In the midst of high volatility and lower rate of interest, the demand for dividend investing is on the upswing. These cash pay-outs are foremost sources of steady income for shareholders when there is a high risk of return from the equity market. Stocks with robust dividend yield and high returns are considered to be an outstanding options for investors looking to build a portfolio that plays well in a volatile market and provides security.

Investors can take the benefit of soaring current income, while forestalling capital growth regardless of tough market conditions.

A Winning Approach

Stocks with a strong dividend growth history falls into mature companiesâ category, which are less prone to large changes in the market, and thus, act as a fence against economic or political ambiguity. At the same time, these stocks offer downside security with their steady rise in pay-outs.

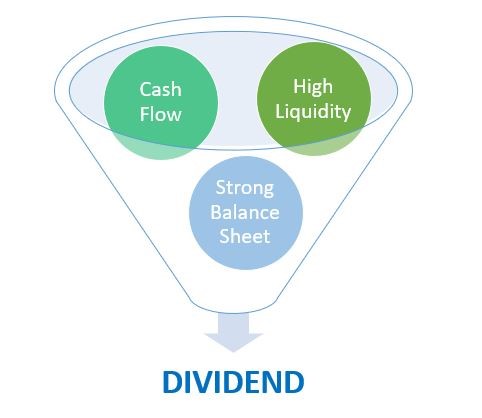

Moreover, these stocks have outstanding fundamentals that make such an approach, an encouraging investment for the long term. These include a balanced business model, a prolonged trail of productivity, increasing cash flows, high liquidity, healthy balance sheet and some value attributes. Further, a record of strong dividend growth suggests that dividend surge is expected in the future.

Benefits of Dividend Stocks

5 Steps to Find Dividend Stocks with Higher Returns

Finding a strong dividend-yielding stock may appear tricky, but investors should not feel too daunted. The list is an ideal list that should be considered with related benchmarks:

- Stocks having a market capitalisation of over $200 million across the range of Blue-chip, Mid-cap and Small-cap groups.

- Stocks offering a high dividend yield of at least 5% (with or without franking).

- Stocks having a positive return on equity (ROE) are generally considered as good ones.

- Stocks with strong fundamentals should be considered.

- Stocks with specific types of dividend declared by the corresponding companies.

Usually, large market cap companies are considered to be the top dividend payers as they have more room to profits. These large market cap companies are also recognised as âBlue-Chipâ companies. These stocks are considered to be well established with long-term investment opportunity and sound financial system.

Blue chips stocks are less volatile and delivers dividends to their shareholders on a regular basis.

As a result, picking dividend stocks with higher returns appear as successful approache when some other factors are also included.

Dividend Stocks to Watch:

Southern Cross Media Group Limited (ASX: SXL)

Entertaining media solutions provider, Southern Cross Media Group Limited is involved in business of innovation and broadcasting of content on free-to-air commercial radio, television and other online media platforms.

Financial Highlights for FY19: The company reported revenue of $660.1 million, marginally up by 0.5% year over year. Underlying EBITDA came in at $159.9 million, up 0.9% year over year. Underlying NPAT or net profit after tax was noted at $76.2 million, rising by 3.1 percent.

The Board of the company declared a dividend of to 7.75 cents per share (fully franked dividends), which is in line with the previous year. This includes 4.00 cps final dividend and 3.75 cps interim dividend.

Stock Performance: Southern Cross Media Group Limited has a market cap of $688.27 million with ~ 769.01 million outstanding shares. The company has an annualised dividend yield of 8.66%, Franking coming to 100% and ROE being 6.4% (as on 13 December 2019). The companyâs stock was trading at $0.930, up by 3.911% (at AEDT 1:50 PM).

Whitehaven Coal Limited (ASX: WHC)

Whitehaven Coal Limited is involved in producing top-quality thermal coal for trade to developing and emerging economies throughout North and South East Asia.

Financial Highlights: The companyâs TRIFR for the twelve months ended September 2019 saw an improvement and came in at 5.14. The company reported ROM coal production of 4.4Mt, up of 22% year over year. Moreover, saleable coal production came in at 4.9Mt, up 23% year over year.

In FY19, the board declared an interim dividend of 20 cps, which totalled $198.4 million. Also, a final dividend was declared by the company amounting to 30 cps worth $298 million.

Stock Performance: Whitehaven Coal Limited has a market cap of $2.82 billion with ~ 1.03 billion outstanding shares. The company has an annualised dividend yield of 10.18%, Franking coming to 21.67% and ROE being 15.1% (as on 13 December 2019). The companyâs stock was trading at $2.740, down by 0.364% (at AEDT 1:59 PM).

Harvey Norman Holdings Limited (ASX: HVN)

A public limited company, Harvey Norman Holdings Limited principal activities primarily consists of an integrated retail, property, franchise, digital enterprise etc.

Recent Updates: On 27th November 2019, the company announced details of its aggregate sales from 1st July 2019 to 31st October 2019. Sales from wholly owned company-operated stores came in at $2.44 billion, an increase of 2% year over year.

The company declared a fully franked final dividend of 21 cents per share, paid on 1st November 2019. Total dividend for the year ended 30 June 2019 increased 96.77% and came in at 33 cps.

Stock Performance: Harvey Norman Holdings Limited has a market cap of $5.22 billion with ~ 1.25 billion outstanding shares. The company has an annualised dividend yield of 7.88%, Franking coming to 100% and ROE being 13.2% (as on 13 December 2019). The companyâs stock was trading at $4.240, up by 1.193% (at AEDT 2:06 PM).

National Australia Bank Limited (ASX: NAB)

National Australia Bank Limited is engaged in renting, credit and access card facilities in the banking area. It is one of the top banks in Australia with over 30,000 employees serving around 9 million customers.

FY19 Highlights: In FY19, the company reported cash earnings of $5.097 billion, as compared to $5.702 billion in FY18. Net profit stood at $4.798 billion, as compared to $5.554 billion in FY18.

The company reduced its FY19 interim dividend and full year dividend to 83 cents per share, down 16% from FY18. Total dividend paid during the year was $737 million, with a pay-out ratio of 92.8%.

Stock Performance: National Australia Bank Limited has a market cap of $74.12 billion with ~2.95 billion outstanding shares. The company has an annualised dividend yield of 6.6%, and franking coming to 100%. The companyâs stock was trading at $25.530, up by 1.511 (at AEDT 2:21 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.