While searching for investment asset in the stock market, an investor generally looks for companies, which have the capability propel growth in the future. Growth refers to increase in quantitative as well as qualitative values.

In the below article, we would discuss six investment assets, which could increase the value of an investorâs portfolio. Short-term traders are on a look out for sound business profile as well as decent technical rally.

Letâs have a look at six companies with their latest updates:

Bravura Solutions Limited

Bravura Solutions Limited (ASX:BVS) is in the business of licensing, development of management software applications.

Issue of Shares

- On 27 September 2019, the company issued 439,440 ordinary shares, fully paid, at the issue price of $4.39/ share.

- The shares were issued in respect to the final dividend under its DRP, which was paid on 27 September 2019.

- The DRP price of $4.39 per share included a discount of 2%, applicable under the DRP.

Financial Performance

- For the financial year ended 30 June 2019, the company reported an operating cash flow of $46.5 million, reflecting a cash conversion of 95%.

- It posted revenue amounting to $257.7 million with a rise of 16% as compared to FY18.

The stock of BVS quoted $3.830, up 0.52% on 11 October 2019. The stock has generated return of -16.63% and -28.25% during the last three-month and six-month, respectively.

Pushpay Holdings Limited

Pushpay Holdings Limited (ASX:PPH) offers a donor management system, which comprises of donor and finance tools along with a custom community application. The company, through a release dated 9 October 2019 notified that it would announce results for the six months ended 30 September 2019, in the interim results investor briefing on 6 November 2019.

Issue of Securities

- The company on 30 September 2019 granted 506,555 restricted share units at the consideration of NZ$3.3095 each.

- The objective behind grant of restricted share units was the RSU scheme, as part of the remuneration package of certain employees.

Guidance for Financial Year 2020

- The company is expecting annual operating revenue in the range of US$122.5 million and US$125.5 million and gross margin of more than 63%.

- The guidance for EBITDAF stood in the ambit of US$18.5 million and US$20.5 million.

the stock of PPH quoted $2.920, down 2.66% as on 11 October 2019. The stock has generated negative returns of 5.96% and 9.37% during the last three and six months, respectively.

REA Group Ltd

REA Group Ltd (ASX: REA) has a presence in the market with its purpose to enhance property experiences. It provides digital tools, information and data for people interested in property.

Change in Directors Interest

The company recently communicated about the changes in holdings made by directors:

- On 5 September 2019, the company stated that Tracey Fellows disposed 9,100 ordinary shares at the consideration of $956,428, which led to change in directorâs interest in the company. Following the change total securities held with Tracey Fellows stood at 7,386.

- Accordingly, Owen Wilson also disposed 1,000 ordinary shares at the value of $105,681. The total securities held with Owen Wilson post-change stood at 13,682 Ordinary Shares, 6,063 Performance Rights with a performance period ending 30/06/2020, 7,335 Performance Rights with a performance period ending 30/06/2021.

Financial Statistics

For the year ended 30 June 2019, the company updated the market with its financial highlights from core operations:

Revenue amounted to $874.9 million, reflecting a growth of 8% and EBITDA of $501.2 million with 8% growth.

- However, there was a decline of 58% in reported net profit and the figure stood at $105.3 million, which reflects one-off transactions in both periods.

- The 8% lift in the Aussie business led to growth in revenue, driven by the strong performance of the Developer and Residential businesses amid the tough market conditions nationwide, majorly in the 2H.

- When it comes to return to shareholders, the Board declared a fully franked final dividend amounting to 63.0 cps. This brings the total dividend to 118.0 cps for the 2019 financial year, with growth of 8% as compared to the previous year.

The stock of REA quoted $109.56, down 0.4% as on 11 October 2019. The stock has generated returns of 11.13% and 46.17% during the last three-month and six-month, respectively.

SEEK Limited (ASX: SEK)

SEEK Limited (ASX: SEK) is primarily involved in online matching of hirers and candidates with career opportunities and related services.

Recent Issue of Securities

The company recently issued some securities:

- Issue 1: The company issued 224,696 wealth sharing plan options and 455,259 wealth sharing plan rights.

- Issue 2: It issued 5 equity rights issued to executives under the SEEK equity plan

- Issue 3: 58 performance rights have been issued to senior management under the SEEK equity plan

- Issue 4: The company issued 7 performance rights issued to senior management in Malaysia under the SEEK equity plan.

- Issue 5: SEEK issued 491 restricted rights to a senior manager in Malaysia under its equity plan.

- The issue 1,2,3 and 4 was made on 23 September 2019 and issue 5 wrapped up on 28 August 2019.

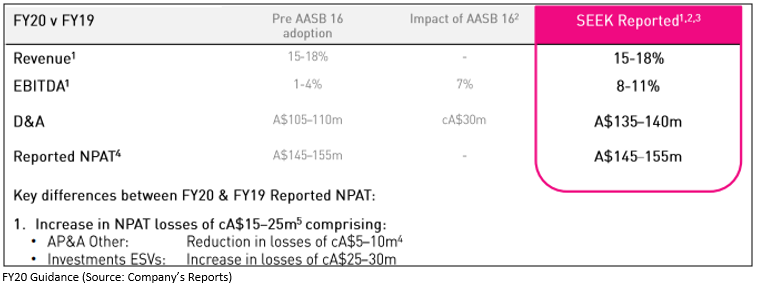

Strong Growth in Financials

- For the 12 months ended 30 June 2019, the company reported strong growth of 18% over pcp in revenue as it pursues large revenue opportunity.

- The company posted growth of 6% in EBITDA in comparison to pcp, which was resulted by SEEK ANZ, SEEK Asia and Zhaopin.

The stock of SEK quoted $20.97, up 0.52% as on 11 October 2019. The stock has generated 18.46% in the past six months.

Qantas Airways Limited (ASX: QAN)

Qantas Airways Limited (ASX: QAN) deals with domestic and international air transportation services.

NZD Currency Conversion

The company through a release dated 3 September 2019 announced that the NZD currency conversion rate for dividend were as follows:

- QAN announced the payment of a fully franked dividend of $0.13 per ordinary share on 22 August 2019.

- The currency conversion rate stood at NZ$1.0675 to A$1.00, and the converted dividend payment amount stood at NZ$0.1388 per ordinary share.

The company would be conducting its 2019 Annual General Meeting on 25 October 2019. The key business items for the same would be:

- To receive and consider the Financial Report.

- Election of Directors.

- Participation of the Chief Executive Officer, Alan Joyce, in the long-term incentive plan.

- Remuneration report.

- Resolutions sponsored by the Australian Centre for Corporate Responsibility and requisitioned by 102 shareholders.

For more information, READ HERE

The stock of QAN quoted $6.350 and traded flat on 11 October 2019. The stock has generated return of 8.92% and 10.63% during the last three-month and six-month, respectively.

Noni B Limited

Noni B Limited (ASX:NBL) is in the business of retailing of womenâs apparel and accessories with a market capitalisation of $272.34 million as on 11 October 2019.

Issue of Shares

- The company issued 104,596 fully paid ordinary shares at the consideration of $2.89 per share on 8 October 2019.

- The company issued shares as part of its long-term incentive program in order to align the interests of the recipients with those of the shareholders and are issued under the terms of its share plan.

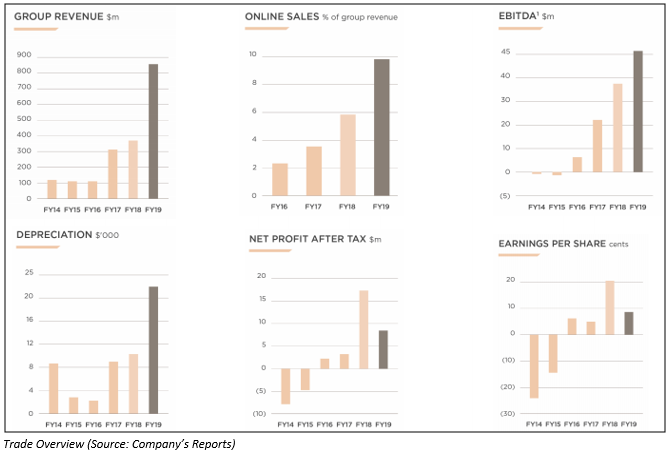

When it comes to the financial end, the company reported a growth of 22% in underlying EBITDA, at $45.5 million. It declared final dividend amounting to 5.5 cents per share, fully franked. The below picture depicts an overview of trade overview of the company:

The stock of NBL quoted $2.840, up 1.06% as on 11 October 2019. The stock has generated 2.18% in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.