Investment in defensive stocks seems attractive to some investors as they turn out to be safer during market volatility, although the returns might be lesser than growth stocks. They are less/not affected by economic cycle.

Consumer defensive stocks belong to companies whose products are demanded by customers irrespective of the market/economic cycle; for example- healthcare, housing, personal care, etc.

Bod Australia Limited (ASX: BDA)

Bod Australia Limited (ASX:BDA) is a cannabis-focused healthcare company with the market capitalisation of $21.86 million on 12 July 2019.

Distribution Agreement with BHC: The company has recently inked a distribution agreement with Burleigh Heads Cannabis (BHC) for its pharmaceutical grade medicinal cannabis product, MediCabilisâ¢. The agreement also includes BDAâs partner company, Cannabis Doctors Australia (CDA), which provides recommendation, support and product to clinicians and patients with respect to the medicinal cannabis in Australia.

BDA Medicabilis⢠medicinal cannabis oil (Source: Company Presentation)

Under the terms of agreement, Bod will have the access to BHCâs wholesale distribution network established for the supply of medicinal cannabis products as well as CDAâs extensive network of medical specialists and physicians. The company eyes strong demand to follow, underpinned by CDAâs prescriptions to clinics and patients. These sales could favourably take the companyâs revenue to grow over the coming months.

Bod currently is in discussions with a number of potential distribution partners and further intends to collaborate with BHC to produce novel non-THC cannabis prescription products. The company believes that premium quality and consistent nature of MediCabilis⢠positions it favourably to meet growing demand.

Medicinal cannabis product supply for PTSD trial: Also, Bod recently confirmed that it would sell and supply its medicinal cannabis product for landmark Post Traumatic Stress Disorder (PTSD) trial being undertaken by Cannabis Access Clinics. This translates the supply of Bodâs MediCabilis⢠product to participants through its pharmacy distribution network, generating revenues and growth in patients and prescriptions.

PTSD trial, which commenced in June 2019, measures the efficacy of cannabis extract ECs315 in oil form on PTSD sufferers. PTSD is a particular set of reactions that can develop in people who have experienced a traumatic event, which threatened their life or safety, leading to develop feelings of intense fear, helplessness and horror in the sufferers.

BDA shares were trading at $0.345, up 9.52% by the end of the trading session on 12 July 2019. Over the past 12 months, the stock has fallen by 39.42%, including a negative price change of 4.55% in the past three months.

Also Read: Bod Australia confirms CBD Waferâs Excellence post the clinical trial

Asaleo Care Limited (ASX: AHY)

Asaleo Care (ASX: AHY) is an ASX-listed personal care and hygiene company that holds a portfolio of market-leading brands includes TENA, Purex, Libra, Tork, Treasures, Handee Ultra, Deeko, Sorbent, Orchid and Viti.

Appointment of CFO: The company recently announced the appointment of its new Chief Financial Officer (CFO) Campbell Richards, effectice 29 April 2019. Mr Richards has been entrusted with the responsibility of leading the companyâs finance and investor relation functions.

Asaleo CEO and Managing Director Sid Takla stated that the time of Mr Richardâs joining is an added advantage to the companyâs recent divestment and focus on our core businesses in Personal Care and Business-to-Business.

2018 Financial Results: In 2018, Asaleo delivered underlying EBITDA of $80.6 million, down 35% on the previous corresponding period. The loss in earnings mainly represents the now sold Australian Consumer Tissue business of Asaleo and the headwinds experienced in the costs of the companyâs business.

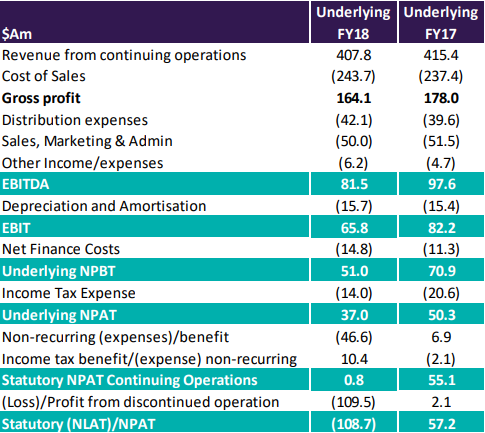

Snapshot of AHY FY2018 Financial Results (Source: Company Presentation)

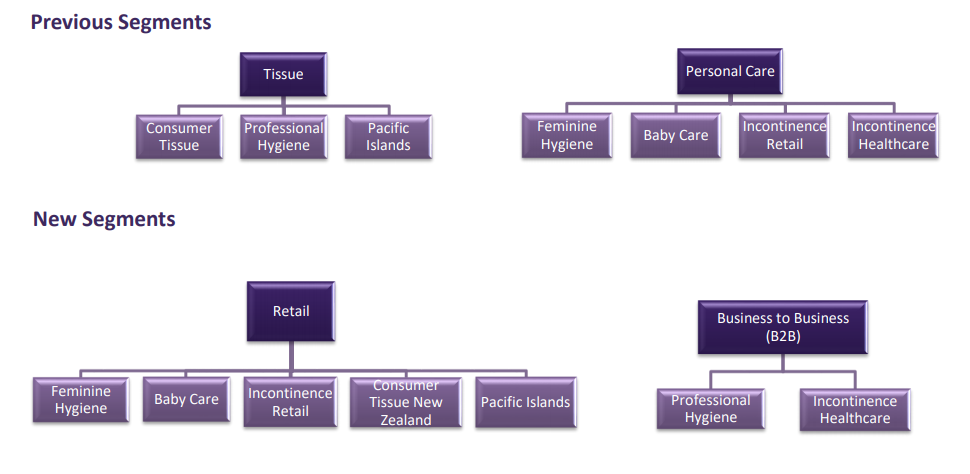

With the sale of the Australian Consumer Tissue business, the company changed its reporting for continuing operations to be under Retail and B2B segments. It was previously Tissue and Personal Care. Underlying EBITDA in 2018 from this continuing operations perspective, was $81.5 million, down 16.5% on last year. This decline was reportedly driven by a massive $33 million cost increase in pulp prices and continuing high energy costs. Lower sales in the companyâs Baby care and Feminine care businesses also had an adverse effect, as per the companyâs information.

AHY Segment Change (Source: Company Presentation)

During the fiscal year ended 31 December 2018, the company focused on Feminine Care to transition off the âevery dayâ pricing mechanism and reinvest in increased trade spend to support market share and protect the companyâs volumes against competitor discounting. As a result, AHY successfully achieved 3 consecutive quarters of volume growth, with 2nd half volumes higher than the previous 2nd half.

However, still the decline in Baby and Feminine Care was to such an extent that revenue growth in the Incontinence Care, Consumer Tissue NZ and the Pacific Islands businesses fell insufficient to offset; this took total Retail revenue down 5.2% on the prior year.

In Chairmanâs address to shareholders, Mr Harry Boon stated âStrong capital management continued throughout 2018 with solid free cash flow of $64.8 million. AHY net debt was reduced to $262 million at year end, with a leverage ratio of 3.25xâ

Divestment of AHY Australian Consumer Tissue Business: Following the strategic review, Asaleo Care decided to divest its Australian Consumer Tissue Business. The sale of this business for $180 million to Solaris was announced in December 2018 and was completed at the end of March 2019.

The company believes that the sale proceeds will significantly strengthen its balance sheet, reduce net debt, improve its leverage ratio, and is expected to reduce volatility in future earnings.

Extension of Agreement with Essity: As part of the strategic review, the company also reached in principle agreement with Essity to extend its Trade Mark and Technology Licence Agreement by a further 5 years, through to 2027. This agreement provides exclusive access to technology, marketing and sales rights for the Tork and TENA brands, and access to world-leading research, development and innovation for all its brands to Essity.

Outlook for FY 2019: Looking ahead to 2019, utilising the new lease accounting Standard, Asaleo EBITDA outlook for continuing operations stands in a range of $80-85 million. The company informed that under the same new Standard, 2018 continuing EBITDA would have been $90.6 million.

Stock Performance: AHY stock was trading at $0.945, up 0.53%, on 12 July 2019. Over the past 12 months, the stock has declined by 28.79% despite an upside of 2.73% in the past three months. The market capitalisation of the company sits at $510.54 million with 543.12 million shares outstanding.

3P Learning Limited (ASX: 3PL)

3P Learning Limited is into education business that consists of the development, sales and marketing of online educational programs to schools and to parents of school-aged students. The market capitalisation of the company is $134.46 million as on 12 July 2019.

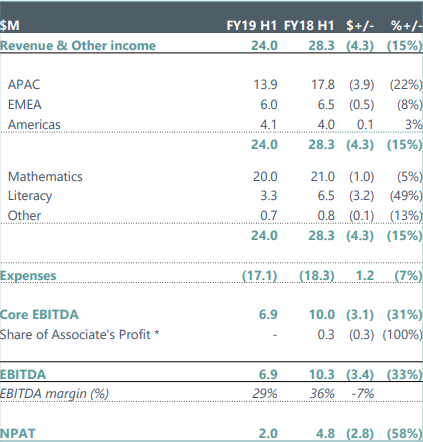

1H FY19 Performance: The Group recently announced its half-year results for the period ended 31 December 2018. Its Revenue was $24.0 million, down $4.3 million on prior year period; Core EBITDA declined $3.1 million to $6.9 million; NPAT was down $2.8 million to $2.0 million.

Snapshot of 3PL 1HFY19 Financial Results (Source: Company Presentation)

3PL informed that this half-year decline was due to re-phasing of APAC annual renewals from the first half to the second half of the current year, in line with the start of the school year in Australia and New Zealand. EMEA revenue declined as a result of uncertain market conditions due to political instability from the expected withdrawal of the United Kingdom from the European Union and government school funding cuts. However, revenue in the Americas segment moved up 1% on the prior year.

3PL 3-year Growth Plan: 3P Learning Limited has mapped out its 3-year growth plan for 2020-2022. The company confirmed that it is on track of executing its 3-year strategic plan which has achieved its goals to reset the operating model, taking significant cost out and reinvesting in strengthening the product portfolio and building a scalable digitised sales and marketing model.

It aims growth through product, customer, geographic expansion and improvements in customer retention over the target period. However, 2020-2022 complete plan remains pending for release in 3PLâs full-year results.

Outlook: Going Forward, the group focuses on revenue growth from an improved and broader product portfolio to new and existing customers in ANZ, in-line with growth-focused 2022 strategy. It major focus is on retention and LTV through our Customer Success initiatives including more flexible SaaS models and pricing and an expanded product portfolio in H2.

3PL believes that Latin American partners will drive penetration into new geographic opportunities coupled with Mathletics Play (Spanish) due for FY19 launch. It further confirmed that the sales momentum is building; the company is on track to grow licences, year-on-year revenue and EBITDA for FY19.

Stronger Balance Sheet with $25 million to $28 million of cash expected at year-end that will allow the company to continue to support and grow the business, stated 3PL.

Stock Performance: 3PL shares settled the dayâs trading at $0.965 on 12 July 2019. Over the past 12 months, the stock has declined by 19.25% including a negative price change of 9.81% in the past three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)