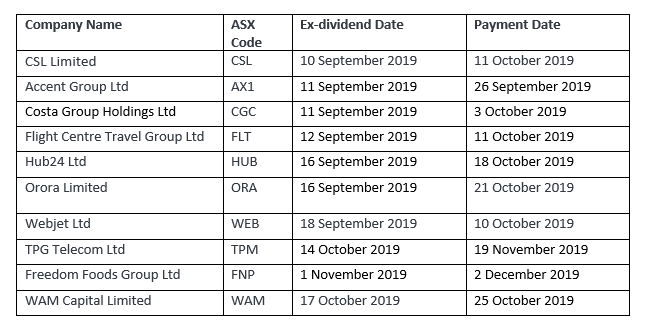

If someone purchases a stock on its ex-dividend date (usually set one day before the record date) or after, he/she will not be entitled to receive the next dividend payment. This means that in order to receive the dividend payment of a stock, one must be the shareholder of the company before the ex-dividend date. Letâs look at few ASX-listed stocks that are going ex-dividend in the next 2 Months.

CSL Limited (ASX:CSL)

Leading global biotechnology, CSL Limited (ASX: CSL) is primarily involved in developing and delivering innovative medicines to help people with life-threatening medical conditions.

The company will pay its final dividend for FY19 on 11 October 2019. The Directors have resolved to pay a final dividend of US$1.00 per ordinary share, taking the total dividend for FY19 to US$1.85 per share. The ex-dividend date is set at 10 September 2019 while the record date is 11 September 2019.

At market close on 6 September 2019, CSL stock was trading at a price of $241.990 with a market capitalisation of circa $108.62 billion. The stock is currently trading near to its 52 weeks high price of $242.100.

Accent Group Ltd (ASX:AX1)

Regional leader in the retail and distribution of performance and lifestyle footwear, Accent Group Ltd (ASX: AX1) recently announced a final fully franked dividend of 3.75 cents per share, taking the total dividend for FY19 to 8.25 cents per share, up 22% on the prior year.

The dividend has payment date of 26 September 2019, ex-date of 11 September 2019 and a record date of 12 September 2019.

For FY19, the company reported an EBITDA of $108.9 million and NPAT of $53.9 million, both up by 22.5% on the prior year.

At market close on 6 September 2019, AX1 stock was trading at a price of $1.665, up 2.778% intraday, with a market capitalisation of circa $876.81 million. AX1 stock is trading near to its 52 weeks high price of $1.710.

Costa Group Holdings Ltd (ASX:CGC)

Australiaâs leading grower, packer and marketer of premium quality fresh fruit and vegetables, Costa Group Holdings Ltd (ASX: CGC) will soon pay the interim dividend of 3.5 cents per ordinary share, fully franked on 3 October 2019. The dividend as a record date of 12 September 2019 and an ex-dividend date of 11 September 2019.

For the half year ended 30 June 2019, the company reported revenue from ordinary activities of $573.42 million, up 12% on pcp.

In the past six months, CGCâs stock has provided a negative return of 31.52% as on 5 September 2019. At market close on 6 September 2019, the CGC stock was trading at a price of $3.550, up 0.852% intraday, with a market capitalisation of circa $1.13 billion.

Flight Centre Travel Group Ltd (ASX:FLT)

One of the worldâs leading travel agency groups, Flight Centre Travel Group Ltd (ASX: FLT) has recently declared a final dividend of $0.98, payable on 11 October 2019. The stock has an ex-date of 12 September 2019 and record date of 13 September 2019.

In FY19, the group established a new TTV (total Transaction Volume) milestone of $23.7billion. The companyâs overseas businesses generated more than 50% of TTV & PBT (Profit Before Tax).

In the past six months, FLT stock has provided a return of 7.02% as on 4 September 2019. At market close on 6 September 2019, FLT stock was trading at a price of $47.930, down by 1.134% intraday, with a market capitalisation of circa $4.9 billion.

Hub24 Ltd (ASX:HUB)

Financial services company, Hub24 Ltd (ASX: HUB) has declared a final dividend of 2.6 cents per share, payable on 18 October 2019. The dividend has an ex-date of 16 September 2019 and a record date of 17 September 2019.

During the year, HUB24 achieved the following financial results:

- FY19 Platform Revenue of $54.1 million up 36% on FY18;

- Funds Under Administration (FUA) grew by 54% to $12.9 billion from $8.3 billion, with record net inflows of $3.9 billion

- FY19 Platform Underlying EBITDA of $18.0m up 52% on FY18;

In the past six months, HUB stock has provided a return of 6.27% as on 5 September 2019. At market close on 6 September 2019, HUB stock was trading at a price of $12.970, up by 0.621% intraday, with a market capitalisation of circa $806.78 million. The stock is trading at a PE multiple of 111.70x with an annual dividend yield of 0.36%.

Orora Limited (ASX:ORA)

Packaging solutions company, Orora Limited (ASX: ORA) quoted $2.770 per share on ASX after the close of trade hours on 6 September 2019. The company has a mar cap of around $ 3.29 billion. Most recently, the company has declared a dividend of 6.5 cents relating to the period of six months ending 30 June 2019. The dividend has an ex-date of 16 September 2019 with a record date of 17 September 2019. The dividend is expected to be paid on 21 October 2019.

In FY19, the company earned a revenue of $4,761.5 million, up 12.1% on the previous year. The company reported and EBIT of $246.6 million for FY19, up 6.2% on pcp.

Webjet Ltd (ASX:WEB)

Leading digital travel business, Webjet Ltd (ASX: WEB) recently declared the final dividend of 13.5 cents per share for FY19. The dividend is due to be paid on 10 October 2019. It has an ex-date of 18 September 2019 and record date of 19 September 2019.

At market close on 6 September 2019, Webjetâs stock quoted $12.590 with a market capitalisation of circa $1.66 billion. In the past six months, WEBâs stock has provided a negative return of 21.70% as on 5 September 2019.

TPG Telecom Ltd (ASX:TPM)

Australiaâs leading telecom company, TPG Telecom Ltd (ASX: TPM) recently declared a final dividend of 2.0 cents per share for FY19. The dividend is payable on 19 November 2019. It has a record date of 15 October 2019 and ex-dividend date of 14 October 2019.

In FY19, TPG earned reported revenue of $2,477.4 million and underlying NPAT of $376.2 million.

The company is currently in the middle of a merger with Vodafone Hutchison Australia. The merger is subject to various conditions including shareholder and regulatory approvals.

- On 8 May 2019, the ACCC announced it had decided to oppose the proposed merger;

- On 24 May 2019 proceedings were lodged with the Federal Court of Australia by the merger parties, seeking orders that the proposed merger will not have the effect, or likely effect, of substantially lessening competition;

- The Federal Court hearing is scheduled to commence on 10 September 2019 and complete within three weeks.

At market close on 6 September 2019, TPMâs stock quoted a price of $6.420 with a market capitalisation of circa $5.95 billion. In the past six months, TPMâs stock has provided a negative return of 4.47% as on 5 September 2019. The stock has PE multiple of 34.280x and an annual dividend yield of 0.62%.

Freedom Foods Group Ltd (ASX:FNP)

Food & beverages company, Freedom Foods Group Ltd (ASX: FNP) is currently the fastest growing branded supplier in the Australian Grocery market out of the top 100 suppliers. Most recently, the company declared a final dividend of 3.25 cents per share for FY19, payable on 2 December 2019. The dividend has an ex-date of 1 November 2019 and a record date of 4 November 2019.

FY19 Results Highlights:

- Net Sales increased +34.9% to $476.2 million, an increase of $123.2 million

- Operating EBDITA increased +40.9% to $55.2 million, an increase of $16.0 million

- EBDITA margins for the period increased from 11.1% to 11.6%

- Operating NPAT increased +40.1% to $21.9 million.

At market close on 6 September 2019, FNPâs stock quoted $5.680 with a market capitalisation of circa $1.58 billion. In the past six months, FNPâs stock has provided a return of 19.59% as on 5 September 2019. The stock has a PE multiple of 123.670x and an annual dividend yield of 0.95%.

WAM Capital Limited (ASX:WAM)

WAM Capital Limited (ASX: WAM) most recently declared a fully franked dividend of 7.75 cents per share, taking the full year dividend to 15.5 cents per share.

The dividend has a payment date of 25 October 2019, ex-dividend date of 17 October 2019 and a record date of 18 October 2019. For FY19, the company has reported an operating profit of $14.5 million (after tax).

At market close on 6 September 2019, WAMâs stock was trading at a price of $2.180 with a market capitalisation of circa $1.56 billion. In the past six months, WAMâs stock has provided a negative return of 3.13% as on 5 September 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.