The beef cattle industry is an important contribution to the Australian economy. The Australian government also understands the importance of this industry which is why it has various development plans and schemes arranged for the betterment of this industry. Now lets take a look the performance of one of the leading players of beef cattle industry, Australian Agricultural Company Limited (ASX: AAC).

Australiaâs leading integrated cattle and beef producer, Australian Agricultural Company Limited (AACo) currently operates across 19 owned cattle stations, 2 leased stations, 5 agisted properties, 2 owned feedlots, and 2 owned farms located throughout Queensland and the Northern Territory. The company is involved in distributing branded beef to its various customers spread across the world.

Three principal activities of the company include:

- Sales and marketing of high-quality branded beef into global markets;

- Ownership, operation and development of pastoral properties; and

- Production of beef including breeding, backgrounding, feedlotting and processing of cattle.

At 2019 annual general meeting, the companyâs Chairman Donald McGauchie AO told that the year 2019 has been another significant year for the company, a year of progress and great challenges. The companyâs ability to produce the highest quality branded beef at scale sets it apart from its competitors. While others can produce quality and some can produce scale, but no one is as well positioned as AACo to do both, said Chairman at the AGM.

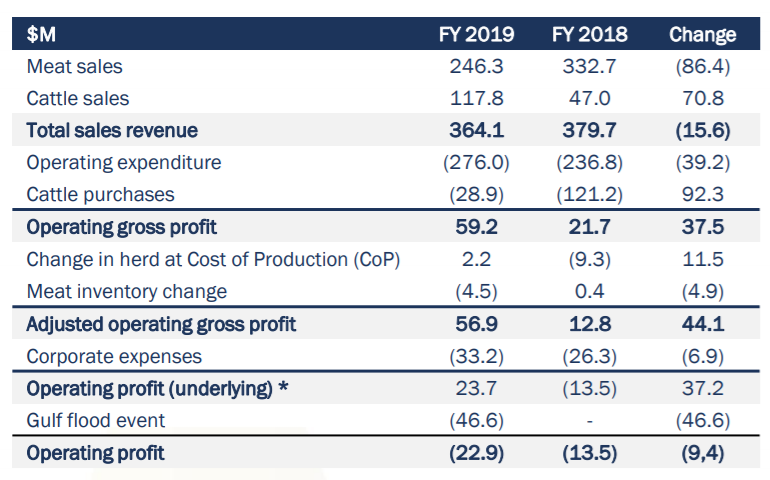

During FY19, the company was committed on progressing its premium branded beef strategy, which has been unaffected by extreme seasonal impacts. For FY19, the company reported a statutory EBITDA loss of $182.7 million, majorly driven by the market value movements in the value of the closing herd of $89.0 million, Gulf flood write-offs and emergency expenses of $46.6 million. The company reported operating loss of $22.9 million in FY19, which is higher than the loss of $13.5 million incurred in last year.

FY19 Results Snapshot (Source: Company Reports)

A look at Gulf Flooding Event: In the month of February 2019, a huge flood swept through the Gulf of Carpentaria Region, extending around 400km from the Gulf to Julia Creek, and reached around 70km wide in many areas. The flood impacted various companyâs stations in the gulf region. Canobie, Carrum, Wondoola and Dalgonally, all witnessed infrastructure and livestock losses due to the flood.

Sadly, around 82,000 head of cattle were exposed to this event with total losses estimated at 43,000 head and along with this, fencing and water infrastructure on various of the companyâs properties, as well as buildings at Wondoola station, were damaged. The total livestock losses of 43,000 head was estimated at a value of $45.6 million and around $5 million was estimated as costs of replacing the damaged infrastructure.

Key Decisions Made: During FY19, the company made some important decisions which have simplified the business and created a more efficient AACo. During the year, the operations at the Livingstone Beef processing facility were suspended and along with that, the 1824 program was also discontinued. As a consequence of the Livingstone and 1824 decisions, a lower reliance on non-wagyu herd numbers has led to a decline in the non-wagyu headcount. Further, the drought conditions during the year resulted in an increase in sales of these non-wagyu animals and the 43,000 cattle lost in the Gulf flood were almost exclusively non-wagyu cattle.

For the full year, the company reported a total sales revenue of $364.1 million, compared with $379.7 million in FY18, with lower volumes due to the Livingstone and 1824 decisions. Wagyu meat sales revenue was up 4.5 per-cent compared to the last year.

Story of Livingstone Beef: Last year, the cash-generating unit of Livingstone Beef witnessed adverse market conditions as a result of lower than average meat sales demand and high cattle procurement costs.

As indicators of impairment existed, the company tested the CGU for impairment and calculated the recoverable amount of the CGU which came out to be around $40.2 million, lower than the carrying value by $69.5 million. It is to be noted that, the carrying value prior to this assessment was $109.7 million, representing $104.8 million of property, plant and equipment and $4.9 million of working capital.

As a result of this, the company incurred an impairment loss of $69.5 million with respect to buildings, improvements, plant and equipment, and reduced the carrying values of these assets in the CGU by the same amount i.e., $69.5 million.

During the first half of FY19, the operations were suspended at Livingstone Beef. On 30 September 2018, management recalculated the recoverable amount of the CGU based on the updated conditions, using Level 3 fair value inputs as per AASB 13 Fair Value Measurement, it was found that the recoverable amount was materially consistent with the current carrying value of the CGU, and as such no adjustment was made to the carrying value of Livingstone Beef on 30 September 2018.

On 31 March 2019, consideration was given to internal and external factors impacting the CGU, noting no indications of a material change to the carrying value of Livingstone Beef at the year-end.

The companyâs Board and management are reviewing various strategic options for Livingstone Beef.

What now? During FY19 company demonstrated improved underlying operating profit during the year despite facing seasonal and external challenges. The company is now focussed on improving the quantity and quality of its earnings by expanding the companyâs exposure to premium branded beef prices, and through its medium-term strategy, the company is putting a special emphasis on optimising its supply chains, implementing a differentiated branding strategy and investing in innovation and technology.

Recent Board Changes: Recently on 2nd August 2019, the company announced the appointment of Mr. Marc Blazer as a non-executive Director. Mr. Blazer has a lot of experience in the food and hospitality sector and has a great understanding of how to build brands around people and products. On the education front, he has a graduate degree from the London School of Economics. He has also done BA from the University of Maryland in the year 1990.

Recently on 31 July 2019, the company announced that it has entered into a 10-year lease of Rewan Station, adding to the companyâs already significant property portfolio, demonstrating AACoâs commitment to its branded food strategy.

In the past six months, AACâs stock has provided a negative return of 1.89% as on 8 August 2019. At market close on 9th August 2019, AACâs stock was trading at a price of $1.075 with a market capitalisation of circa $626.88 million. AAC has a 52 weeks high price of $1.425- and 52-weeks low price of $0.880 with an average volume of 448,432.

A quick look at few other Agricultural Stocks:

Elders Limited (ASX:ELD)

Leading agribusiness, Elders Limited (ASX: ELD) recently entered into a scheme implementation deed (SID) with AIRR Holdings Limited (AIRR) to acquire all of the AIRRâs shares. The company believes that this acquisition is aligned with Eldersâ Corporate Acquisition Principles. Various key strategic advantages of the acquisition for the company are as follows:

- AIRR is a large-scale wholesale business with a strong track record having achieved an FY13 â FY19 EBITDA CAGR of 18%;

- The acquisition will have immediate short-term benefits in improving Eldersâ supply chain and a solid longer-term pathway to adapt to changes in consumer demand;

- It creates the opportunity for Elders to leverage AIRRâs distribution and logistics coverage;

- It provides Elders with a new channel for growth through access to independent rural, pet and produce retailers; and

- It increases Elders' portfolio of APVMA registrations, particularly in animal health, and provides the opportunity to grow the reputable AIRR, Tuckers, apparent and Independents Own brands.

In order to fund the acquisition, the company recently completed a Retail Entitlement Offer, representing the final stage of Elders' approximately A$137 million equity raising.

In the past six months, ELDâs stock has provided a return of 10.83% as on 8 August 2019. At market close on 9th August 2019, ELDâs stock was trading at a price of $6.750 with a market capitalization of circa $920.09 million. ELD has a 52 weeks high price of $8.830 and 52-weeks low price of $5.314 with an average volume of ~794,722.

Wellard Limited (ASX:WLD)

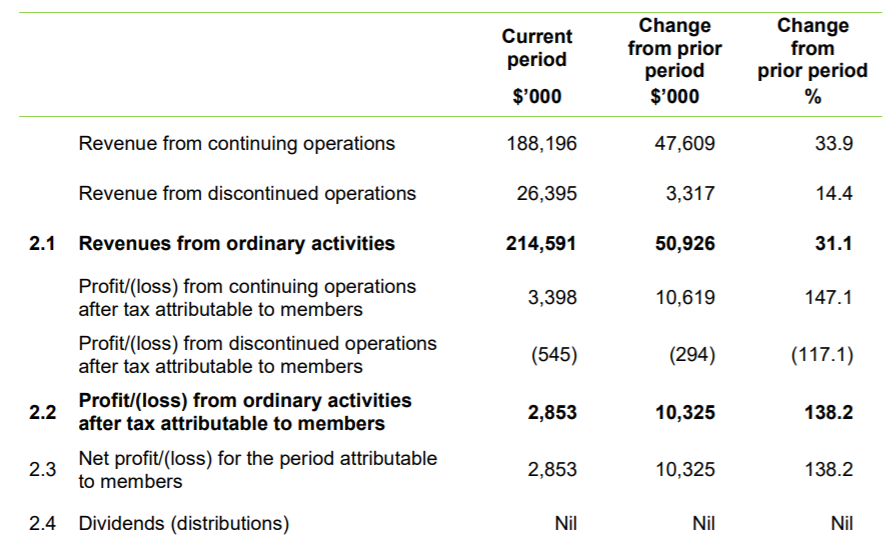

Supplier of quality livestock, Wellard Limited (ASX: WLD) recently accepted a proposal to sell the M/V Ocean Swagman for US$25.2 million to Trim Shipping SA, Panama. In the first half of FY19, the company reported revenue from continuing operations of $188.19 million which was 33.9% higher than pcp.

Interim Results Snapshot (Source: Company Reports)

In the past six months, WLDâs stock has provided a return of 2.44% as on 8 August 2019. At market close on 9th August 2019, WLDâs stock was trading at a price of $0.038 with a market capitalisation of circa $21.25 million. WLD has a 52 weeks high price of $0.105 and 52-weeks low price of $0.022 with an average volume of ~327,594.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.