The below-mentioned mining stocks have published significant updates in the recent past, which is why they are currently on the watchlist of investors. Letâs take a quick look at the each of them.

AVZ Minerals Limited (ASX:AVZ)

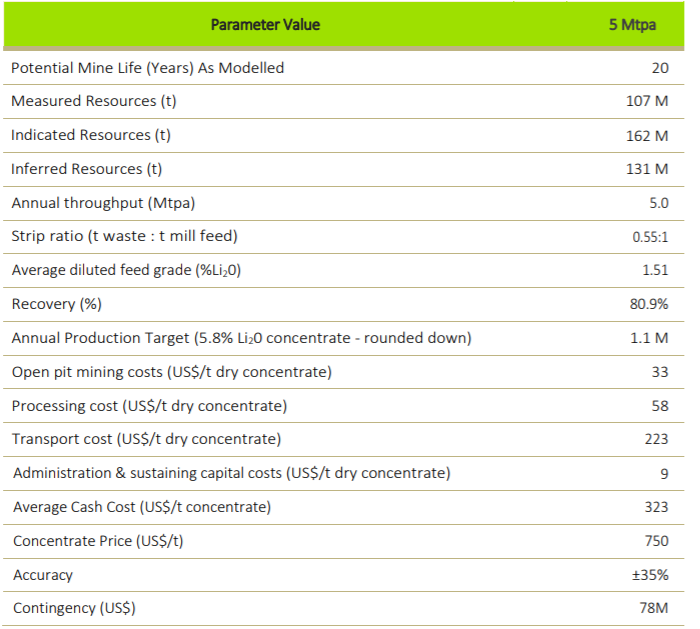

A mineral exploration company, AVZ Minerals Limited (ASX: AVZ) recently announced the extended results of the Scoping Study (Study) for 5 Mtpa capacity on the Manono Lithium and Tin Project, which confirmed the excellent quality of the Manono Project and further underlined the expandability of the project.

Key Operating Parameters (Source: Company Reports)

Key Operating Parameters (Source: Company Reports)

The company owns 60% of Manono Lithium and Tin Project. Recently, Manona was confirmed as the Largest Measured and Indicated Lithium Resource in the World, which is very encouraging news for the company and its shareholders. As at 31st March 2019, the company had cash and cash equivalents of $12,066k.

In the last six months, the share price of AVZ decreased by 25.93% as on 28th May 2019. AVZâs shares last traded at $0.064, up by 6.667% during intraday trade, with a market capitalisation of circa $136.99 million as on 29th May 2019.

Liontown Resources Limited (ASX:LTR)

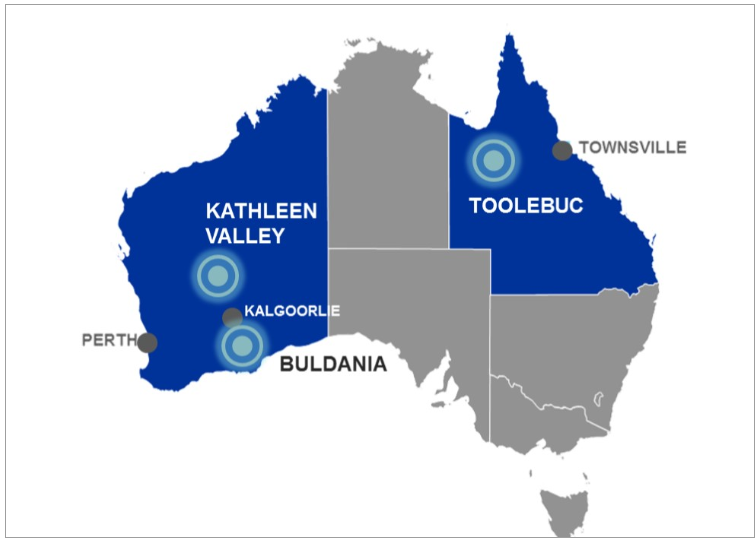

Battery metals exploration and development company, Liontown Resources Limited (ASX: LTR)

is involved in the development of 100%-owned lithium assets at Kathleen Valley and Buldania, both located in the premier WA mining districts.

Liontown Project Locations (Source: Company Reports)

Liontown Project Locations (Source: Company Reports)

The company recently reported a record intercept of 90m grading 1.3% Li2O from 209m down-hole from the ongoing resource expansion drilling program at its Kathleen Valley Lithium-Tantalum Project, encouraging news for the company and its shareholders. The results confirmed the strike and depth continuity of a thick high-grade zone defined by recently reported intersections, including 52m @ 1.4% Li2O in KVRC0204 and 48m @ 1.5% Li2O in KVRC0218.

In the last six months, LTRâs shares increased by 365.21% as on 28th May 2019. LTRâs shares last traded at $0.115, down by 4.167% during the dayâs trade, with a market capitalisation of circa $183.41 million as on 29th May 2019.

Greenland Minerals Limited (ASX:GGG)

The share price of Greenland Minerals Limited (ASX:GGG) has increased by 18.182% during the intraday trade. Greenland Minerals is involved in the exploration of rare earth minerals through its Kvanefjeld Project, favourably located in Southern Greenland, with year-round direct shipping access to the project area.

In the recently released Kvanefjeld Optimised Feasibility Update, the company reported an 8% increase in rare earth recoveries to 94% within the refinery circuit. It is expected that the increased recoveries will result in the production of 32,000 tpa rare earth oxide (REO), which will position Kvanefjeld as the lowest-cost undeveloped ASX-listed rare earth project.

In the last six months, the share price of the company increased by 39.24% as on 28th May 2019. GGGâs shares last traded at $0.130, with a market capitalisation of circa $124.59 million as on 29th May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.