Introduction

When the stock goes ex dividend, on that particular date, often the price of the stock witnesses a decline in its performance, by the amount of the dividend declared. This is actually adjusted by the stock exchange. However, when the dividend is declared by the company, the price of the stock rises. Further, it has been observed that the stock price rises before the ex- dividend date, as the investors go for buying the stock to be eligible to get the dividend. The investors, even if they sell the stock on or after the ex-dividend date, can still be eligible to receive the dividend, and are not required to wait till the pay date to receive the dividend.

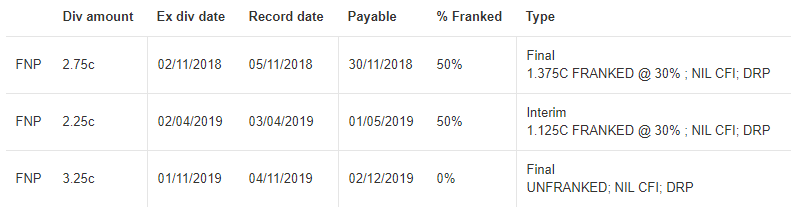

Freedom Foods Group Ltd (ASX: FNP)

Freedom Foods Group Ltd (ASX: FNP) produces & retails dairy products, vegetarian soy-based foods, beverages etc. It will pay the unfranked dividend of 3.25 cents on 2 December 2019 (for the period closed 30 June this year) and will be ex-dividend on 1 November 2019. The company has an annual dividend yield of 1.01%.

Source: ASX

On 31 October 2019, FNP stock last traded at $5.360, slipping by 1.289 percent from its last close. The stock has produced a return of 12.66 percent in the past three months duration.

Wellcom Group Limited (ASX: WLL)

Wellcom Group Limited (ASX:WLL) a leading company that is into creative production, will pay the dividend of 21 cents (for the period closed 30 June) on 27 November 2019 and will be ex-dividend on 5 November 2019. The declared dividend/distribution will be 100% franked and the stock has an annual dividend yield of 3.21%.

On 31 October 2019, WLL stock last traded at $6.82, declining by 0.365 percent from its last close. The stock has produced a return of 0.007 percent in the past 30 days duration.

Bank of Queensland Limited (ASX: BOQ)

Bank of Queensland Limited (ASX: BOQ) provider of banking solutions & services like bank accounts, credit cards, all types of loans like home loans, personal loans, savings, investment instruments and insurance, will pay the dividend of 31 cents (for the period closed 31 August) on 27 November 2019 and will be ex-dividend on 6 November 2019. The company has an annual dividend yield of 7.21% & their dividend is 100% franked.

On 31 October 2019, BOQ stock last traded at $9.05, going up by 0.333 percent from its last close. The stock has produced a return of -3.22 percent in the past 90 days period.

Brickworks Limited (ASX: BKW)

Brickworks Limited (ASX: BKW), is into the production and delivery of clay and concrete goods, development of properties and make investments. It will pay the dividend of 38 cents 9for the period closed 31 July) on 27 November 2019 and will be ex-dividend on 6 November 2019. It will be 100% franked and has an annual dividend yield of 3.16%.

On 31 October 2019, BKW stock last traded at $18.09, moving up by 0.388 percent from its last close. The stock has produced a return of 10.08 percent in the past 6 months duration.

Sandfire Resources NL (ASX: SFR)

Sandfire Resources NL (ASX: SFR), that is into the exploration & production of metal & mining of metals like copper, gold etc. will pay the dividend of 16 cents (for the period ended 30 June) on 29 November 2019 and will be ex-dividend on 14 November 2019. The company has an annual dividend yield of 3.95% & their dividend is 100% franked.

On 31 October 2019, SFR stock last traded at $5.81, moving down by 0.172 percent from its last close. The stock has given year till date return of -9.06 %.

Washington H. Soul Pattinson and Co. Ltd (ASX: SOL)

A diversified entity, Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) is into investments, mining of coal, gold and copper mining and refining and consulting. It will pay the dividend of 34 cents (for the period closed 31 July) on 9 December 2019 and will be ex-dividend on 15 November 2019. The company has dividend yield of 2.58% & their dividend is 100% franked.

On 31 October 2019, SOL stock last traded at $21.720, declining by 0.504 percent from its last close. The stock has given the return of -22.34 % in the last 12 months duration.

NRW Holdings Limited (ASX: NWH)

NRW Holdings Limited (ASX: NWH) is a company that has an expertise in civil construction and mining services, will pay the dividend of 2 cents (for the period closed 30 June) on 16 December 2019 and will be ex-dividend on 29 November 2019. The company has an annual dividend yield of 1.78 % & their dividend is not franked.

On 31 October 2019, NWH stock last traded flat at $2.25. The stock has given the return of -23.47 % in the past 6-month timeframe.

OM Holdings Limited (ASX: OMH)

OM Holdings Limited (ASX: OMH) is into the production of manganese, silicon, and will pay the dividend of 1 cent (for the period closed 30 June) on 29 November 2019 and will be ex-dividend on 7 November 2019. The company has an annual dividend yield of 6.67% & their dividend is not franked.

On 31 October 2019, OMH stock last traded at $0.49, moving up by 8.889 percent from the previous closing price. The stock has given the return of -67.39 % in the past 12-month timeframe.

NAOS Ex-50 Opportunities Company Ltd (ASX: NAC)

An investment entity, NAOS Ex-50 Opportunities Company Ltd (ASX: NAC) invests in ASX listed stocks & also seeks opportunities in offshore stocks. The company intends to give the investors the regular stream of income through dividends & return above the benchmark index, being S&P/ASX 300 Industrials Accumulation Index.

NAC will pay the dividend of 1.35 cents (closed 30 September 2019) on 19 November 2019 and will be ex-dividend on 5 November 2019. The company has an annual dividend yield of 5.68% & their dividend is 100% franked.

On 31 October 2019, NAC stock last traded at $0.930, moving up by 0.541 percent from the prior closing price. The stock has given the year till date return of 3.93%.

NAOS Small Cap Opportunities Company Ltd (ASX: NSC)

A listed investment company, NAOS Small Cap Opportunities Company Ltd (ASX: NSC) invests in stocks to provide regular stream of fully franked dividends & return above the benchmark index, being S&P/ASX Small Ordinaries Accumulation Index. It will pay the dividend of 1 cent (for the period closed 30 September) on 19 November 2019 and will be ex dividend on 5 November 2019. The company has an annual dividend yield of 4.87% & their dividend is 100% franked.

On 31 October 2019, NSC stock last traded at $0.745, moving down by 0.667 percent from the prior closing price. The stock has given the 12 months return of 2.74%.

Pengana International Equities Ltd (ASX: PIA)

Pengana International Equities Ltd (ASX: PIA), a listed investment company that offers the investors access to a diversified portfolio of 30-50 global equities, will pay the dividend of 3.5 cents (for the period closed 30 June) on 19 November 2019 and will be ex-dividend on 4 November 2019. The company has an annual dividend yield of 6.19% & their dividend is 67.14% franked.

On 31 October 2019, PIA stock last traded at $1.125, moving down by 0.442 percent from the prior closing price. The stock has given the 3 months return of 4.63%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.