Energy stocks are of those companies that deal in the production and supply of energy. Players engaged in oil and gas reserve exploration and development in addition to other activities such as drilling and refining fall in this category.

We are discussing three energy stocks that have a steady business model and decent product presence. All the three stocks have a good dividend payout history along with a decent dividend yield ratio. Letâs look at the performances of BPT, WOR and CTX.

Beach Energy Limited (ASX: BPT)

Beach Energy Limited (ASX: BPT) is engaged in the production and exploration of oil and gas in geographies like Australia and New Zealand. The company has exploration assets and several ownership interests in strategic oil and gas infrastructure in addition to a processing facility in Moomba and Otway Gas Plant. The company is headquartered in Adelaide, South Australia.

Recently, Cooper Energy (ASX:COE) made an announcement regarding the spudding of Dombey-1 onshore gas exploration well in PEL 494, in which COE has a 30% interest, while BPT has a 70% interest.

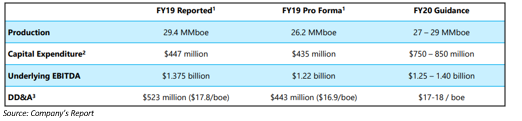

Record Production in FY19 ended 30 June 2019:

In FY19 financial results for the period ended 30 June 2019, Beach Energy Limited reported

- Sales revenue at $1,925.4 million, higher by 54% on a y-o-y basis.

- Net profit after tax of $577.3 million as compared to $198.8 million in FY18.

- Gross profit of $870.3 million as compared to $493.6 million in the prior corresponding period.

- Operating cash flow stood at $1,038.2 million, up 57% from the same period a year ago.

- Net assets at $2,374.4 million in FY19, compared with $1,838.0 million in FY18

- Cash balance of $171.9 million as on 30 June 2019.

- During FY19, the company witnessed record production of 29.4 MMboe, up by 55% from FY18.

- BPT reported 85% of drilling success rate in Beach-operated wells.

- The business also reported 204% of organic 2P reserves replacement ratio.

Outlook:

As per the management guidance, BPT is expecting production of 27 - 29 MMboe for FY20, while capital expenditure is expected at a range of $750 â 850 million. The management has guided underlying EBITDA to be in between $1.25 billion and $1.40 billion.

The company has also upgraded its five-year production target to 34 â 40 MMboe from the previously unveiled target of 30 â 36 MMboe. The company will continue to invest additional $1.5 billion in value accretive opportunities in the coming years.

Stock Update:

The stock of BPT was trading at $2.375 on 10 October 2019 (AEST 02:48 PM) with a market capitalisation of $5.47 billion. The 52-week low and high trading range of the stock stands at $1.275 to $2.790, respectively. The stock is available at a price to earnings multiple of 9.47x while the dividend yield of the stock stands at 0.83%. The stock has generated returns of 28.80% and 21.78% during the last three months and six months, respectively.

WorleyParsons Limited (ASX: WOR)

WorleyParsons Limited (ASX:WOR) is engaged in providing several services like engineering design and project delivery services, including providing maintenance, reliability support services and advisory services to sectors including energy, chemicals and resources.

On 07 October 2019, WOR informed that one of its directors named Andrew Peter Wood acquired 135,854 ordinary shares, resulting in the change is directorâs interest in terms of vesting of performance rights and share price performance rights in accordance with the companyâs Performance Rights Plan.

The company is scheduled to hold its annual general meeting on 19 October 2019.

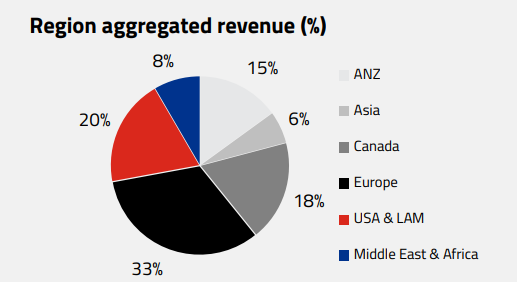

FY19 Revenue Nears $7 Billion:

During FY19 ended 30 June 2019, on a consolidated basis, WOR reported

- Aggregated revenue of $6,924.3 million as compared to $4,835.8 million in FY18.

- Net profit after income tax of $164 million as compared to $75.7 million on the prior corresponding year.

- Cash and cash equivalents stood at $457.3 million at the end of the year

- Total assets of $11,046.3 million and net assets at $6,018.5 million as on 30 June 2019.

- The business witnessed robust performance across the regions of Norway and the Middle East.

- The company also posted higher procurement revenue across UKIS which has contributed to the growth in EMEA.

- ECR reported growth in all regions, especially in North America while Canada showed strong growth in the Americas segment.

- The company reported increase in operational EBITDA margin, which was offset by a lower margin from construction revenue in ECR.

- The business witnessed Strong growth in Canada, Oman and Qatar, supported the aggregated revenue in the energy sector for FY2019.

- The company derived 33% revenues from Europe, 20% from USA & LAM, 18% from Canada. ANZ, Asia, and Middle East & Africa contributed 15%, 6% and 8%, respectively to the companyâs revenue.

Geography-wise Revenue Bifurcation (Source : Companyâs Reports)

Outlook:

The management guided that energy, chemicals and resources market indicators and growth in backlog provide evidence of continued improvement in market conditions. However, several challenges like global macroeconomic uncertainties may act as negative catalysts for the business. The management also expects that in FY20, the business is likely to witness the benefits of the acquisition of ECR including the realisation of cost, margin and revenue synergies.

Stock Update:

The stock of WOR was trading at $12.430 on 10 October 2019 (AEST 03:10 PM) with a market capitalisation of $6.54 billion. The 52-week low and high trading range of the stock stands at $10.720 to $19.307, respectively. The stock is available at a price to earnings multiple of 34.53x while the dividend yield of the stock stands at 2.19%. The stock has generated negative return of 16.92% and 15.92% during the last three months and six months, respectively.

Caltex Australia Limited (ASX: CTX)

Caltex Australia Limited (ASX: CTX) is a fuel supplying company with more than 2,000 company-owned or affiliated sites in Australia.

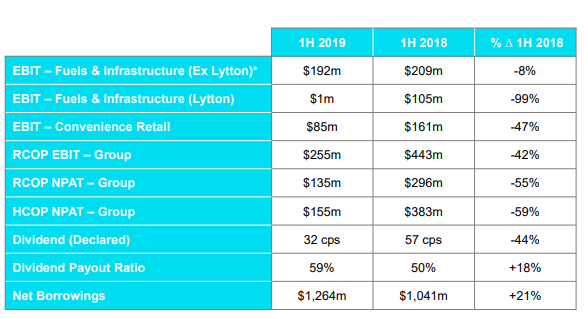

Key Operating Highlights for H1FY19

CTX reported Total Fuel Revenue during H1FY19 ended 30 June 2019 at $2,119 million as compared to $2,070 million in the same period a year ago, while EBIT stood at $85 million as compared to $161 million on pcp. Network Shop Revenue during the year stood at $543 million, remaining flat on the year-ago period. The company reported total shop revenue at $429 million as compared to $330 million during the six-month period ended June 2018.

Source: Companyâs Reports

Outlook:

As per the management guidance, 2019 CRM sales expected at ~5.5BL, due to earlier advised closures and economic decision to lower feedstock purchases. The company expects that freight differential and premiums for Australian grade products provide ongoing protection to Lytton's earnings. The company has downgraded its 2019 capex to $300 million. CTX will continue expansion across Gull New Zealand and Seaoil in the Philippines. The company will divest ~50 sites to maximise value to shareholders. The company has guided of a dividend payout ratio of 50-70% in FY19.

Stock Update:

The stock of CTX was trading at $25.370 on 10 October 2019 (AEST 03:26 PM) with a market capitalisation of $6.37 billion. The 52-week low and high trading range of the stock stands at $20.52 to $30.47, respectively. The stock is available at a price to earnings multiple of 19.81x while dividend yield of the stock stands at 3.65%. The stock has generated a negative return of 0.35% and 5.62% during the last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.