A listed investment company or LIC has features of both managed funds as well as ASX-listed companies. LICs put money in different companies to give its shareholders cost-effective exposure to a variety of companies.

As per Mr. Boyd Peters, national distribution manager at Contango MicroCap, LICs are increasing in popularity for several reasons, including:

- Simplicity - you place your order to buy or sell on ASX as you would for any company;

- Access - some investment managers are only available through an LIC;

- Cost - management fees can be as low as 0.15 per cent per annum;

- Certainty of income

The S&P/ASX 200 Accumulation Index increased strongly during November (up 3.3 per cent), as global indices also climbed higher prompted by optimism at the time over a positive trade deal between the US and China. In Australia, there was also speculation about a further cash rate cut by the RBA, although this did not eventuate.

While financial markets are strong, economic fundamentals remain relatively soft. Since the start of 2019, Australian consumers have benefited from three interest rate cuts, tax cuts, strong commodity prices and a bottoming in the housing market.

In light of this scenario, letâs take a look at few LICs that are trading on ASX.

WAM Microcap Limited (ASX: WMI)

In November 2019, WAM Microcap investment portfolio decreased slightly by 0.7%. On the one hand, online business lender Prospa (ASX: PDL) was a detractor for the portfolio and on the other hand, corporate bookmaker PointsBet (ASX: PBH) was a significant contributor.

On 18 October 2019, the company paid fully franked final dividend of 2.25 cents per share and fully franked special dividend of 2.25 cents per share.

If we look at the WMI Investment Portfolio performance in last three month till November 2019, the portfolio has outperformed S&P/ASX Small Ordinaries Accumulation Index by 6.1%.

On YTD basis, WMI stock has provided a return of 18.93% on ASX. At market close on 20 December 2019, WMI stock was trading at a price of $1.485 with a market cap of around $208.62 million.

Australian Foundation Investment Company Limited (ASX: AFI)

Last year, Australian Foundation Investment Company Limited made various changes to its Board, which include:

- Terry Campbell retired from the AFIC board and chairmanship at the end of the AGM last year;

- In January Jacquie Hey retired from the board after nearly 6 years of service;

- In May 2019, Rebecca Dee-Bradbury joined the board

As at 30 November 2019, the company had portfolio of $8.2 billion. In last one-year AFI stock price has increased by 21.52% on ASX. At market close on 20 December 2019, AFI stock price was trading at $7.020 with a market cap of $8.47 billion.

MFF Capital Investments Limited (ASX: MFF)

MFF Capital Investments Limited holds a minimum of 20 stock exchange listed international and Australian companies and is focussed specially upon companies with attractive business characteristics at discounts to their intrinsic values.

As at 13 December 2019, the companyâ weekly net tangible asset (NTA) per share was at 3.664 pre-tax and $2.997 post-tax.

On YTD basis, MFF stock has provided a return of 40.23% to its shareholders.

Magellan Global Trust (ASX: MGG)

Formed in the year 2006 to generate attractive returns for clients, Magellan Global Trust has developed a track record for creating and safeguarding wealth for its investors. As at 13 December 2019, NAV per unit of Magellan Global Trust was at 1.9423.

Key Features of MGG

- Target Cash Distribution yield of 4% per annum paid semi-annually

- An attractive distribution reinvestment plan with a 5% discount to the NAV per Unit in respect of the Target Cash Distribution

- Currency exposure to be managed by Magellan, currently 50% hedged to AUD

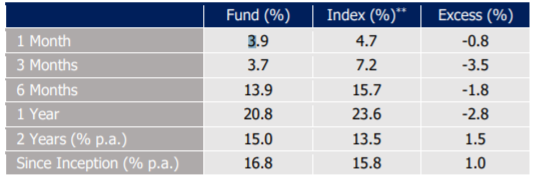

Fund Performance as at 30 November 2019 (Source: Company Reports)

In the last one-year MGG stock has provided a return of 17.01% to its shareholders.

WAM Capital Limited (ASX: WAM)

During November 2019, WAM investment portfolio increased by 12% while S&P/ASX All Ordinary Accumulation Index increased by 3%. The major contributor was Emeco which had a strong start to its FY2020. EML Payments was also a significant provider to the portfolio. In the last one year, the companyâs portfolio has outperformed S&P/ASX Small Ordinary Accumulation Index by 1.7%.

In the last six months, WAM stock price has increased by 11.39%.

WAM Research Limited (ASX: WAX)

During November 2019, WAX investment portfolio decreased by 0.1% while S&P/ASX All Ordinary Accumulation Index increased by 3%. Employment management service provider Smartgroup Corporation was the detractor during the month, while Emeco was the leading contributor to the portfolio.

In the last six months, WAX has provided a return of 7.27% to its shareholders. At market close on 20 December 2019, WAX stock was trading at a market price of $1.490 with a market cap of around $283.39 million.

MILTON Corporation Limited (ASX: MLT)

Milton is a long-term investor which has a long track record of paying fully franked dividends (refer below image).

Dividend and Investment growth (Source: Company Reports)

As at 30 November 2019, Milton had NTA per share of $5.01 (before-tax).

On YTD basis, MLT stock has provided a return of 16% to its shareholders. At market close on 20 December 2019, MLT stock was trading at a price of $4.950 with a market cap of around 3.32 billion.

Clime Capital Limited (ASX: CAM)

In November 2019, CAM portfolio pre-tax net return was 4.1%.

Key contributors and detractors to the portfolio return for the month were:

- Australian Equity Large Cap Sub-Portfolio: Positive contributors Amcor (AMC), BHP Group (BHP), CSL (CSL) & Woodside (WPL), detractors Westpac Banking Corporation (WBC), Australia and New Zealand Banking Group (ANZ) & National Australia Bank (NAB);

- Australian Equity Mid Cap Sub-Portfolio: Positive contributors Bravura Solutions (BVS), Webjet (WEB), Afterpay (APT) and Credit Corp (CCP), detractor HUB24 (HUB);

- Australian Equity Small Cap Sub-Portfolio: Positive contributors Audinate (AD8), Citadel Group (CGL), Navigator Global Investments (NGI) & APN Property Group (APD), detractor Lovisa Holdings (LOV).

At market close on 19 December 2019, CAM stock was trading at a price of $0.970 with a market cap of around $109.73 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.