A 52-week high in a stock is simply the highest price which the stock has traded in last one year. Few investors tend to feel that 52-week high share price presents a high-risk price level, but other investors may think that the investment is such stocks will provide good return on investment. If the company’s fundamentals are strong and the stock surpasses the 52-week high share price, it gives an opportunity to the investors to earn a good return on investment.

Metals and Mining Sector Soars Post Trump’s encouraging comments

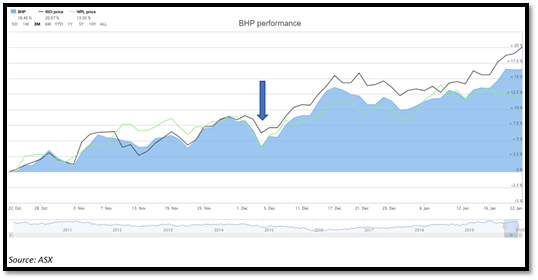

On 4 December 2019, the major surge was seen in the metal and mining stocks after the U.S president commented; “Trade talks with China were going well”. It was well noted from the above performance chart that the shares prices of all the three companies i.e. BHP Group Limited, RIO Tinto Limited and Woodside Petroleum Limited, have increased and reached closer to their 52-week highs.

The S&P ASX 200 index also surged recently and many analysts believe that the optimism over a planned signing of a preliminary Sino-U. S trade could be a major reason behind this gain.

Let us have a look at three stocks from the metals and mining sector and recent updates which impact their share prices.

BHP Group Limited (ASX: BHP)

BHP Group Limited is a leading metals and mining company. The company is a producer of various commodities such as iron ore, copper, uranium etc. BHP Group is headquartered in Melbourne, Australia and is officially listed on the Australian Securities Exchange.

Stock Performance

The stock of BHP was trading at $40.530 on ASX on 24 January 2020 (AEDT 03:38 PM), down by 1.339 per cent from its previous close. The company has approximately 2.95 billion outstanding shares and a market cap of $121.02 billion. The 52 weeks low and high value of the stock are at $32.245 and $42.330 respectively. The stock has generated a negative return of 1.20 per cent in the last six months.

BHP Operational Report

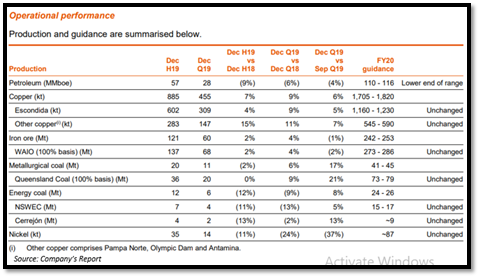

On 21 January 2020, the company has announced the activity report for the half year ended 31 December 2019; a few highlights of the company’s activities are as follows;

- The unit cost and production guidance of the company for the financial year 2020 remains unchanged.

- The Group copper equivalent production remain unchanged in the half-year while the volume is expected to be slightly higher for the full year as compared to that in the last year.

- The company and Woodside have signed a non-binding agreement in petroleum to progress the Scarborough gas development project.

- BHP’s third phase of drilling program at Oak Dam in South Australia is expected to be completed in the June 2020 quarter.

- At the end of December 2019, the company had major six projects under development in iron-ore, copper, potash and petroleum with a combined capital allocation of US$ 11.4 billion.

- In December 2019, the company has agreed to fund a total of US$793 million to financially support the Renova Foundation and Samarco.

- The company’s total petroleum production has declined by 9 per cent to 57 MMboe in 1HFY20 and guidance has remained unchanged at a target range of 110-116 MMboe for 2020.

- BHP’s Natural gas production decreased by eight per cent to 189 bcf in 1H FY20 from the year-ago period.

Cooper Energy completes Minerva Gas Plant Acquisition

On 5 December 2019, the Cooper Energy Limited (ASX: COE) has announced the acquisition of the Minerva Gas Plant by the participants in the Casino Henry joint venture. The plant has been acquired from the Minerva Joint Venture participants after the cessation of production from the Minerva gas field which was announced on 3 September 2019. The plant has a processing capacity of up to 150 TJ/day and can process liquid hydrocarbons.

The plant has been acquired from the Minerva Joint Venture participants in which BHP Petroleum has 90 per cent interest and Copper Energy has 10 per cent interest. Cooper Energy and Mitsui have acquired the plant to process gas from the Casino, Henry and Netherby gas fields and the project is expected to be completed by mid-2021 and is subject to FID and other approvals.

Rio Tinto Limited (ASX:RIO)

Rio Tinto Limited is an Australia-based, metal and mining company. Headquartered in London, and founded in 1873, the company has an interest in mining of coal, copper, aluminium, gold, iron-ore, uranium etc.

Stock Performance

The stock of RIO was last traded lower at 103.490 on ASX on 24 January 2020 (AEDT 03:38 PM), down by 2.543 per cent from its previous close. The company has approximately 371.22 million outstanding shares and a market cap of $39.42 billion. The 52 weeks low and high value of the stock are at $75.401 and $107.790 respectively. The stock has generated a positive return of 4.37 per cent in the last six months.

Bauxite Production increased in Q4 2019

On 17 January 2020, the company has released its Q4 2019 production results, a few highlights of the results are as follows;

- The company’s bauxite production increased by 28 per cent to 15.1Mt as compared to the prior corresponding period.

- Production of pellets and concentrate at the Iron Ore Company of Canada has been surged by 18 per cent in FY 19 compared to FY 18.

- The company’s Pilbara iron ore shipments of 327 million tonnes were 3 per cent lower as compared to 2018 due to weather and operational challenges.

- The Aluminium production was 2 per cent lower to 3.2 million tonnes when compared to 2018.

- Post signing of renewable power agreements in Chile, Escondida has raised a provision related to the cancellation of existing coal contracts. The company has recognised a charge of approximately $200 million against 2019 underlying EBITDA.

- On 18 November 2019, RIO has announced support for Energy Resources of Australia Limited’s (ERA) plans for a renounceable entitlement offer to raise $324 million for the rehabilitation of the Ranger Project Area in Australia’s Northern Territory.

RIO Restarts operations at Richards Bay Minerals

On 30 December 2019, the company has initiated a process to resume operations at Richards Bay Minerals (RBM) in South Africa. This follows discussions led by the Premier of KwaZulu-Natal, Sihle Zikalala, involving all stakeholders in order to address issues faced by the community and for ensuring a stable environment.

The process has been re-initiated with RBM expected to return to full operations in early January, leading to regular production in early 2020. The company is contacting customers who were informed of cessation of supply that has now been lifted.

Woodside Petroleum Limited (ASX: WPL)

Woodside Petroleum Limited, headquartered in Perth, Australia is the leader in the LNG industry in Australia. The company produces and explores oil and gas from offshore and onshore facilities in Western Australia and Northern Territories. The WPL product portfolio includes domestic gas, liquified petroleum gas (LPG), liquified natural gas and crude oil. Recently, the company has been awarded contracts for Scarborough Project, the details of which can be accessed here.

Stock Performance

The stock of WPL was trading at 35.390 on ASX on 24 January 2020 (AEDT 03:38 PM), up by 0.397 per cent from its previous close. The company has approximately 942.29 million outstanding shares and a market cap of $33.22 billion. The 52 weeks low and high value of the stock is at $30.580 and $37.700 respectively. The stock has generated a positive return of 3.83 per cent in the last six months.

Sales Revenue soared by 12 per cent in Q4 2019

On 16 January 2020, the company has announced the fourth quarter result for the period ended 31 December 2019; a few highlights of the report are as follows;

- The company’s production has increased by 3 per cent to 25.7 MMboe compared to previous quarter.

- Sales revenue of the company increased by 12 per cent from previous quarter and was recorded at $1.3 billion.

- WPL has executed a long-term offloading agreement with Uniper Global Commodities SE for the sale of liquified Natural Gas (LNG) for a period of 13 years, commencing 2021.

- WPL has achieved FID on Julimar-Brunello Phase 2 and start-up from PLA07 Pluto infill well.

- The company’s Sangomar Field Development was approved and was transitioned into the execution phase.

To read more about the approval of Sangomar Field Development click here