What is the Telecommunications Services Industry?

Telecommunications companies primarily operate, maintain or give access to facilities that transmit sound, voice, text, data, and video through cable, wire, wireless and satellite network.

Telecom Sector in Australia:

The rise in demand for mobile services has affected the demand of fixed-line services, modifying the way Australians interact by providing increased connectivity. The revenue generated via wireless services has witnessed an increase, driven by the rise in mobile data consumption volumes and enhanced mobile connectivity. However, this growth in the wireless sector has caused profit margins of telecom services subdivision to decline, driven by intensified price competition.

According to market experts, the total subdivision revenue is anticipated to grow at an annual rate of 0.2 per cent over five years through 2018-19, amounting to $37.8 billion.

Key Players in the Aussie land:

The major fixed broadband service providers in Australia are:

- Telstra Corporation Limited (ASX: TLS)

- TPG Telecom Limited (ASX: TPM)

- Macquarie Telecom Group Limited (ASX:MAQ)

- Vocus Group Limited (ASX: VOC)

- Vodafone Australia

Letâs look at the recent updates on two telecom sector stocks listed on ASX as follows:

Vocus Group Limited:

Across Australian and New Zealand region, Vocus Group Limited (ASX:VOC) has laid beyond 30,000 kilometres of fibre optic cable operating now. It is a specialist fibre network services provider and was incorporated in 2008.

In 2016, Vocus Communications Limited and M2 Group Ltd merged together, and in the latter part of the same year, VCO acquired NextGen.

Few VOC products (Source: Company website)

On 27th May 2019, the company had obtained non-binding, confidential and indicative proposal from EQT i.e. EQT Infrastructure. This was related to the acquisition of all company shares at A$5.25 per share in cash. The companyâs Board had decided to give EQT non-exclusive due diligence which is accessible to EQT so that EQT can potentially put across a formal binding proposal to VCO.

Post a paced up due diligence period, and the company announced on 4th June 2019 that EQT had terminated the transaction which had been laid down in the Indicative Proposal, ceasing all discussions on it.

Regarding the same, MD & CEO, Kevin Russell stated that the company remains optimistic about its network assets and foresees great opportunity to gain market placement in Vocus Networks.

A strategy update for investors is scheduled for the last week of June.

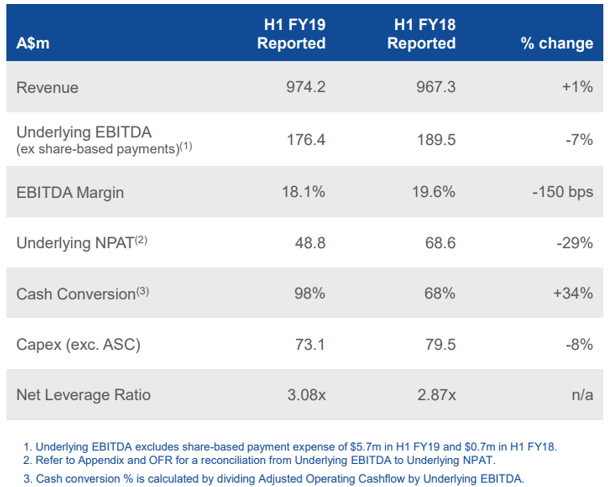

The company released its H1 FY19 Financial results in February this year. It has an Underlying EBITDA guidance range between $350 million and 370 million for FY19.

Financial Highlights (Source: Companyâs report)

On the technical front, the stock of the company had closed at A$3.770, down by 17.686% compared to its last close. In the past year, it has delivered a return of 92.44%.

Telstra Corporation Limited:

A telecommunications carrier, Telstra Corporation Limited (ASX: TLS) is based out of Melbourne. It caters customers with telecom and informative services.

On 29th May 2019, the company announced that there had been good progress on its T22 strategy, and it was anticipating making a non-cash impairment and write down of the value of its IT assets by approximately $500 million. Further for FY19, TLS raised its guidance by almost $200 million on the restructuring costs. This was an outcome of bringing forward a consultation on the proposed job reductions.

The company informed that it was way ahead of its initial plan on the simplifying its structure and work ways. It had begun the consultation with employees and representative unions on proposed job reductions. By the closure of the financial year, TLS is expecting to notify a drop of ~ six thousand roles. By the close of 2022, this would be in sync with the net cost out the target of $2.5b.

The restructuring costs would have an increment to around $800 million (from $600 million) in FY19. The employees under the effect would not leave TLS until the beginning of 2020 and the consultation is most likely to end in mid-June.

On 9th April 2019, TLS hired Vicki Brady, former Group Executive, Consumer and Small Business as the new CFO and Head of Strategy. Her new role would commence on 1st July 2019. Also, Michael Ackland would be leading the Consumer and Small Business function permanently.

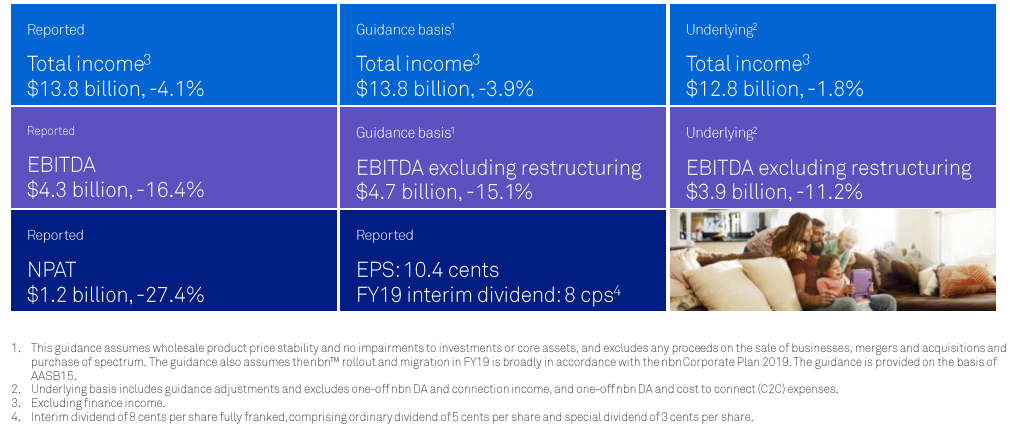

The company delivered its HY19 results in February this year. Total income reported amounted to $13.8 billion, which was down by 4.1% on pcp. The EBITDA was $4.3 billion, down by 16.4% on pcp, whereas the NPAT was recorded at $1.2 billion, which was down by 27.4%.

The total income recorded was $13.8 billion, and EBITDA (excluding restructuring costs) amounted to $4.7 billion.

Financial highlights (Source: Companyâs report)

On the technical front, the stock of the company closed at A$3.650, down by 0.273% compared to its last previous dayâs closing price. In the past year, the stock return has been of 34.88%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)