In the Australian health care sector, the advancement in medical science have completely changed the health care services. New and advanced technologies have a high impact on medical and health services. These technologies are improving the health system, such as the introduction of digital health technologies added value to the diagnostic services.

The Australian Government is investing in medical research and technological innovation through the Medical Research Future Fund for providing the appropriate facilities to the patients, medical centres and health care practitioners. In 2016â17, Australia spent nearly $181 billion on health - by the Australian Government (41%), state and territory governments (27%), individuals, private health insurers (17%) and non-government organisations (6%).

Letâs discuss Six ASX listed health care stocks HLS, PME, PNV, SIG & AVH.

Healius Limited (ASX:HLS)

An Australian headquartered, leading health care company Healius Limited (ASX:HLS) is engaged in providing imaging services, pathology and health technology. The main business of Healius are pathology, imaging and medical centres, and it also has three emerging businesses- dental, day hospitals and IVF.

On 25th November the company updated the market with its Annual general meeting (AGM) presentation highlighting its financial results and strategic projects.

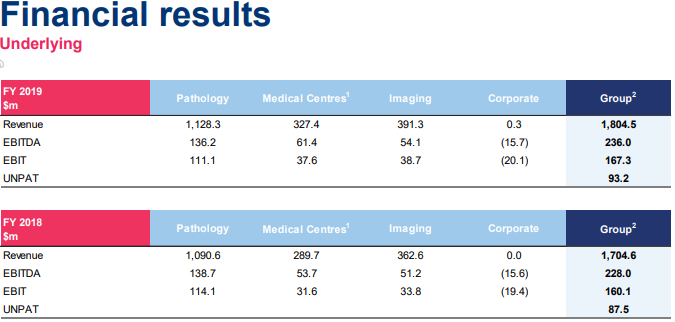

- The company generates a group revenue $1,804.5 million, which includes revenue from pathology, medical centres, imaging and corporate.

- The group EBITDA was $236.0 million for FY2019.

- Underlying Net Profit After Tax (UNPAT) of the company was $93.2 million for the last fiscal year.

- The company acquired Montserrat in October 2018 and opened three hospitals which includes Westside with more than forty specialists.

Source: Companyâs Report

FY 2020 forecast-

- The company is expecting an underlying NPAT of ranging $94 million to $102 million for FY 2020.

- Healius delivers an increase of 9.4%, in line with the seasonally adjusted 2H19 run-rate.

The HLSâ stock was trading at $3.030 on 26 November 2019, down by 0.329% (at AEST 2:13 PM), with a market capitalisation of nearly $1.89 billion. HLS has approximately 622.74 million shares outstanding. It has 52 weeks high noted at $3.315- and 52-weeks low noted at $2.190. The annual dividend yield of HLS stock was 2.37% with a P/E ratio of 33.040x.

Pro Medicus Limited (ASX:PME)

An Australian based, health care service provider Pro Medicus Limited (ASX:PME) offers seamless, medical imaging products to the health care sector. Visage Imaging is PMEâs completely owned subsidiary which is engaged in providing imaging and advanced visualisation solutions worldwide.

Recently, the company released its AGM presentation for FY2019, in which the Managing Director and CEO of Pro Medicus Dr Hupert, mentioned the overview of the company and its new contracts with their renewal, and also highlighted about the new Visage AI Accelerator.

New contracts with extension or renewal:

- Seven years of agreement with Duke Health worth $14 million.

- The company signed a contract with Partners Healthcare for seven yearsâ worth $27 million.

- PME recently signed a five yearsâ contract with The Ohio State University worth $9 million.

- The company contract with Government Hospital in Germany was extended.

The PME stock was trading at $24.57 on 26 November 2019, down by 2.267% (at AEST 3:01 PM), with a market capitalisation of nearly $2.61 billion. PME has approximately 103.98 million shares outstanding. It has 52 weeks high price of $38.390- and 52-weeks low price of $0.035. The annual dividend yield of HLS stock was 0.32% with a P/E ratio of 135.890x.

PolyNovo Limited (ASX:PNV)

An ASX listed health care player PolyNovo Limited (ASX:PNV) is engaged in providing dermal regeneration solutions by using NovoSorb- its patented bio-resorbable polymer technology. NovoSorb BTM is the first product of PolyNovo and is a dermal matrix which promotes repairing of the dermal skin. The company has wholly owned 47 granted patents (in the family).

Recently, PNV presented to its investors in New York city, talking about the overview of its business expansion related work and near-term investments made by the company.

According to the investorâs presentation highlights of the fiscal year 2019 are-

- From sales of NovoSorb BTM the company generated a revenue of nearly $9.3 million.

- For FY2019, the cash on hand was approximately $13.9 million.

- The company reported a reduction in net cash outflow, down by 51%, from operating activities.

- Due to high production demand by the increased sale, the company purchased a new property.

- New regulatory approvals in three countries - India, Singapore and Malaysia.

Strategy for the fiscal year 2020-

- PolyNovo would make substantial increase in sales of BTM in the US and ANZ regions.

- The company is aiming to attain US DoD sales

- At the end of the FY2020, the company may file for Hernia US FDA 510(K).

On 26 November 2019, PNV stock was quoting $1.85, moving up by 2.267% (at AEST 3:26 PM). PNV stockâs market capitalisation was noted of nearly $1.19 billion. PME has around 661.09 million shares outstanding. Its 52 weeks high was recorded at $2.660- and 52-weeks low was noted at $0.530.

Sigma Healthcare Limited (ASX:SIG)

A Rowville headquartered health care company Sigma Healthcare Limited (ASX:SIG) is a full-line wholesaler and distributor to the pharmacies, that provides a range of quality and affordable Private and Exclusive Label products. Sigma Healthcare Limited is the largest retail pharmacy footprint in Australia and owner of some Australian pharmacy retail brands such as DDS, Guardian & Amcal Max.

New My Chemist/Chemist Warehouse Group (MC/CW) supply agreement

Sigma has entered in an agreement with the MC/CW Group for the supply of FMCG products, which is effective from 1 December 2019. It is the first-line supply contract for 4.5 years period, with approximate sales of $700-800 million in the first full year of operations.

Sigmaâs Managing Director and CEO Mark Hooper commented on this agreement and said:

The SIG stock was trading at $0.730 on 26 November 2019, up by 0.69% (at AEST 3:34 PM), with a market capitalisation of nearly $768.09 million. PME has approximately 1.06 billion shares outstanding. SIG stock has 52 weeks high of $0.750- and 52-weeks low of $0.405.

AVITA Medical (ASX:AVH)

A global regenerative medicine company AVITA Medical (ASX:AVH) is engaged in providing a technology platform for the unmet medical needs in aesthetics, wounds and burns. AVITAâs medical devices work by preparing an autologous suspension of patientâs skin cells (REGENERATIVE EPIDERMAL SUSPENSIONâ¢) which generates natural healthy epidermis. The companyâs first product, RECELL® System, was approved in September 2018 by the United States Food and Drug Administration (US FDA).

Collaboration with the University of Colorado-

In a recent announcement made on 25th November 2019, the company unveiled about a preclinical research collaboration with the University of Colorado for establishing proof-of-concept and to explore the development of a spray-on treatment of genetically modified cells for patients having epidermolysis bullosa with the potential applicability to other skin (genetic) diseases.

With this partnership, AVITA Medicalâs Spray-On Skin⢠would combine with the new patent-pending joint reprogramming and gene-editing of Gates Center to enable cells to work in a proper way.

According to the terms of the Sponsored Research Agreement, AVITA Medical hold the option to license technologies to come up from this partnership, for the commercialisation and development.

The AVHâs stock was trading at $0.602 on 26 November 2019, up by 4.696% (at AEST 3:50 PM) with a market capitalisation of nearly $1.22 billion and a daily volume of 15,001,628. The stock has approximately 2.12 billion shares outstanding, with 52 weeks high price of $0.740 and a 52 weeks low price of $0.076.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.