Financial industry is witnessing a regular disruption in terms of digital transactions. Recent victim being banks disbursing credit cards, by the introduction of âbuy now and pay laterâ concept. Three important stocks in this segment are EML Payments Limited (ASX:EML), Splitit Payments Ltd (ASX:SPT), and Zip Co Limited (ASX:Z1P). Letâs see how these stocks are performing based on their recent updates.

EML Payments Limited (ASX:EML)

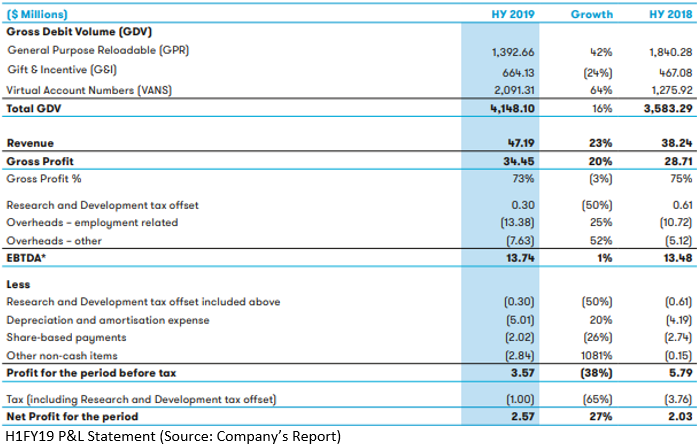

EML Payments Limited (ASX:EML) recently announced that it will be providing branded reloadable card programs for a payout of Salary Packaging benefits to Smartgroup Corporation Limited (ASX: SIQ). EML has worked with SIQ since 2017 and it is presently managing around 50K benefit accounts. It is expected that the Company will provide its services to more than 0.26 Mn benefit accounts by April 2022, and the total annual Gross Debit Volume for this business segment is expected to be around $2 Bn following the transaction process.

On the stock information front, at market close on May 24, 2019, the stock of EML Payments was trading at $2.550, up 6.25% during the intraday trdae, with a market capitalisation of $600.61 million. Its current PE multiple stands at 214.290x, and its last EPS was noted at $0.011. Its 52 weeks high price stands at $2.560 and 52 weeks low price at $1.210, with an average volume of ~748,931 (yearly). Its absolute returns for the past one year, six months and three months are 83.21%, 66.67% and 53.35%, respectively.

On the stock information front, at market close on May 24, 2019, the stock of EML Payments was trading at $2.550, up 6.25% during the intraday trdae, with a market capitalisation of $600.61 million. Its current PE multiple stands at 214.290x, and its last EPS was noted at $0.011. Its 52 weeks high price stands at $2.560 and 52 weeks low price at $1.210, with an average volume of ~748,931 (yearly). Its absolute returns for the past one year, six months and three months are 83.21%, 66.67% and 53.35%, respectively.

Splitit Payments Ltd (ASX:SPT)

Splitit Payments Ltd (ASX:SPT) recently published its Investor Presentation, where it highlighted that it has 437 merchants in 27 countries around the world. It has offices in New York, London, Tel Aviv and shortly in Sydney. Recently, SPT has hired an Australian Director of Sales and a Sales Engineer, and they are expected to start their service by mid-May. Splitit has identified a number of target countries to focus its sales and marketing efforts, with a focus on the US, Canada, UK, Italy, Singapore and Australia. SPT is strong in the five key verticals such as Medical, High-End Fashion, Sports Equipment, Home Goods & Electronics, and Travel & Leisure.

On the stock information front, at market close (on May 24, 2019) the stock of Splitit traded at $0.815, down 4.678%, with a market capitalisation of ~$230.56 million. Its absolute returns for the past three months and one month are -2.64%, and -18.57%, respectively.

On the stock information front, at market close (on May 24, 2019) the stock of Splitit traded at $0.815, down 4.678%, with a market capitalisation of ~$230.56 million. Its absolute returns for the past three months and one month are -2.64%, and -18.57%, respectively.

Zip Co Limited (ASX:Z1P)

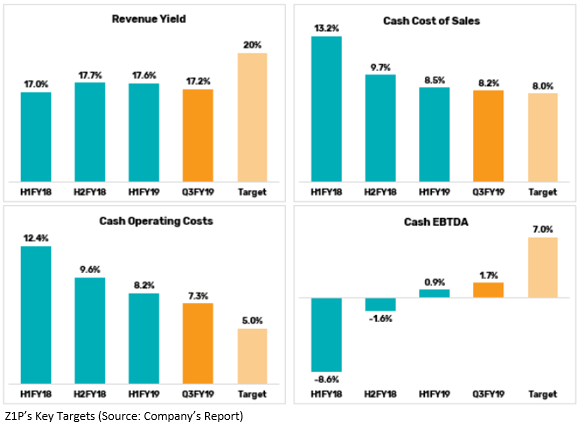

Zip Co Limited (ASX:Z1P) recently announced the change in the interest of its shareholder, where Regal Funds Management Pty Ltd decreased its voting power from 6.21% to 5.12%, effective from May 21, 2019. In its Q3 FY19 (ended on March 31, 2019) quarterly update, Z1P reported that its quarterly revenue increased by 20% to $23 million as compared to Q2 FY19. Its receivables increased by 16% to $565.3 million as compared to Q2 FY19. Its transaction volumes increased by 107% to $281.4 million year-on-year. Its customer numbers increased by 14% to 1.2 million as compared to Q2 FY19. During the period, Z1P raised $56.7 million in equity capital. It had signed a wholesale agreement with global payments provider named Adyen, which allowed the company to market Zip to its Australian clients. Zip was officially launched in New Zealand, supporting the rollout of Super Retail Group.

On the stock information front, at market close (on May 24, 2019), the stock of Zip Co traded at $3.500, with a market capitalisation of ~$1.31 billion. Its absolute returns for the past one year, six months and three months are 365.0%, 285.49% and 148.83%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.