Xref Limited

Xref Limited (ASX: XF1) is a Sydney-based company which was formerly known as King Solomon Mines Limited. Since 2011, the company has been committed to pioneering positive change in HR as well as recruitment industries.

Xref is an automated reference checking software that helps the user to gather smart reference insights easily. It is fully responsive, user-friendly and ensures the validity of every hire. It also gets connected to the existing tools of the user.

XRef (Source: Companyâs Website)

Recently, on 30 April 2019, the company announced that its sales for March 2019 were $1.1 million. There was an increase in international sales by 51% as compared to the previous corresponding period. There was a slight increase in the gross cash outflow from $3.98 million in December 2018 quarter to $4.04 million in the March 2019 quarter. The cash by the end of March 2019 quarter was A$9.6 million.

There was a net cash outflow of A$1.938 million through the operating activities and A$0.039 million through the investing activities of the company. The estimated cash outflow in June 2019 quarter is A$4.090 million.

The shares of XF1 have generated a decent YTD return of 37.23%. By the closure of the trading session on 24 May 2019, the closing price of XF1 stock was A$0.635, down by 1.55% as compared to its previous closing price. XF1 holds a market cap of A$106.8m and approximately 165.58m outstanding shares.

Buddy Technologies Ltd

Buddy Technologies Ltd (ASX: BUD) is a company engaged in designing, developing and marketing a global data exchange.

Buddy Ohm is a product of the company which provides a simple, complete as well as low-cost solution. Buddy Ohm helps in providing new understanding for tenants as well as operators to monitor critical systems and at the same time, drive down monthly resource spending. When Buddy Ohm is presented with instantaneous data, users can make a real-time decision. Ohm acts as an activity tracker for buildings as the residents could see the link between their activities as well as energy consumption of the building directly.

Buddy Ohm (Source: Companyâs Website)

On 01 April 2019, the company completed the acquisition of LIFX, which is the leading smart lighting technology company and on 8 May 2019, the company announced that Google at the annual Google I/O Developers conference showcased the products of LIFX. LIFX got collaborated with Google to create a better smart home when it gets connected to a Google Nest Speaker or display through google assistance.

In the last five years, the shares of BUD have generated a return of 119.23%. By the closure of the trading session on 24 May 2019, the closing price if the shares of BUD were A$0.056, down by 1.754% as compared to its previous closing price. BUD holds a market cap of A$102.79 million and approximately 1.8 billion outstanding shares.

LiveTiles Limited

LiveTiles Limited (ASX: LVT) is a company that forms a part of IT sector is involved in the development as well as the sale of business software in Australia and abroad. LiveTiles is a complete intelligent workplace platform for Office 365, Azure and SharePoint which simplifies the complexities of the userâs business by combining their existing technology systems with the LiveTiles platform.

On 22 May 2019, the company announced that it had been chosen by Microsoft as a key partner as a key global launch partner of âhome sitesâ. As a part of this launch, the global pharmaceutical company, Novartis announced its new global corporate intranet utilizing SharePoint, home sites along with LiveTiles owned Wizdom Software. This announcement further strengthens the relationship of LVT with Microsoft as LVT pursues strong growth in enterprise customer base.

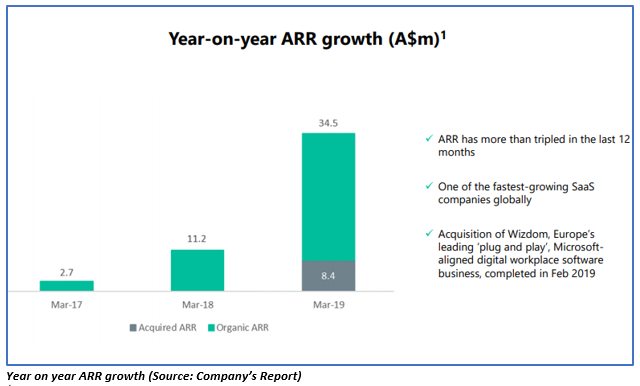

In its investor presentation published on 10 May 2019, the company reported an increase in ARR by more than 208% year-on-year to $34.5 million with 879 paying customers in just four years. There was a strong growth in the customer cash receipt in the March 2019 quarter by 256% as compared to the previous corresponding period.

LVT aims to organically grow the ARR to at least $100mn by 30 June 2021.

By the closure of trading session on 24 May 2019, the closing price of the shares of LVT was A$0.475, up by 1.064% as compared to its previous closing price. LVT holds a market cap of A$307.31 million and approximately 653.86 million outstanding shares.

Praemium Limited (ASX:PPS)

Praemium Limited (ASX: PPS) is a company from the IT sector, and it provides portfolio administration services. The leading accountants, financial advisers, investment managers and so forth, around the world uses Praemium for handling their investments internationally across more than 500k accounts.

Recently on 22 May 2019, the company in the Shaw and Partners Emerging Leaders Conference provided an overview of its current activities (till 16 May 2019) along with the 1H FY2019 result highlights. The company also highlighted its newly launched next-generation platform, Unified Managed account, which provides the user with a unified experience across model portfolios, bespoke portfolios and non-custodial holdings.

Companyâs Financials (Source: Companyâs Report)

Companyâs Financials (Source: Companyâs Report)

By the closure of trading session on 24 May 2019, the closing price of the shares of PPS was A$0.390, up by 1.299% as compared to its previous closing price. PPS holds a market cap of A$156.03 million and approximately 405.29 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.