Investors are always looking for companies which have the potential to become future leaders. Investments in these companies can help investors to expand their wealth by several folds. Budding small cap or mid-cap stocks which have rewarded investors with exponential returns are usually known as Multi-bagger stocks. Generally multi-bagger stocks are young companies with a unique product or service with high potential demand from consumers.

We have identified three multi-baggers, belonging to different sectors, which investors should know about. Let’s take a closer look at these multi-baggers.

Afterpay Touch Group (ASX:APT)

Technology-driven payments company, Afterpay Touch Group has successfully increased its shareholders’ wealth by several folds in the past two years. The stock price of the company has increased from $6.940 on 20 February 2020 to $39.110 as at 21 February 2020 (as at AEDT 2:30 PM), representing an increase of around 463% in the last two years. The stock is currently trading near to its 52 weeks high price of $41.140.

Last year was a transformational year for the company as it was able to operate in the US for full year while expanding to the UK and increased its active customer base by 130% and its active merchant partners by 101%.

The Afterpay company was set up by its founders in 2015. The model was developed to provide an alternative to traditional credit, allowing customers to pay for their goods in 4 equal instalments, without paying a fee or interest. The company has now evolved into retail technology company that connected its retail partners, with the hardest to reach and most valuable consumers.

What makes APT unique?

- It is not a bank or a traditional credit provider

- It is a non-aligned, independent player

- It is a retail technology company that delivers shared value to both retailers and customers

- It is about small purchases - average transaction is $150, with built-in consumer protections

- The vast majority of its revenue is made from retailers paying a fee, as opposed to customers

APT is expected to release the results for the six?month period ended 31 December 2019 on 27 February 2020.

Nanosonics Limited (ASX:NAN)

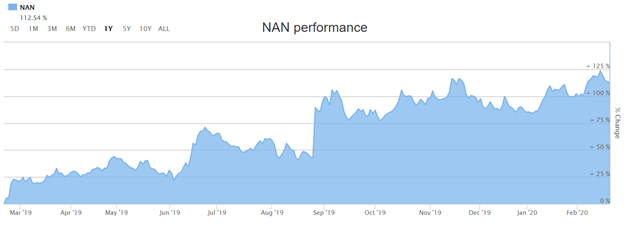

Healthcare technology company, Nanosonics Limited has witnessed an uplift of 325% in the five years. At this time two years back, Nanosonics was trading at $2.870 (as at 20 February 2018). Encouragingly for shareholders, the stock has risen to $7.220 (as at 21 February 2020 AEDT 2:29 PM), representing an increase of 150% over two years.

The company’s past financial year has been one of great achievements as significant delivery on its strategic growth agenda to further position Nanosonics as a global leader in infection prevention.

During FY19, the company delivered an impressive financial result, with a 39 percent increase in revenue to $84.3 million and a 201% increase in operating profit before tax to $16.8 million. Importantly, the company delivered a return on invested capital of around 15%, well in excess of its cost of capital. These strong financial results, together with the positive market sentiment, is highly indicative and supportive of the company’s growth prospects.

In terms of product pipeline, the company is continuing with a significant focus on internal development. In parallel, the company has made investments in both people and new programs, which will underpin its capability to commercialise technology in terms of internal development as well as other external opportunities for sourcing.

Going forward, the company expects its FY20 operating expenses to be around $67 million reflecting FY19 Q4 run rate plus accelerated investments in the company’s growth strategy across:

- New Product Development

- Business Development

- Regional and Corporate Infrastructure Expansion

- New Product Launch Readiness

- Sales and Marketing

The company expects its FY20 profit to be weighted to H2 FY20, taking into consideration the planned increased investment in new products and geographical expansion of the base trophon business; phasing of trophon sales; and the realisation of consumables margin benefit associated with the new GE healthcare distribution agreement, the benefit of which comes into effect in H2 FY20.

NAN’s 1-year Stock performance (Source: Company Reports)

Fortescue Metals Group Ltd (ASX:FMG)

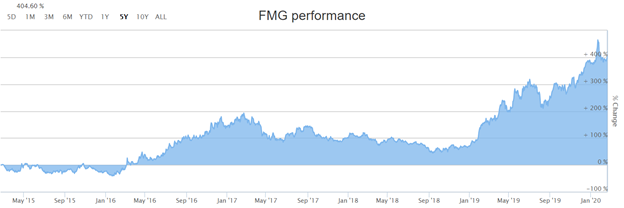

Among the metal and mining sector, Fortescue Metals Group Ltd is one such company which has achieved operational progress while increasing the shareholders’ money by several folds over past years. In the past one year alone, FMG stock has increased by 89.29% on ASX.

The company has recently released its half year results for six months ending 31 December 2019. Over the period, the company reported record shipments of 88.6 million tonnes (mt), underlying EBITDA of US$4.2 billion and net profit after tax of US$2.5 billion with strong margins, driven by the company’s industry leading cost position and product strategy. The half year results reflect the impact of improved price realisation, strength in operational performance and the sustained contribution of productivity and efficiency initiatives across the business.

The company has declared a fully franked interim dividend of A$0.76 per share, representing a 65 per cent payout ratio of 1H20 net profit after tax.

The FY20 guidance is as follows:

- Shipments at the upper end of the range of 170 – 175mt.

- C1 costs in the range of US$12.75 – US$13.25/wmt.

- Average strip ratio 1.5. Total capital expenditure of US$2.4 billion incorporating the Pilbara Energy Connect program.

- Depreciation and amortisation of US$7.70/wmt

- Dividend pay-out policy is a ratio of 50 to 80 per cent of full year net profit after tax

The company believes that its continued focus on disciplined capital management together with a flexible balance sheet positions it strongly for the next phase of growth and the delivery of enhanced returns to shareholders.

FMG has an annual dividend yield of 8.82% and is trading at a PE multiple of 4.900x. In the past one year FMG stock has provided a return of 404% to its shareholders.

FMG’s five years stock performance (ASX: Source: company reports)

With diversified multi-baggers in portfolio, investors have higher chances of getting exponential return on its investment. Merely looking at the returns can sometimes result in fatal blows as it might happen that the stock is overvalued and may go down in the near future. Hence, in order to choose the right stocks, investors should carefully study the company, its operations, product, sector outlook, macro-economic factors and then make an informed decision.