Last week has been a spectacular one for the global markets as major frontline markets posted significant gains. The rally was driven by optimism generated from the gradual lifting of lockdown across economies and a massive stimulus package introduced by the European Central Bank (ECB).

The rally of British and European market took a back step and fell today (before the market close on 8th June 2020) and following were the major triggers that ruled the market sentiments today:

- Tens of thousands of people gathered in Central London in protest for the George Floyd killing.

- UK Coronavirus death rose 77 to 40,542, as per the government data published on Sunday.

- The CityUK stated that Companies might be struggling by the end of March 2021, for meeting the financing cost of up to GBP 36 billion of debt under the Coronavirus credit scheme.

Considering the above sentiments, we are going to discuss two media stocks today, ITV PLC (LON:ITV) and Mediazest PLC (LON:MDZ). As on 8th June 2020 (before the market close at 1.14 PM GMT+1), MDZ witnessed a sharp jump of around 117.45 per cent, while ITV gained about 2.40 per cent. Lets quickly dive through the current trading and financial position of the Company, to understand this share price movement better and make inference over the plausible outlook situation.

ITV PLC (LON:ITV) – Unable to Provide Guidance as Revenue Tumbled in Q1 FY20

ITV PLC is a media company, which operates as an integrated producer broadcaster and offers content at a global level with multiple platforms. It bifurcates its business operations into divisions - ITV Studios and Broadcast & Online. The ITV studios segment caters genre related to drama, entertainment and factual and provides content in around 14 countries (including the United Kingdom). The Broadcast division manages commercial channel in the UK which are free-to-air and delivers content via ITV Hub. The Company is presently a constituent of FTSE 100 index and was admitted to the London Stock Exchange on 2nd February 2005.

(Source: Annual Report)

Recent Significant Developments of 2020

1st May 2020: Graham Cooke, who is a founder and CEO of Qubit and formerly worked on Google’s strategy, has been appointed as an Independent Non-executive Director from 1st May 2020.

3rd April 2020: In response to the COVID-19 scenario, the Company announced several measures to reduce costs, including a 20 per cent cut in remuneration of Management Board and Executive Directors and also, a cancellation of the annual bonus for them.

Q1 Trading Update – Showing Challenging Environment, with Tightly Manage the Cashflow and Liquidity and Reduce Costs

On 6th May 2020, ITV provided an update on the trading for the first quarter of the financial year 2020 ending 31st March 2020, with total external revenue reduced by 7 per cent at £694 million (2019: £743 million). Some more points to be highlighted below:

- For the three months to 31st March 2020, Total ITV Studios revenue tumbled 11 per cent at GBP 342 million (2019: GBP 385 million) and was wedged by the restrictions on working practices due to Coronavirus and phasing of deliveries.

- In Q1 FY20, Broadcast revenue surged by 2 per cent to GBP 500 million (2019: GBP 489 million), reflecting an increase in online revenues (up 26 per cent) and ITV total advertising (up 2 per cent).

- The Group has shown robust demand in Studios Global Distribution business for library content internationally with good growth for BritBox.

- ITV has taken effective steps to reduce cost and preserve cash to tackle the uncertain period. ITV has decent liquidity position with unrestricted cash of more than GBP 100 million, RCF of GBP 630 million and bilateral facility of GBP 199 million.

- Most of its employees was working from home and enabled the company to broadcast six channels. The group, along with the entire industry, is in talks with the Government for protocols for return-to-production.

- ITV Group has resumed production for various popular programs in different markets internationally.

- ITV continues to apply Hub acceleration plan, which resulted in strong viewing growth in the first quarter of the financial year 2020 and launched a deal with EE related to distribution.

Share Price Performance

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 8th, 2020, before the market close

ITV’s shares were quoting at GBX 91.22 on 8th June 2020 (before the market close at 3:02 PM GMT+1). Stock's 52 weeks High is GBX 165.90 and Low is GBX 50.06. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 3.53 billion.

Outlook

The Company will decrease overhead costs by GBP 60 million in 2020. At least GBP 100 million decreases in the programme budget to approximately GBP 1 billion. The outlook stays uncertain and is changing rapidly. Therefore, the Group is not giving any guidance for the second quarter of 2020 and for the remainder of the year. Led by the recent outbreak of Coronavirus, ITV anticipates another challenging operating environment. The Company will take effective action when necessary to manage the costs and cash tightly. Meanwhile, ITV Group will deliver double-digit growth in online revenues and an increase in direct to consumer.

Mediazest PLC (LON:MDZ) – Implementing Cost Savings Plans to Withstand the Market Volatility

Mediazest PLC is a FTSE AIM All-Share listed media company which provides one-stop visual, audio, satellite delivery, consumer interaction platform, and content management to brand owners and retailers. The Group had acquired TouchVision Ltd in September 2005 and was admitted to London Stock Exchange on 22 February 2005. The Company is headquartered in London, United Kingdom.

(Source: Company Website)

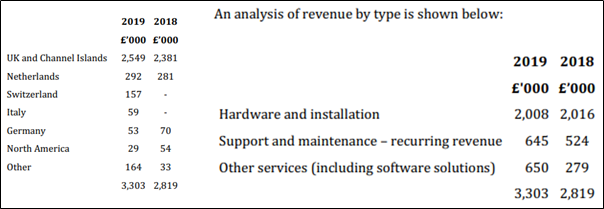

Revenue breakdown by product type and geography for the financial year 2019, can be seen in the image below:

(Source: Annual Report, Company Website)

Synopsis of Recent Major Regulatory Updates

3rd April 2020: The Group affirmed that it had taken a range of cost-cutting measures to withstand the short-term disruption caused by the COVID-19 crisis and hence, the Group had already identified a cost savings of approximately GBP 150,000.

23rd December 2019: The Company reported a loss in H1 FY20 and cited difficult market conditions. While the Group stated about reducing cost base by GBP 200,000 for FY20.

Trading Update – Decent Performance Amid Elevated Global Volatility.

On 3rd April 2020, the Company provided the trading update for the second half of the financial year to 31 March 2020 and also updated investors on the Covid-19 impact. Results for February 2020 and mainly March 2020 were adversely impacted by the Covid-19 outbreak, due to temporarily close of stores and other places of business and clients initially started to defer some projects. Additional Highlights are stated below:

- Led by the disruption caused by Covid-19, the management expects revenue for February and March to be lower than the estimate and abridged to around GBP 300 thousand in aggregate (against the last year of GBP 319 thousand), with a subsequent small loss at consolidated Group level and a modest net profit at the operational level.

- In light of COVID-19 outbreak, the Group expects to realise a modest loss after tax in the 6 months to 31 March 2020 (compared to 6 months ended 31 March 2019 loss of GBP 201 thousand) albeit with a profitable EBITDA for the six months to 31st March 2020 (6 months ended 31 March 2019 loss of GBP 144 thousand). Whilst the Company is expected to be profitable in its subsidiary company (MediaZest International) in the 12-month period.

- In recurring revenue, the Group has been impacted by store closures. Although three of the MDZ’s clients are keeping stores open as selling essential goods.

- In the period from October 2019 to January 2020, the business was in well-positioned, with revenue stood at GBP 1.2 million, and profit at the operating subsidiary MediaZest International was GBP 167 thousand at EBITDA level and a net profit after tax of GBP 127 thousand.

Share Price Performance

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 8th, 2020, before the market close

MDZ’s shares were quoting at GBX 0.05370 on 8th June 2020 (before the market close at 2:59 PM GMT+1). Stock's 52 weeks Low is GBX 0.015 and High is GBX 0.098. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 381.92 thousand.

Outlook

In this unprecedented crisis, it is not possible to predict the impact on the forthcoming trading and financial performance. Further, the cost savings of approximately GBP 150 thousand have been identified and executed already with further reductions. The Company is working in an ever-evolving market in which customisation and advertisers demand will increase, along with the requirement for AI (artificial intelligence) and machine learning services. The Group is continuing to provide maintenance and support services to these businesses remotely and in accordance with the latest UK Government recommendations and guidelines.