Small cap stocks comprise of the companies with their worth ranging from $300 million to around $2 billion, with a lot of prospect. Such stocks have a potential to witness price increases in excess of 100 percent to even more than 1000 percent. They do come with associated risks as well, since they have big price swings every day. However, even an investment of smaller amount can pay off in a huge way.

Recently, Coronavirus started spreading from China to other nations of the world. Though the worry of coronavirus induced slowdown is looming around the various economy of the world, most of the healthcare stocks have been the top gainer in the stock exchange amidst the outbreak.

On 10 March 2020, S&P/ASX 200 Health Care (Sector) was trading at 41,528.8, down by 0.86% (at AEDT 12:23 PM). While the Australian benchmark index S&P/ASX200 was trading at 5785.8 points, rising by 0.4%

Let’s now have a look at a few small cap healthcare stocks - CGS, MVP, MX1 and their latest update.

CogState Limited (ASX: CGS)

Projects Loss in FY 20 & EBIT Profit for FY 21:

CogState Limited (ASX: CGS) a healthcare company is into the manufacturing and distribution of diagnostic and therapeutic products that are related with the neurological disorders and the computerised cognitive tests. CGS does assessments related to brain health for the enhancement of new drugs and to get earlier clinical insights. CGS works in association with pharmaceutical and biotechnology companies to underpin its clinical trials that reflects the effect of a drug’s impact on cognition.

CGS stock plunged 11.22% on March 6th, 2020 after the company from 1 January 2020 has executed $9.1 million of clinical trials sales contracts, which reflects the total value of clinical trials sales contracts executed by the company till date in FY 20 is $36.0 million. The company for the first half 2020 had executed $26.9 million of clinical trials sales contracts.

Moreover, for the first half of 2020, the company has reported 12.8% fall in the total revenue to $9.7m compared to 1H19. The company has delivered the loss after tax of $2.1 million, which is in line with the 1H19 result. The company had posted the loss before tax of $2.9 million for 1H 2020.

There has been 24.8% fall in the Clinical Trials revenue to $8.3 million on the back of the lower value of Clinical Trials sales contracts executed in the FY 19. This decline in Clinical Trials revenue was however partially offset by the growth in Healthcare revenue, that includes the upfront royalty paid by Eisai due to licensing of Cogstate technology for the Japanese market.

The company’s cash position stood strong, with cash reserves of $7.2 million at the end of December 2019 after raising of capital completed during the half year. The company had raised $7.5 million of new capital through private placements of shares and an entitlement offer.

Further, the company’s revenue backlog stood strong, as contracted revenue that will be recognised in future periods had risen to $37.2 million at the end of December 2019, which is higher than the previous best of $35.0m posted at the end of Dec 2017. The company projects $10.1 million of this backlog will be recognised as Clinical Trials revenue in the second half of 2020.

Additionally, CGS for the second half of 2020, has planned to launch digitial cognitive assessment technology to physicians and consumers in Japan, which the company will do with its partnership with Eisai. For fiscal 2020, the company projects to incur the loss though the financial performance of the company will improve in the second half of FY20 on the back of projected increase in Clinical Trials revenue in 2H20. The company anticipates posting EBIT profit for FY21.

Clinical Trials sales contracts executed, per quarter, since 1 July 2016 (Source: Company’s Report)

On 10 March 2020, CGS was trading at $0.430, rising by 3.614% (at AEDT 12:48 PM). Meanwhile, CGS stock has risen 29.69% in three months as on March 9th, 2020.

Medical Developments International Limited (ASX: MVP)

CEO Resigned:

Medical Developments International Limited (ASX: MVP), an Australia's leading specialised healthcare company is into the manufacturing and distribution of a pharmaceutical drug, and medical devices and veterinary equipment.

MVP stock ended the market session, going down by 0.25% on March 6th, 2020. Also, the company’s Chief Executive Officer, Mr. John Sharman resigned from the company. MVP is now looking for the candidate that could bring growth in the US and the EU and could also bring the flow technology and associated products to market.

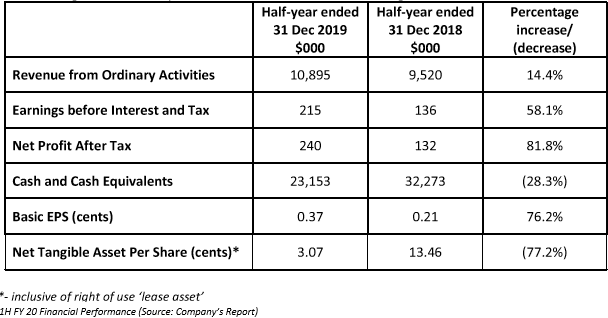

On the other hand, for the first half of 2020, the company has reported 15% rise in the Gross Revenue to $11.2 million, 82% growth in the Net Profit after Tax to $240,000 and 21% increase in the EBITDA to $1,503,000. However, during the period, the cash & cash equivalents decreased by 28.3% to $23,153,000.

Moreover, in US, after getting the feedback from FDA the company continues to do the required pre-clinical animal study and expects to complete in Q3 2020. MVP will address in full, all the clinical hold issues during the third quarter of CY20 and intends to refill the IND in CY20. The company in the first half of 2020, has delivered strong growth in respiratory device sales, on the back of 88% increase in North America business, 44% rise in Australian business, that comprised of 31% increase in Breath-A-Tech ® business and 73% rise in Europe and the UK.

On 10 March 2020, MVP was trading at $6.610, down by 0.602% (at AEDT 12:49 PM). Meanwhile, MVP stock has given a negative return of 10.38% in three months as on March 9th, 2020.

Micro-X Limited (ASX: MX1)

Received Additional $1 million in Sales Orders for Nano:

Micro-X Limited (ASX: MX1) is a healthcare company that is into the manufacturing and distribution of an ultra-lightweight carbon nanotube-based X-ray products to be used to counter IED imaging security markets around the world.

MX1 stock surged 13.51% on March 6th, 2020 after the company received $1m of additional sales orders of DRX Revolution Nano from 13 February 2020, which represents an increase of 200% over pcp. This also reflects that the company has received the total sales orders of total $1.8 million for the current quarter compared to $0.2M sales for the December 2019 Quarter, which the company will recognize majority of it in the current quarter & the rest in the June 2020 Quarter. These additional purchase orders are meant to deliver it to Asia and Europe.

On 10 March 2020, MX1 was trading at $0.180, rising by 2.857% (at AEDT 1:19 PM). Therefore, MX1 stock has risen 16.67% in one month as on March 9th, 2020.