The benchmark index S&P/ASX 200 traded upward by 35.9 points or 0.53% to settle at 6,717.5, while S&P/ASX 300 Metals and Mining (Industry) closed at 4,404.7, down 0.48% and S&P/ASX 200 Health Care (Sector) inched up by 0.11% to close at 35,747.1 on 19 September 2019.

Below discussed are five small-cap stocks from metals & mining and health care sectors. Let us have a look at recent updates from these companies.

Corazon Mining Limited

Corazon Mining Limited (ASX:CZN) is engaged in mining and exploration activities with primary focus on minerals like copper, cobalt, gold and nickel.

Appointment of Non-Executive Chairman:

In a market update, CZN notified regarding the appointment of Mr Terry Streeter as Non-Executive Chairman, replacing Mr Clive Jones, who will retain the role of a Non-Executive Director in the company. Mr. Streeter is expected to help boost the exploration and development activity at the Lynn Lake nickel-copper-cobalt sulphide project in the province of Manitoba, Canada. He has an immense experience of over 30 years in the nickel sulphide sector.

Meanwhile, the company has secured commitments for a placement of ~417.6 million ordinary shares to raise $1 million. Shares would be issued at a price of $0.0025 per share to sophisticated and professional investors. The capital raising would be directed towards accelerating exploration activities at Lynn Lake.

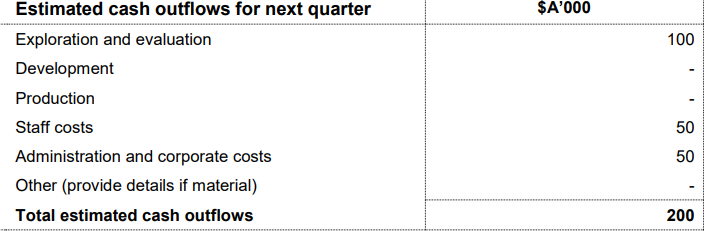

Quarterly Cash Flow Update:

Releasing its June quarter cashflow results, the company reported cash used in operating activities of $74,000, cash used in investing activities of $52,000 and net cash inflow from financing activities of $281,000. CZN reported cash balance of $413,000 as on 30 June 2019. Further, the company provided estimates for the next quarter at $200,000, which includes $100,000 in exploration and evaluation, $50,000 in staff costs and $50,000 for administration and corporate costs.

Source: Companyâs Report

Stock Update:

The stock of CZN closed the dayâs trading at flat $0.003 on 19 September 2019, with a market capitalisation of $4.89 million. The 52-week trading range of the stock stands at $0.002 to $0.008. The stock has appreciated 16.67% in the last one month.

Bounty Oil & Gas NL

Bounty Oil & Gas NL (ASX:BUY) is engaged in oil production, as well as exploration and development of oil & gas.

JV Termination for PEP11 Project:

On 17 September 2019, BUY informed that Advent Energy Ltd has cancelled the RL Energy Joint Venture Agreement for the PEP11 permit. BUY has a stake of 15% in the permit, while the rest 85% is held by Advent through wholly owned subsidiary, Asset Energy Pty Ltd. The PEP11 project is supremely located to potentially supply gas into the east coast gas market.

The joint venture is currently engaged in assessing the work program and evaluating proceeding with the drilling of a well at the Baleen drill target, subject to NOPTA and other regulatory approvals.

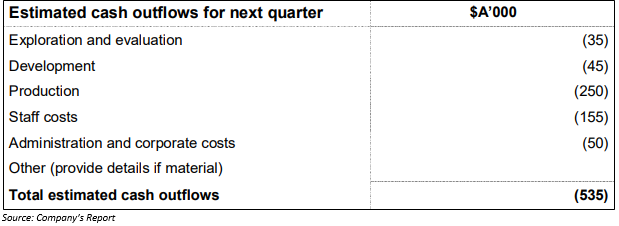

Quarterly Cash Flow Update:

The company announced its fourth quarter numbers for the period ended 30 June 2019, wherein it reported $348,000 of net cash from operating activities and $1,000 in net cash used in investing activities. The company reported cash balance of $814,000 at the end of fourth quarter of FY19. For the next quarter, cash outflows are estimated at $535,000.

Stock Update:

The stock of BUY traded flat at $0.005 on 19 September 2019, with a market capitalisation of $4.77 million. The 52-week trading range of the stock stands at $0.002 to $0.007. The stock has given a positive return of 66.67% and 25% in the last three months and six months, respectively.

Cynata Therapeutics Limited

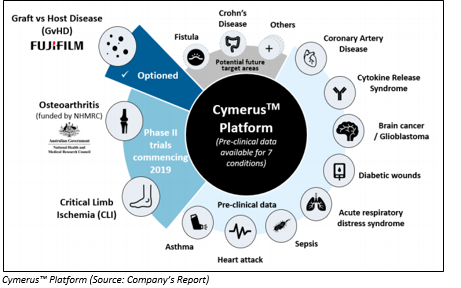

Cynata Therapeutics Limited (ASX:CYP) is a clinical-stage biotechnology company engaged in the development and marketing of a proprietary mesenchymal stem cell (MSC) technology used for human therapeutics with a brand name Cymerusâ¢. Recently on 18 September 2019, CYP announced the issue of 500,000 fully paid ordinary shares at a price consideration of $1.00 per ordinary share.

Fujifilm Exercises License Option:

On 17 September 2019, FUJIFILM Corporation exercised its license option in graft-versus-host disease (GvHD), according to CYP. The collaboration between FUJIFILM and CYP elaborates that the former will bear all costs regarding the product development activities in relation to GvHD, along with responsibility for regulatory submissions and distribution. The above deal was agreed at

- US$43 million in an upfront cash fee to Cynata

- Additional future milestone payments of up to US$43 million on the condition to complete industry standard product development and commercial milestones.

FY19 Highlights:

- CYP reported a 3.36% increase in revenues to $1.60 million

- Loss of $8.47 million in FY19 a loss of $4.57 million in FY18

- The company reported successful completion of first clinical trial of Cymerus⢠MSC product CYP-001 in graft-versus-host disease.

Outlook:

As per the management guidance, the company will remain focused on the marketing of the Cymerus⢠technology and will look for strategic partnerships and business development opportunities in FY20.

Stock update:

The stock of CYP closed the dayâs trading at $1.585 on 19 September 2019, down 8.646% from its previous close, with a market capitalisation of $177.55 million. The stock has given positive returns of 39.92% in the last three months.

Victory Mines Limited

Victory Mines Limited (ASX:VIC) is engaged in exploration activities, with focus on minerals like copper and gold.

Capital Raising:

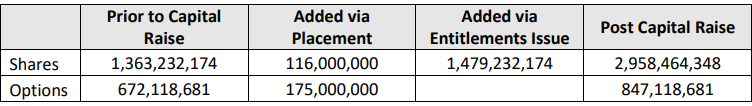

VIC unveiled its capital raising program to raise $1.48 million through a non-renounceable rights issue, fully underwritten by DJ Carmichael Pty Limited. For this capital raising, the company would offer $175 million options to raise $17,500 and a fully underwritten non-renounceable entitlement issue to raise up to $1,479,000 before costs.

A placement of 116 million shares to sophisticated investors has been completed at an issue price $0.001 per share to raise $116,000 before costs

Capital Structure after Completion of Above Raisings (Source: Companyâs Report)

Q4FY19 Cash Flow Update:

The company reported its Q4FY19 quarterly numbers for the period ended 30 June 2019 wherein, it reported $198,000 of cash used in operating activities and $184,000 in net cash from financing activities. VIC reported cash balance of $129,000 as on 30 June 2019. Further, the company provided guidance on the estimated cash outflow for Q1FY20 at $320,000.

Stock Update:

The stock of VIC closed trading at $0.001 on 19 September 2019, with no change from its previous close. The market capitalisation of the company stood at $1.48 million, while total number of shares outstanding is 1.48 billion. The stock has given a positive return of 50% in the last one month.

Eclipse Metals Limited

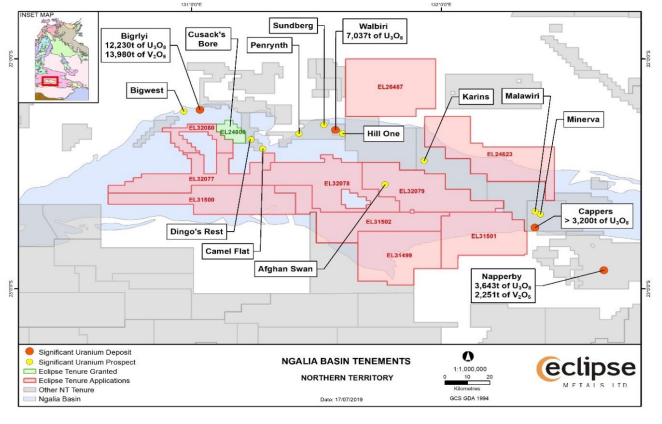

Eclipse Metal Limited (ASX:EPM) is engaged in exploration activities for multi-commodity mineralisation. The company is majorly focused on the Northern Territory and Queensland.

June Quarter Report:

The company disclosed its Q4FY19 cash flow activities for the period ended 30 June 2019 wherein it reported net cash used in operating activities of $58,000 and cash balance of $358,000 as on 30 June 2019. The company provided estimation for Q1FY20 cash outflows at $130,000.

During the quarter,

- EPM suspended field work at Mary Valley during the wet season in south-east Queensland.

- Results from gravity survey of Ngalia Basin EL24808 uranium prospect demonstrated the presence of multi-branch paleochannel system

The company is now analysing results from historical regional exploration in the Ngalia Basin.

Stock update:

The stock of EPM last traded at $0.003 on 18 September 2019 with a market capitalisation of $3.45 million. Total number of shares outstanding stood at 1.15 billion. The stock has generated positive returns of 50% and 20% in the last one month and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.