The IPO fever has gripped the stock markets across the world, with several companies entering the public markets with a bang and many others expected to join soon. Private companies consider IPOs as a route to open up new opportunities for their businesses and accelerate growth. Going public makes a private company, a publicly traded and owned entity, increasing their prestige and diversifying ownership.

Usually, the companies go public to raise money and spread the ownership risk between a significant number of shareholders. The raised money can then be used to expand the business, repay debt, meet general working capital requirements, invest in research and development and for multiple other purposes.

Trending IPOs

In order to grab a range of opportunities offered by IPOs, many private companies have either gone or are planning to go public on stock exchanges worldwide. Let us discuss the IPOs trending on various stock exchanges that are grabbing investorsâ attention around the globe:

Australian Stock Exchange (ASX)

ASX is one of the worldâs leading exchange groups, wherein many growing and successful private companies consider listing via an IPO. Moreover, many foreign companies list on ASX to access the Australian capital markets.

A major IPO that has grasped spotlight throughout the world is the Latitude Financial Group Ltd.âs IPO, which has been cancelled by private equity group KKR and its partners.

The IPO was expected to become the biggest IPO of Australia in 2019. The non-bank consumer lender of Australia, Latitude, was gauging demand for billion dollarsâ worth of shares, valuing the company at $3.2 billion.

Previously, the companyâs big three investors repriced its IPO to $1.78 a share, depicting 5.8 per cent dividend yield and 11-times profit. This is the second time when the companyâs owners have failed to sell the company.

On the other hand, a cloud-based workplace management platform, Damstra Holdings Limited has made a solid ASX debut on 16th October 2019, jumping from 90 cents (issue price) to $1.345 during the trading session.

Another IPO that has gained attention is Funlab, the leader in out of home entertainment business, that is planning to go public before the end of the year. Funlab expects to earn operating revenue and EBITDA of $152.4 million and $29.2 million, respectively in FY 2020.

Besides, Australian firm Onsite Rentals is also preparing for its IPO expected on 18th November 2019. The company has been valued at $700 million by brokers Macquarie Capital and Bank of America Merrill Lynch.

Recently, PropertyGuru, online property classifieds portal, has also lodged a prospectus with ASIC for its IPO on the ASX, in order to raise up to $380 million.

In addition, mall owner, Home Consortium has recently marked the largest IPO of 2019, by commencing trading on the ASX on a deferred settlement basis. The shares of the company ended the first day trade at $3.75, with a rise of 11.9 per cent than its $3.35 offer price.

Besides HomeCo, many private companies that got listed on the ASX in 2019 delivered substantial returns on the 1st day of trading, including Invex Therapeutics Limited (168.8 per cent), QuickFee Ltd (150 per cent) and Splitit Payments Ltd (90 per cent).

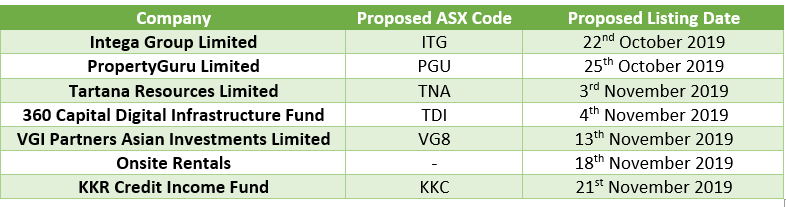

Below is the list of some of the upcoming IPOs on the ASX:

American Stock Exchange

Brazilian restaurant chain Grupo Madero is likely to launch an IPO in the US in the second half of 2020, that could value USD 2.42 billion to Madero. The company has forecasted an EBITDA of 380 million reais for 2020.

Recently, Vir Biotechnology marked its entry into the IPO space, losing 30 per cent of its value on just the first day of trading. The stock opened at USD 16.20 a share, dropping to USD 14.02 a share at the end of the day.

Besides, Investors are keenly eyeing PowerBar maker, BellRing Brands which is all set to launch its IPO on NYSE on 17th October 2019, by offering 30 million shares at a price range of USD 16 to USD 19 to raise USD 525 million.

Another name that has been trending in the IPO space is American real estate company, WeWork, that has recently postponed its IPO after getting a dull response from the investors. The companyâs widening losses and its former CEOâs unusual grip on the firm, induced investors to pull back their support.

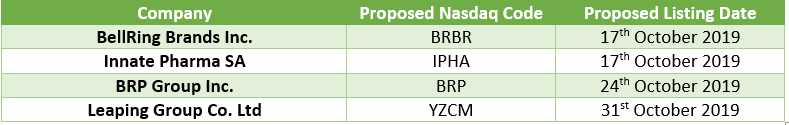

Below is the list of some of the upcoming IPOs on Nasdaq and NYSE:

Recently, Nasdaq tightened restrictions on the IPOs of small Chinese companies to limit the stock market fluctuations, accusing them of raising most of the capital from Chinese sources instead of U.S. investors for the IPOs. Amidst the ongoing trade dispute between the US and China, it was termed as a major trouble spot in their financial relationship.

Saudi Stock Exchange

Investors are eagerly looking for the IPO launch of Saudi Aramco, which is one of the largest companies in the globe by revenue. The IPO which is likely to be the biggest one in history, has created a frenzy of excitement among the investors across the world. Initially, the company will get listed on the domestic stock market, with no update over listing on any international share market.

Bombay Stock Exchange

Indian Railwaysâ subsidiary IRCTC has made a stellar stock market debut, surging 128 per cent on the Bombay Stock Exchange, marking the largest stock market debut for any Indian firm in almost two years. The stock of the company opened 101.25 per cent above the issue price at ? 644, closing at ?728.60.

Frankfurt Stock Exchange

Recently, a German device connectivity software company, TeamViewer has completed its biggest ever IPO since the dot-com bubble burst in the tech field. The company got listed on the Frankfurt stock exchange with a market valuation of â¬5.25 billion. However, the companyâs shares slipped from the offer price of â¬26.25 per share to â¬25.32 per share on the day of IPO.

London Stock Exchange

In a long-delayed IPO, the mobile network operator of Africa, Helios Towers Ltd has marked its debut in London, with a total valuation of USD 1.42 billion to USD 1.79 billion. The company offered its shares at 115 pence per share, with its shares settling at 116 pence by the end of the day.

The buoyant IPO market is inducing investors worldwide to place sizeable bets on the companies going public. With a lot of IPOs coming to the market, it would be interesting to keep a watch on their opening day stock returns.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)