About Australian Equity Market

The Australian equity market has a total capitalisation of approximately $2 trillion from listed companies, with around $5 billion shares being traded every day. As the numbers speak, the Australian equity market is amongst the largest and most high-profile financial markets in Australia.

Most large well-known companies in Australia, such as the major banks and resources companies, listed on ASX account for a large part of Australian output and provide employment to a significant number of individuals.

The major Australian equity market, Australian Securities Exchange (ASX), came into existence as a result of the merger of the Sydney Futures Exchange and the Australian Stock Exchange. Currently, ASX is among the top-10 listed exchange globally measured in terms of market capitalisation.

Over the years, the Australian equity market has evolved significantly in terms of ways of doing business as well as growth and expansion. The market has undergone various fluctuations and endured through the domestic as well as global economic uncertainties.

Letâs take a look at few highlights from the ASX Group Monthly Activity Report for the month of September 2019:

- Average daily number of trades was 30% higher than the pcp

- The average daily value traded on-market of $5.4 billion was up 17% on the pcp

- Total capital raised was $5.4 billion, down 33% on the previous corresponding period (pcp)

- Average daily futures and options on futures volumes were up 15% on the pcp

- Average daily futures volume was up 15%, and average daily options volume was up 91% on the pcp

- Single stock options average daily contracts traded were up 3%, and index options average daily contracts traded were down 27% on the pcp

- Managed Portfolio Services Limited resigned as an ASX Market and ASX Settlement Participant

Australia is a strong economy with the ability to minimise the exposure to the risks faced by other developed nations in the globally uncertain scenario. The geographical proximity of Australia with the key emerging markets along with sturdy commodity prices adds to the growth prospects of the country for the upcoming years.

The safe and reliable business environment of Australia for hosting business makes it strikingly attractive destination for foreign investors to invest. There can be several reasons as to why investing in an equity market would be a viable investment for an inexperienced as well as experienced investor. Below are some reasons:

- Prudent Financial Regulatory Framework

Australia has solid corporate governance laws and ensures effective investor protection through its vigilant regulatory bodies. Australia's financial regulatory framework comprises of three agencies, each with specific functional responsibilities, namely,

- the Australian Prudential Regulation Authority (APRA) responsible for prudential supervision

- the Australian Securities and Investments Commission (ASIC) responsible for market integrity and consumer protection across the financial system

- the Reserve Bank of Australia (RBA) responsible for monetary policy, overall financial system stability and regulation of the payments system

Recently, to further strengthen Australia's financial architecture, key proposals in the CLERP 9 Paper aimed at ensuring the effectiveness and quality of the audit process were introduced. Some of them are:

- expanding the responsibilities of the Financial Reporting Council to include oversight of auditing standard-setting arrangements and auditor independence requirements;

- amending the Corporations Act 2001to include provisions relating specifically to auditor independence;

- the compulsory rotation of audit partners every five years;

- a requirement that all companies included in the All Ordinaries share price index (the top 500 listed companies) have an audit committee;

In addition to this, the shares of a few Australian companies have experienced a dip in their prices or have been placed in trading halt by the ASX. To some extent, the dip in their prices was witnessed as an implication of persisting regulatory risks.

- Growing Profits of Listed Company

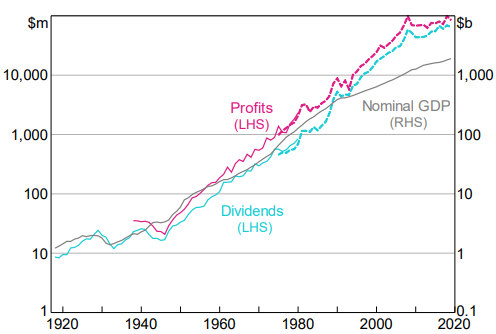

It is important to understand trends in profits since dividend payments to shareholders are largely driven by corporate profits. As per the RBA, the company profits of the ASX listed companies have increased by an average of approximately 10% per year since 1937.

During the course of time, the earnings noticeably outshined GDP in conjunction with the expansion of the stock exchange. As per RBA, the growth of the Australian stock exchange was at a faster pace as compared to the growth of the economy.

More recently, with the stabilization in the market in terms of relative size, growth in the earnings has been significantly aligned with or a bit slower than the nominal GDP

Profits and Dividends of Listed Companies (Source: RBA)

- Diverse Opportunities

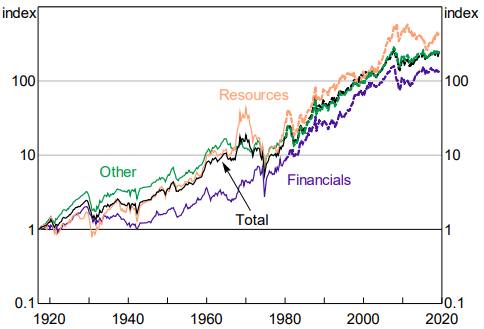

More than half of the Australian Securities Exchange by market capitalisation is comprised of financial companies and resources companies. However, it is worth noting that there have been significant fluctuations in the relative share of various sectors in the equity market of Australia over time.

With listed companies from diverse sectors and industries, including companies having major offshore operations, ASX provides an enhanced opportunity to the investors for better opportunities and exposure.

The employment of technology in the financial markets has facilitated the integration of financial markets and synchronisation of market investing ways. An investment in foreign equity markets can help to counter the risk involved with the domestic stock market and provides fortification against volatility to some extent.

The wide variety of investment alternatives provided by ASX to investors for portfolio development are constituted by the listing of a huge number of companies from multiple sectors like healthcare, technology, media, oil and gas, telecommunication etc.

- Defensive Characteristics

The performance of the Australian equity market was noted to be relatively stronger than other global markets during the period after the global financial crisis, as an implication of the continuous demand from a Chinese-induced commodity boom.

Moreover, with almost all businesses open to foreign competition, robust regulatory frameworks and transparent business processes, Australia continues to be an attractive and dynamic destination for investment.

Australia has witnessed a remarkable uninterrupted expansion for a period of 28 consecutive years. Along with setting a record among developed economies, the Australian economy gained credibility and reliability as a low-risk and safe environment for business.

This fortunate record of steady growth validates the robustness of Australiaâs economy, coupled with empowered regulatory institutions in the country. With the strong infrastructure in the regulatory area, the Australian economy has developed the ability to respond to global changes. The steady growth of the Australian economy is fortified by a diversified and services-based economy.

- Yields

Stepping into the shoes of an investor, one must realise that a more imperative figure for the investor is the dividend yield (the ratio of annual dividends to share price). The dividend yield reflects the profit that an investor earns as a reward for holding shares of a company.

As per the report of RBA, the dividend yields during the early 20th century was quite high, with fluctuations around 6% â 7%. Moreover, the S&P/ASX 200 has a dividend yield of around 4.5% (as of 2019), which is one of the highest yields among the global equity price indices. However, dividend yields were noted to go down as an implication of share price growth outdid dividends during the 20th century.

The shares in the Australian equity market have not only provided yields in the form of dividends and recurring profits but have also generated significant appreciation in the share prices, thereby generating capital gains for the investors.

According to Reserve Bank of Australia, the share prices of the top 100 companies have increased by approximately 6% per year in terms of a geometric average, or by around 2% (after accounting for inflation) over the period of last 100 years.

Equity Price Indices (Source: RBA)

Notwithstanding the fluctuations of overperformance and underperformance in the long-term, it is notable that the different industrial sectors in Australia have performed quite similarly.

Founder and CEO of Plato Investment Management, Don Hamson, quoted:

â2018-19 financial year might just be the biggest year for dividends at the market level, particularly if one includes special dividends and tax-effective, off-market buybacksâ

In conjecture to the above,

âWe forecast that Australian shares will provide substantially more income than cash and bonds in 2019â

âLow inflation and a softening housing market in Sydney and Melbourne suggest the official cash rate is likely to remain stubbornly low at 1.5 per cent for some timeâ

Bottomline

The Australian equity market has grown over the past century to be one of Australiaâs most important financial markets.

All the trading venues and clearing and settlement facilities in relation to ASX are regulated and supervised by the Australian Securities and Investments Commission (ASIC). Moreover, the Reserve Bank of Australia maintains the oversight of financial system stability in Australia. The combined efforts of ASIC and RBA further strengthen the credibility in the operations of ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.