Gold Spot (XAU/USD) at the time of writing was trading at US$1453.90 as on November 26, 2019 (13:20 (UTC+11)). In order to have a fresh upside rally, it requires to maintain levels above US$1400. Three important Australian gold stocks are Saracen Mineral Holdings Limited (ASX:SAR), Dacian Gold Limited (ASX:DCN) and Tribune Resources Limited (ASX:TBR).

Saracen Mineral Holdings Limited (ASX:SAR)

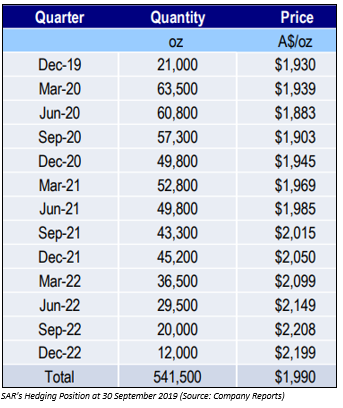

Saracen Mineral Holdings Limited (ASX: SAR) is involved in gold mining, processing & sales and mineral exploration. On November 25, 2019, the company informed the market that it has entered additional gold hedges of 200K ounces of gold at an average price of $2,187 per ounce, with deliveries scheduled for the December quarter in the year 2022. The new hedging provides SAR with financial certainty, while taking advantage from a strong Australian-dollar gold price and repayment of $400 Mn debt used in the purchase of a 50% stake in the Kalgoorlie Super Pit.

Now, the companyâs total hedge book consists 541.5K oz of Au at an average delivery price of $1,990 per ounce. The binding sale agreement of Saracen with Barrick Gold Corporation to acquire the latterâs 50% interest in the Kalgoorlie Consolidated Gold Mines Joint Venture through the purchase of 100% of the shares in Barrick (Australia Pacific) Pty Limited for a price of US$750 Mn is now unconditional.

The Super Pit gold mine in Kalgoorlie-Boulder, Western Australia, is owned and operated by Kalgoorlie Consolidated Gold Mines Joint Venture.

Raleigh Finlayson, Saracen Managing Director, stated that on existing reserves alone, this acquisition would provide the company an asset with more than 10 years of life, along with a pipeline of further growth opportunities supported by outstanding exploration upside and additional resources.

Septemberâ19 Quarter Key Highlights:

There were zero lost time injuries (LTIs) during the quarter with 0.4 Lost Time Injury Frequency Rate (LTIFR). Gold production for the period was reported at 96,324 oz at an AISC of $964/oz. Cash and equivalents as on September 30, 2019, was reported at $196.1 Mn.

FY20 Guidance: Gold production is expected at 350 - 370,000 oz at an AISC of $1,025 - 1,075/oz for FY20.

Stock Performance

On November 26, 2019 (AEST 01:28 PM), the stock of SAR was trading at $3.030, up 1% from its previous closing price. With a market cap of ~$2.5 Bn, its PE multiple stood at 26.550x and EPS was noted at $0.113. Its fifty-two weeks high and fifty-two weeks low stand at $4.659 and $2.276, respectively, with approx. 833.05 Mn outstanding shares. The stock has generated an absolute return of 17.19% for the last one year, -6.46% for the last six months, and -19.51% for the last three months.

Dacian Gold Limited (ASX:DCN)

Australian mid-tier gold producer, Dacian Gold Limited (ASX: DCN) has its head office in Perth, Western Australia.

On November 25, 2019, the company reported outstanding results from in-fill drilling at the Phoenix Ridge deposit.

- The recently discovered high-grade deposit is located less than 500-metre north of the operating Westralia gold mine within its wholly owned Mt Morgans Gold Operation (MMGO), near Laverton in Western Australia;

- The results are likely to support an upgrade of the existing Inferred Resource of 481k tonnes at 8.1g/t Au for 125k oz scheduled for completion in the next quarter;

- The new intersections have confirmed the continuity of the high-grade gold mineralisation and the infill drilling has identified a new high-grade shoot lying less than 50 metres into the hangingwall of the main lode that comprises the Phoenix Ridge Mineral Resource.

Drilling is continuing at Phoenix Ridge with the focus on three key areas, completing the 40m x 40m infill program, which would underpin a resource upgrade to the Indicated category in Q1 2020; testing the interpreted near-surface expression of the Phoenix Ridge deposit; and testing the extents of the newly-defined hanging wall shoot at depth.

Septemberâ19 Quarter Key Highlights:

Gold production for the period stood at 42,002 oz at an AISC of $1,423/oz, which was in-line with the guidance. Production at Mt Morgans Gold Operation (MMGO) for the quarter was reported at an AISC of $1,423/oz and All In Cost of $1,557/oz in line with the semi-annual guidance. Cash and cash equivalents at the end of the quarter was reported at $54.0 Mn, and with repayment of $10.8 Mn in principal during the quarter, total debt reduced to $94.7 Mn.

FY20 Guidance: Gold production is expected at 150,000-170,000 oz, with 45% weighted towards first half and rest towards the second half of FY20. All In Cost for MMGO for FY20 was also reaffirmed at $1,400-$1,500/oz, with commensurate weighting to 1H/2H.

On the stock information front

On November 26, 2019 (AEST 01:30 PM), the stock of DCN was trading at $1.405, down 0.355% the from previous close. With a market cap of ~$321.16 Mn, its PE multiple stood at 100.71x and EPS was noted at $0.014. Its fifty-two weeks high and fifty-two weeks low stand at $2.880 and $0.375, respectively, with approx. 227.78 Mn outstanding shares. The stock has delivered a negative return of 34.11% and 14.80% for the last one year and six months, respectively, while its last three months return is 13.71%.

Tribune Resources Limited (ASX:TBR)

TBR operates in the metals & mining sector as an explorer, developer and producer. In the EKJV (East Kundana Joint Venture) underground gold mining project, Tribune Resources Limited owns a 36.75% stake, while Gilt-Edged Mining Pty. Ltd. and Rand Mining Limited hold a stake of 51% and 12.25%, respectively. On 1 March 2014, Gilt-Edged Mining became a wholly owned subsidiary of Northern Star Resources Ltd. Moreover, TBR has an interest of 24.5% in West Kundana Joint Venture; 50% interest in Seven Mile Hill; and 100% interest in Tribune Resources Ghana Limited.

Quarterly Report for September 2019:

On October 30, 2019, the company published its September quarter report, highlighting that 236,766 tonnes of EKJV ore were processed at the Kanowna Plant, 30,454 tonnes of EKJV ore and zero tonnes of R&T ore were processed at the Greenfields Mill. During the quarter, 25,016 ounces of gold and 3,550 ounces of silver were credited to Rand and Tribune Bullion Accounts, where TBRâs share was 75%.

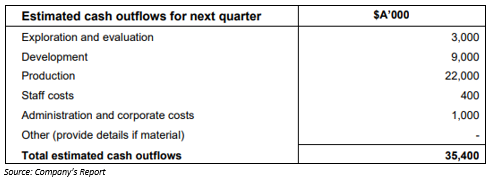

Cash and cash equivalents at the end of quarter was reported at $62.41 Mn. For the December quarter, the company is expecting cash outflows of $35.4 Mn.

FY19 Key Highlights (period ended June 30, 2019):

- Revenue for the period stood at $364.68 Mn as compared to $93 Mn in FY18;

- Profit after income tax expense for the year (FY19) stood at $72.26 Mn, up from $54.42 Mn in FY18.

Stock Performance

On November 26, 2019 (AEST 01:32 PM), the stock of TBR was trading at $6.030, down 1.792% from the previous close. With a market cap of ~$340.79 Mn, its PE multiple stood at 9.410x and EPS was noted at $0.652. Its fifty-two weeks high and fifty-two weeks low stand at $8.800 and $3.661, respectively, with ~55.5 Mn outstanding shares. Moreover, the TBR stock has delivered an absolute return of 31.59% for the last 1 year, 46.28% for the last six months, and -21.37% for the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.