The two ASX traded companies BOT and NHS had updated investors about the latest developments in the market. With a positive YTD return, both stocks have gained momentum over the past few months.

Botanix Pharmaceuticals Limited (ASX:BOT)

Strong Development Pipeline: Pharmaceutical player, Botanix Pharmaceuticals Limited (ASX: BOT) is a clinical stage cannabinoid company, with one of the worldâs most advanced pipelines, studying cannabidiol in a range of inflammatory and anti-microbial applications.

The company, today, on 20th June 2019, released its Investor Presentation with new BTX 1801 data. The company updated shareholders, investors and strategic partners on the key findings of the BTX 1801 antimicrobial study, which shows the potential for BTX 1801 to treat serious skin infections. The presentation also includes the findings from the recently released successful Phase 1b BTX 1308 psoriasis study.

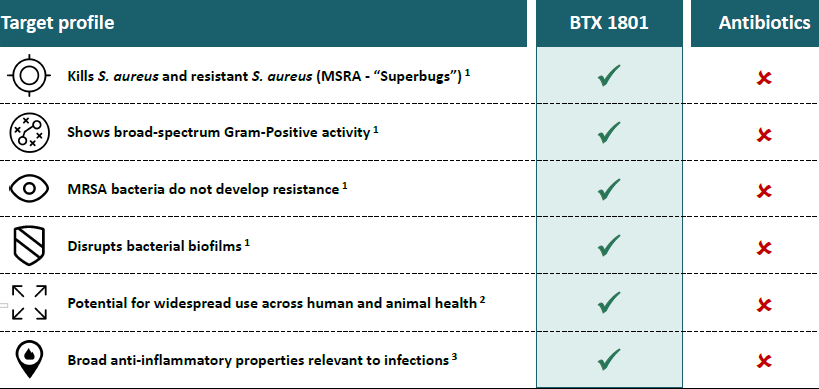

BTX 1801 Profile (Source: Company Reports)

BTX 1801 is the first non-resistance forming antibiotic against superbugs. BTX 1801 is effective against 132 different Gram-Positive bacterias. Cannabidiol is a powerful new antibiotic that is effective in tests against Staphylococcus aureus and methicillin resistant Staphylococcus aureus.

MRSA or golden staph bacteria do not form resistance to BTX 1801. If the antibiotic does not kill the bacteria quickly and completely, repeated dosing allows bacteria to mutate and form resistance to the drug. BTX 1801 shows its effectiveness in an independently tested animal model and is effective against biofilms. Biofilms are the protective barriers that bacteria construct to protect themselves from the antibiotics. BTX 1801 disrupts those biofilms and kills the bacteria swiftly.

The newly announced data from BTX 1308 and BTX 1801 studies provide scientific support for CBDâs mechanism of action, which is highly relevant to both Phase 2 acne and atopic dermatitis studies.

A Principal Investigator and Program Coordinator at the University of Queenslandâs Institute for Molecular Bioscience, Dr Mark Blaskovich, commented that the pipeline of new antibiotics in clinical development is way too small to combat the growing threat of antimicrobial resistance. Most of these agents are only modifications of existing antibiotics, which will not provide long-term solutions to the problem. It is not surprising that the United States Food and Drug Administration has recently provided companies with attractive incentives to develop new antibiotics, including expedited review of drug applications and introduction of the qualified infectious disease products designation program, which allows the companies to gain an extra five years marketing exclusivity following the drug approval.

The Executive Director and Founder of the company, Matt Callahan communicated that the implications and potential applications of these amazing outcomes are immense. This new data will help in the expansion for the potential of BTX 1801. It will serve as a powerful new antibiotic option for doctors and patients and provide further confirmation that the antimicrobial activity may be a significant contributor to the overall efficacy of the Phase 2 products of Botanix Pharma for atopic dermatitis BTX 1204 and BTX 1503 acne.

Turning to stock performance. The Botanix Pharmaâs stock at market close on 20th June 2019, was trading at a price of $0.205, with a market capitalisation of $108.24 million. The stock has yielded a YTD return of 91.78% and exhibited substantial gains of 100.0% and 27.27% and 21.74% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $0.205 and 52-week low price at $0.067, with an average volume of ~1.10 million.

Nuheara Limited (ASX:NUH)

NHS Scotland hearing contract: Nuheara Limited (ASX: NUH) is a leading developer of smart personal hearing devices in Australia. The company is based out of Perth, Australia and have offices in San Francisco and New York, USA. It was the first wearables technology company to be listed on the ASX.

The company announced that the IQbuds BOOST⢠has been successfully placed on the NHS Scotland hearing contract under the Hearables category, Lot 5 â Hearable and Wearable.

IQbudsTM BOOST with Ear IDTM (Source: Company Website)

Under the NHS Scotland Framework, the Hearables category specifically caters for devices that are primarily intended to allow streaming of media to the device, but that also offer a hearing enhancing function not dissimilar to a hearing aid.

IQbuds BOOST⢠are immediately available under the framework and will be supplied and supported under the contract via the UK distributor of the company, Puretone. There are 14 NHS Health Boards within NHS Scotland and incorporates the Healthcare Trust with NHS Northern Ireland. The matter is still in the state of discussion in relation to the English NHS categorisation process of IQbuds BOOSTâ¢, and the company will provide an update as soon as possible.

The CEO of the company, Justin Miller, commented on the NHS developments and said that the company is delighted that it can begin supplying NHS in Scotland and Northern Ireland immediately with IQbuds BOOSTâ¢.

The company is confident that the health agencies such as NHS Scotland see a growing need to now separately categorise hearable products within their hearing programs. This will lead to a change in the status quo and influence of the current hearing device industry. More importantly, it is a major boost for the companyâs future and its ambition to be a global hearing leader by providing more functional, affordable and accessible hearable products.

The company achieved strong numbers in 1H FY19 and in the recent past, has announced that the ordinary shares of the company have been approved for trading on the OTCQB Venture Market (OTCQB) in the United States of America under the symbol NUHRF. The dual listing structure of the company is non-dilutive to existing Nuheara shareholders. No capital is being raised and no new shares are being issued. The listing provides a new source of demand for Nuheara shares from the US, which is the largest pool of investors in the world.

Looking at the stock performance. At market close on 20th June 2019, the stock of Nuheara Limited was trading at a price of $0.072, with a market capitalisation of $71.7 million. The stock has yielded a YTD return of 2.82% and exhibited gains of 8.96% and 4.29% over the past three months and one-month period, respectively. Its 52-week high price stands at $0.120, and 52-week low price at $0.050, with an average volume of ~2.95 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.