Australia has a robust health care system, jointly operated by the federal, state and local governments, and is labeled as one of the best in the world. For investors, health care stands among the top few sectors, and is the safest sectors in Australia despite uncertain and an oscillating stock market environment. Two most important aspects investors should consider while investing in AU health care stocks are a generous funding grants by the Australian Department of Health (ADH) due to growing aging population and rise in chronic diseases, and a strong upward trend in the stock market in the last 10 years.

Growing aging population and rise in chronic diseases: Health care will always be a requisite as the aging population continues to grow in developing countries. As per APH, it is estimated that by 2022, nearly 4 million people will reach an age of 65â84 years with a rapid acceleration in population of over 65 years and over 85 years in the next 10 years. Also, an increase in chronic conditions further increases the demand for flexible and specific health care models as well as innovative R & D. Recent announcements on the latest developments in terms of funding for medical research and disease eradication give a clear picture of how important the health care sector is.

- A grant of $ 1 million to Melbourne Researchers. The grant would be used to test as well as deploy portable tools for brain imaging in air and road ambulances.

- A commitment of $ 13 million for eradication of TB from South East Asia and Pacific area.

- An additional $ 19 million pledged for initiatives involving disease eradication from the Pacific region.

- A $ 10 million grant announced for The Australian Breastfeeding Strategy: 2019 and Beyond recently launched on 5 August 2019 during the World Breastfeeding Week.

A green upward trend for S&P/ASX 200 Health Care: Over the past 10 years, S&P/ASX 200 Health Care (AUD) has been on an upward trend, reporting a spectacular increase of around 360% from 1 August 2009 to 30 August 2019.

S&P/ASX 200 Health Care Index Performance Over 10-Year Period (Source: ASX)

Letâs zoom into three health care stocks worth a watch:

Ramsay Health Care Limited (ASX: RHC)

Ramsay Health Care Limited, based in Sydney, Australia, is one of the largest and most diverse global private health care companies, famous for maintaining highest quality and safety standards and providing outstanding patient care. The company has over 50 years of experience in delivering acute health care services. RHC operates globally with 480 facilities spanning across 11 countries.

Source: Company Presentation on 29 August 2019

RHCâs Year End Report Highlights released on 29 August 2019 are as follows:

For the year ended 30 June 2019 (FY19), RHC reported a Core Net Profit After Tax (NPAT) of $590.9 million, up 2% on the previous corresponding period (pcp), with Core Earnings Per Share (EPS) of 285.8 cents, up by 2.1% on the 279.8 cents noted in the same period a year ago. The company also declared a 91.5 cents fully franked final dividend, representing an increase of 5.8% over the year-ago period, bringing the full year dividend to 151.5 cents fully franked, a rise of 5.2% on the preceding year. The declared dividend has a record date of 6 September 2019 and payment date of 30 September 2019. Meanwhile, the DRP will remain suspended.

RHCâs statutory net profit after tax bounced by 40.5% on the prior year with a net value of $545.5 million. The group performance for FY19 generated a revenue of $11.4 billion, up by 24.4%, while group EBITDA of $ 1.6 billion represented an increase of 14.1%.

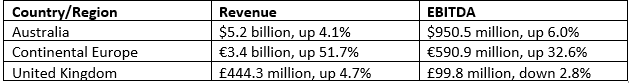

Ramsayâs Segment Results are summarised in the table below:

Source: Companyâs Report

Net profits for Asian joint ventureâs equity accounted share stood at $19.4 million, up 15.5% from FY18. The companyâs vision is continuous shareholder value creation with its group strategy focused on growth, efficiency and sustainability.

Stock Performance on ASX: The stock price on RHC closed trading at $ 65.640 on 30 August 2019, down 2.234% from its previous close. The market cap stands for $13.57 billion with approximately 202.08 million shares and YTD return of +16.24%.

Biotron Limited (ASX: BIT):

Headquartered in Sydney, BIT is a biotechnology company dealing in the development of novel antiviral therapies with a potential to treat several viral diseases. Its robust clinical development program includes BIT225, the lead compound, which is in its mid?stage for HIV-1 and HCV (Hepatitis C virus) infections treatment.

Biotron Limited released full year (2018-19) statuary account and a preliminary final report providing detailed view on its operational and financial activities on 29 August 2019, unveiling a loss of $ 1,611,799 for the period.

Significant Milestones Completed by Biotron during 2018-19:

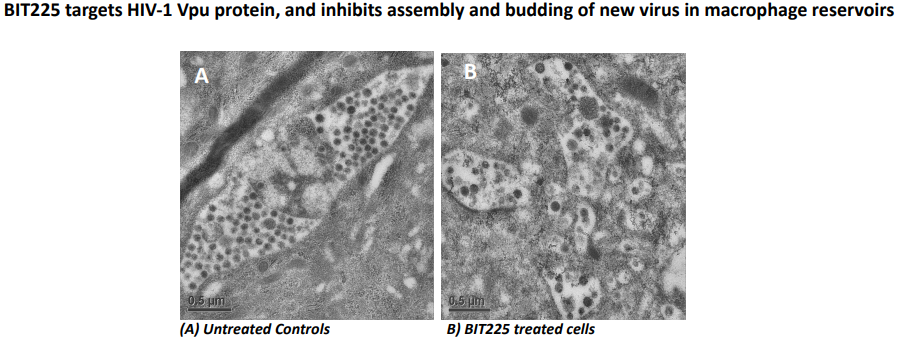

Positive human clinical data from BIT225-009 Phase 2 trial of the lead drug candidate BIT225 in HIV-infected patients collectively with present current antiretroviral drugs, indicated induced immune responses otherwise not seen in patients drugged with approved anti-HIV medicines. This data was presented in HIV DART and Emerging Viruses 2018 conference held in Miami, Florida, US and bagged the Poster Award as well. In view of commercialisation, Biotron is regularly sharing antiviral program details with potential pharmaceutical industry partners.

Source: BITâs Presentation at BIO 2019

Earlier in October 2018, Biotron appointed Professor Stephen Locarnin as a Non-Executive Director of the company. Biotron raised a huge capital of $6,038,728 from the companyâs exercise options including the options exercised by MD Dr Michelle Miller. As the company look forward to commercialising its programs in future, this significant amount puts Biotron at a satisfactory financial position.

A corporate governance statement for the year ended 30 June 2019 has also been released by the company on 29 August 2019, outlining the key corporate governance practices followed by BIT.

Stock Performance: The stock of BIT settled at $ 0.076 at the end of the session on 30 August 2019, up 4.11% from its previous close. It has a market cap of $ 43.49 million and approximately 595.71 million outstanding shares. The stock has generated a negative YTD of 36.52%.

Paradigm Biopharmaceuticals Limited (ASX: PAR)

This ASX listed Australian biopharmaceutical company adopts an intelligent and agile approach of repurposing an FDA approved drug - pentosan polysulphate sodium (PPS) with its lead clinical indications of curing bone marrow edema (BME) and treatment of joint pain and mobility in patients having mucopolysaccharidoses (MPS).

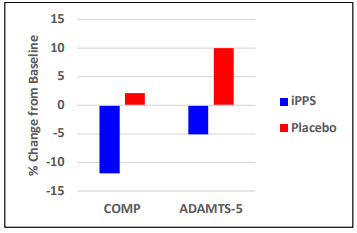

The company released ground-breaking results from Phase 2b clinical trial, indicating a remarkable reduction in COMP (Cartilage Oligomeric Matrix Protein) and ADAMTS-5 biomarkers; both associated with growing osteoarthritis (OA), when dosed with Zilosul® (injectable Pentosan Polysulfate Sulfate; iPPS), suggesting Zilosul® protects gradually worsening cartilage degradation in Knee OA patients in comparison to its placebo arm of the trial.

Below figure depicts changes in the COMP and ADAMTS-5 biomarkers in the serum of patients subjected with iPPS or placebo measured from Day 1 to Day 53.

Source: Companyâs Report

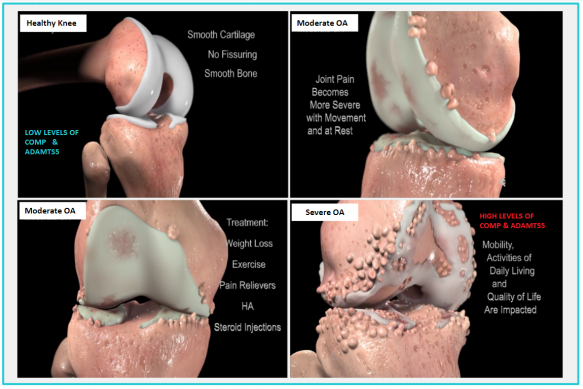

Below figure depicts cartilage breakdown in association with OA and biomarkers levels.

Source: Companyâs Report

Meanwhile, Paradigm CEO Paul Rennie stated that the company is pleased with this breakthrough, mentioning positive correlation between the clinical outcomes and objective measures of structural outcomes as particularly interesting. In coming months, Paradigm is anticipating the release of more data on biomarkers.

Paradigm Biopharmaceuticals Limited also released the preliminary final report, outlining the progress made by the company during the financial year ended 30 June 2019 and plans for the next financial year.

Some key highlights are as follows:

- Clinical developments: Completion of two Phase 2 clinical trials and new IPR in-licensed from Icahn School of Medicine, Mt Sinai, New York during FY19.

- IPR: Three new patents filed under the BMEL patent family. Grant of respiratory patent in AU, NZ, CA, EU & China during the financial year 2019.

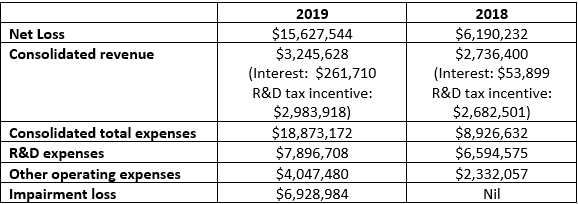

- Operational review: The figures for operating activities during FY19 are given in table below:

Source: Companyâs Report

Due to increased loss and increased no. of shares, the basic and diluted net loss per share risen to 10.93 cents from 5.46 cents in previous corresponding period.

The company plans to undertake new R&D programs with an aim to identify & develop 2nd generation products & mechanism of action of iPPS with OA in pain relief, R&D outsourcing to CROâs and reputed research laboratories, publication of pre-clinical studies in per-reviewed journals during the upcoming year.

Stock Performance: PARâs stock closed trading at $ 1.605 on 30 August 2019, representing a rise of 1.262% from the previously closed price, with ~192.21 million shares in the market, and a market cap of $ 304.65 million with a stunning YTD of 59.90%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)