt provision for a Chinese advisory customer amounting to $ 0.4 million, for which RPMGlobal Holdings Limited is now pursuing legal recovery.

The company reported a rise of 10% in operating costs duw to the purchase of the MinVu business as well as the hiring of additional advisory and software consulting staff. RUL reported an improvement of $ 1.0 million in operating EBITDA to $ 0.9 million for the half year. When it comes to the software division, the company reported a growth of 20% in net revenue with all revenue lines improving YoY such as license -6%, subscription - 167%, maintenance - 14% and Consulting - 24%. The subscription and maintenance revenue lines recorded their highest ever six-month result, while the Software Consulting result was the best since the 2H of 2012.

Stock Performance

The stock of RPMGlobal Holdings Limited last traded on 12 August 2019 at a price of $ 0.580 per share, with a market capitalisation of $ 125.49 million and approximately 216.37 million outstanding shares. The stock has provided returns of -2.52%, -0.85% and -3.33% in the last one month, three months and six months period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.