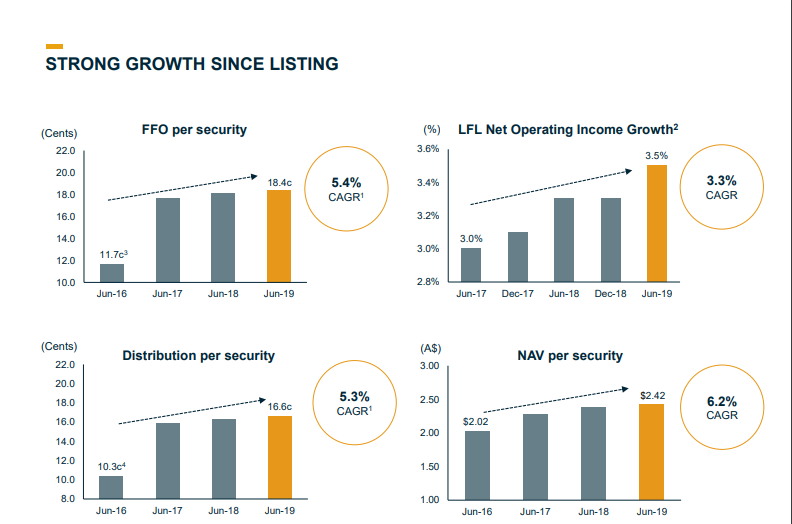

The following four companies from the information technology, industrials, real estate and financial sector have delivered positive returns in the stock market on the Year-to-date basis and the investors may want to keep a close eye to capitalise on the opportunity for gains.

iSignthis Ltd

Melbourne, Australia-based iSignthis Ltd (ASX:ISX) is engaged in the provision of distant identity verification and payment authentication services along with e-money deposit taking, transactional banking and payment processing for merchants via its two key solutions being Paydentity⢠and ISXPay®.

- Paydentity⢠is the reliable back office solution enabling merchants to direct their focus on business growth and stay ahead of the regulatory curve.

- ISXPay® is a principal member of Mastercard In, Visa Inc, Diners, etc. It enables users to access payments through alternative methods like Sofort, WeChat, SEPA, Poli Payments, AliPay.

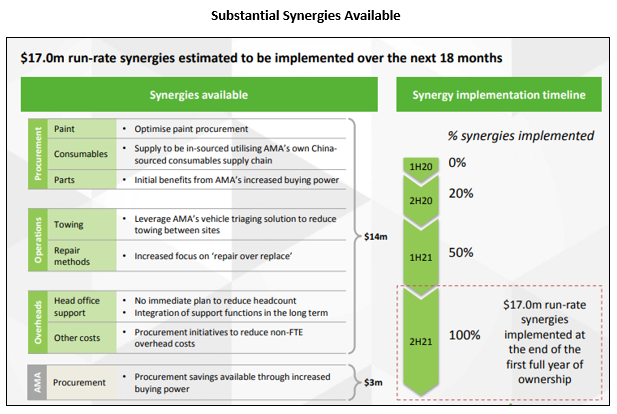

- Operational Update â On 1st October 2019, iSignthis released an operational update informing the stakeholders that its actual processed transactional volumes across the European Union (EU) and Australian regions continued to grow in accord as expected with onboarding of new business customers. Besides MSF % is also consistent with targeted 125Bps ecosystem average.

The company also stated that the Paydentity ecosystem is growing continuously as a business service offering, via an emphasis on customer acquisition and several revenue lines.

Also, the actual annualised EU+AU Paydentity Ecosystem GPTV of $ 1.9 billion was recorded until 30 September 2019.

iSignthis also announced that the approvals sales team continues to work through the growing pipeline of business customer applications and the Group approvals are expanding in line with expectations, up 45% to 304 as of end of quarter ended 30 September 2019, as compared to 270 as at 31 August 2019 and 210 at 30 June 2019 (end of prior quarter).

AMA Group Limited

AMA Group Limited (ASX:AMA) is engaged in identifying, developing and operating businesses in the automotive aftercare market. The company, through its subsidiaries, offers products and services that includes the distribution of automotive paints and smash repair consumables, the manufacturing of dynamometers, and the remanufacturing of transmissions.

Suncorpâs Capital S.M.A.R.T & ACM Parts Businesses Acquisition - On 1 October 2019, AMA Group announced to have reached an agreement with Suncorp Insurance Ventures Pty Ltd to acquire 90% of Capital Smart Repairs Australia Pty Ltd based on an implied enterprise value (100% basis) of $ 420 million. In addition, AMA would also acquire 100% of ACM Parts Pty Ltd from Suncorp for $ 20 million, concurrent with the Acquisition.

There is a strong strategic rationale for the transaction including â

- Strong strategic fit with AMA's existing Vehicle Panel Repair division;

- Further strengthening of AMA's long-standing relationship with Suncorp through strategic service agreement between Capital S.M.A.R.T and Suncorp;

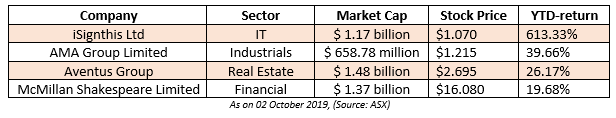

- Significant value creation from the combination with ~ $ 17 million of annual cost saving opportunities to be realised through AMAâs market leading procurement capabilities;

- Attractive shareholder value with double-digit EPS accretion expected in the first full year of ownership (FY21).

- Retainment of experienced high-quality Capital S.M.A.R.T management team.

- Combined market share of metropolitan driveable repair market estimated at ~10% ensuring significant opportunity for future growth.

Source: Investor Presentation

To fund the transaction, a fully underwritten ~$ 216 million equity raising would be undertaken along with new debt facilities comprising â

- A one for 4.5 pro-rata accelerated non-renounceable entitlement offer raising ~$ 139 million.

- Placement of around 67 million shares raising around $ 77 million.

Aventus Group

Aventus Group (ASX:AVN),based in Sydney, Australia, operates as a real estate company that owns, develops, and manages retail centres.

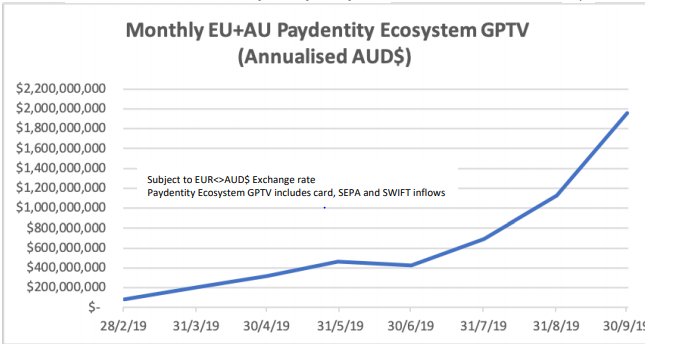

FY9 Results- Recently on 21 August 2019, Aventus Group announced its financial results for the 12 months to 30 June 2019 posting-

Portfolio Highlights -

- Like-for-like Net Operating Income (NOI) growth of 3.5% and achievement of high occupancy of 98.4% (including centres under development).

- Diversified tenancy mix with 38% of the portfolio by income in the Everyday Needs Category.

- Active leasing management with 141 leases negotiated across 108,000 sqm of Gross Lettable Area (GLA) with positive leasing spreads and low incentives achieved.

- Gained increased exposure to national tenants, of which 87% comprised of GLAâs portfolio.

Financial Highlights â

- Funds from Operations (FFO) of $ 96 million or 18.4 cents per security (up from $ 89 million; 18.1 cents per security);

- Distributions of 16.6 cents per security;

- $ 85 million worth of property valuation gains.

- Profit of $ 110 million.

- Gearing of 38.7% within target range of 30% - 40%.

- Weighted average debt maturity of 4.1 years (up from 3.3 years).

Source: Full Year 2019 Results Presentation

Source: Full Year 2019 Results Presentation

Aventus continues to work on its development projects and deliver good returns. In FY19, Aventusâ expenditure stood at ~$ 30 million in accord with its strategy to add value, increase the GLA of centres, enhance shopping experience as well as investor returns. Going forth, the development spend for FY20 is forecast to exceed $ 40 million, with Caringbah in Sydney being the major project.

Besides, the FY20 guidance of FFO per security is expected to grow by 3% to 4% which is equal to 19.0 â 19.2 cents per security.

McMillan Shakespeare Limited

McMillan Shakespeare Limited (ASX: MMS) provides vehicle leasing administration, asset management, salary packaging, and related financial services in New Zealand, Australia and the United Kingdom.

FY19 Results â As per the financial results for the 12 months to 30 June 2019, McMillan Shakespeare posted a modest growth of 0.8% in its revenue to $ 549.7 million in a period punctuated by difficult trading conditions, increased competition and a changing regulatory environment.

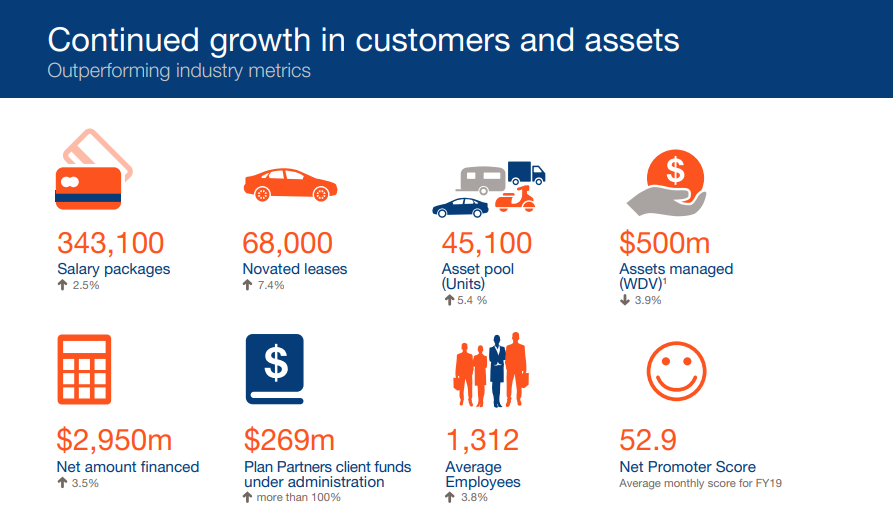

While companyâs UNPATA declined by 5.1% to $ 88.7 million, its respective business units performed well fairly well during FY19. The GRS segment delivered a good operational performance, with revenue increasing to $ 221.9 million, up 6.8% from $ 207.8 million in FY18. The company continued to focus on customer engagement and technological innovation that in turn helped in achieving numbers of salary packages and novated leases.

Source: FY19 Results Presentation

Source: FY19 Results Presentation

For FY19, the companyâs Board announced a fully franked dividend of 74.0 cents per share, a 1.4% increase on the prior year.

During the year, the company also established itâs a dedicated Environment, Social and Governance (ESG) steering committee and also published the 2019 Sustainability Report which highlights MMS Corporate Responsibility and Sustainability performance over FY19. The company reported a reduction in its carbon footprint and emissions with â

- Electricity usage across its Australian operations lower than in FY18, reducing by 0.12 tonnes of CO2 per full time employee (FTE).

- Air travel emissions (tonnes of CO2 by FTE) reduced from 0.36 in FY18 to 0.27 in FY19.

- Car fleet emissions reduced from 0.31 to 0.30 (tonnes of CO2 by FTE).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.