Due to the uncertainty surrounding the impacts of Covid-19, gold is getting increasingly popular among investors as the safest heaven. Ever since the US Federal Reserve has announced new liquidity injections in the economy, experts have started to believe that this will positively impact the prices of Gold as fear-driven purchase is likely to dominate liquidity-driven selling pressure. A leading global investment banking, Goldman Sachs, has increased its price expectations for gold and has advised investors to buy it. In light of the above-mentioned scenario, let us now look at few ASX-listed gold stocks and their recent updates.

Resolute Mining Limited (ASX: RSG)

Australian gold producer, Resolute Mining Limited, recently provided a March quarter production update, wherein, it announced that its gold production during the quarter increased relative to the previous quarter by 5,470 ounces to 110,763oz.

March quarter Highlights

· Gold recovered of 119,683oz; up 15% on the December 2019 Quarter

· Syama sulphide recoveries of 75% as roaster returns to service

· Ravenswood sale completed with gold production of 11,046oz attributed to Resolute prior to settlement

· Comprehensive response initiated to the COVID-19 pandemic

The company has recently updated its 2020 guidance to 430,000 ounce of gold production at an All-In Sustaining Cost of US$980 per ounce with group level cost guidance of US$980 per ounce.

On 26 March 2020, the company provided a business update, wherein, it informed that its gold production has not been impacted by government-regulated COVID-19 restriction and assured that it is taking various measures to mitigate the spread of infection amongst its workforce and to provide a platform for business continuity.

The company recently confirmed the successful completion of its refinancing following first drawdown under its new US$300 million flexible low-cost syndicated loan facility which has been used to refinance the Company’s existing senior debt and completely repay the Project Loan over the Mako Gold Mine in Senegal (Mako). The company is well supported by its logistics partners and remain confident in its key supply chains including fuel, food and product shipment.

Saracen Mineral Holdings Limited (ASX: SAR)

Saracen Mineral Holdings Limited, an exploration company involved in the gold mining, processing & sales and mineral exploration, recently provided a trading update, wherein, it announced record group production of between 150,000 and 155,000 ounces for the March quarter 2020. In the update, the company also assured that it is pro-actively responding to the evolving COVID-19 crisis and is implementing a host of controls and procedures designed to prevent transmission of the virus.

Currently, the company is focused on reducing the operating “footprint” in order to minimise the number of people at Saracen’s sites, the number of transfers into and out of the sites, and the interaction between them.

In the first half of FY20, the company reported Underlying NPAT of $80.2 million, up 84% on the previous corresponding period (pcp), and EBITDA of $178.6 million, up 71% on pcp, driven by the increase in the sales revenue. Currently, the company’s balance sheet is robust and flexible with cash and bullion of between $325-330 million and debt of around $360 million.

Northern Star Resources Ltd (ASX: NST)

Northern Star Resources Ltd, a global-scale Australian gold producer with world-class, low-cost, high-grade gold mines, recently informed that one of its employee at Pogo has been infected by COVID-19 while at home on rostered leave and as a precaution the 8 identified potential close contacts of the employee have been put in self-isolation.

On 26th March 2020, the company announced that in response to the impact of COVID-19, it is implementing prudent financial measures to preserve the value of its business in the long term, however, these measures are creating unavoidable disruptions to normal operations and affecting gold production, as a result of which, the company has withdrawn its production and cost guidance for the year to June 30, 2020 and has decided to defer the payment of its interim dividend due on 30 March 2020.

The company is still of the view that it is in a strong financial position with cash on hand and bullion of around $534 million and total debt of $700 million.

St Barbara Limited (ASX: SBM)

Gold producer and explorer, St Barbara Limited had entered FY20 with a diversified portfolio of gold operations, a number of near mine prospective targets at each operation and a strong balance sheet sufficient to finance the company’s strategy and with flexibility to adapt to different gold price environments.

In the first half of FY20, the company reported revenue from ordinary activities of $361.9 million, up 9% on the previous corresponding period and reported gold production of 181,728 ounces at a Group All-in Sustaining Cost of $1,391 per ounce. On 31 March 2020, St Barbara provided an update on COVID?19, wherein it informed that the company has able to maintain its operations, production and gold shipments in Australia, Canada and PNG and at each of its sites it is implementing and adapting business continuity measures to mitigate and minimise any potential impacts of the global outbreak.

Silver Lake Resources Limited (ASX: SLR)

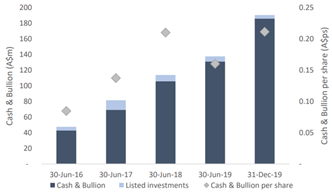

Silver Lake Resources Limited is an ASX listed gold producer with 6 mines and 2 processing facilities in operation across its Deflector and Mount Monger operations. In the past five years, the company has executed a strategy to maximise the value of its assets, through investment to embed options to sustain growth, whilst generating cash.

Cash performance (Source: Company’s Report)

On 3rd April 2020, the company noted the announcement made by Macmahon Holdings Limited (ASX:MAH) wherein it confirmed that it has inked contracts with SLR for extra work at the Mount Monger gold operations carried out in WA region.

Due to the strong balance sheet and cashflow generations, Silver Lake is well placed to progress the pipeline of advanced exploration targets. In January 2020, the company completed the acquisition of Egan Street Resources Limited, offering a near term development prospect to bring in a new high-grade ore source to an advanced Deflector processing facility. As a result of the company’s deliberate operating and investment strategy over the past four years at Mount Monger, Silver Lake now has a high value, near-term projects at Mount Monger including Easter Hollows, Santa and Tank, all of which have the potential to produce sustainable higher margin ounces over the next 12-24 months. Going forward, the company will continue to invest in exploration while focusing on advancing high priority targets at Mount Monger.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_17_2025_03_34_37_469537.jpg)