On 13 November 2019, West Perth-based graphite explorer and developer, BlackEarth Minerals NL (ASX:BEM) announced to have commenced the excavation of 60 tonnes of bulk material from its flagship 100% owned Maniry graphite project in southern Madagascar. The excavation procedure is part of the companyâs trial mining / large-scale pilot program.

BlackEarth is expecting to complete the mining and excavation activities on site by late November 2019, with mining activities at the defined Razafy Resource being carried out with complete cooperation and involvement of the local community. The Beijing General Research Institute of Mining and Metallurgy (BGRIMM), which has already received an initial 250kg of Maniry material at its facility in China, is likely to receive the 60+ tonnes bulk sample in early January 2020.

BGRIMM was recently appointed by BEM to conduct final testing on the Maniry graphite ore and finalise all process engineering related matters as part of its definitive feasibility study on the project. The institute, with offices and laboratory facilities in Beijing, China, is a globally recognised technical leader in the fields of graphite processing and engineering.

More on the contract between BlackEarth Minerals and BGRIMM can be READ HERE.

The institute is expected to start testing shortly, targeted towards establishing optimal operating conditions for the large-scale pilot plant program or the second stage pilot plant program. The results are important for the company, as they will aid towards finalising BEMâs process development work and bankable feasibility study, which is due for completion in the second half of 2020.

The complete program entailing trial mining and piloting will provide the company with:

- Better understanding of early mining conditions;

- Final Process Design Criteria;

- Final equipment sizing and power draws;

- Analysis and test work on the final tailings;

- Sufficient concentrate sample for executing binding offtake arrangements before starting construction.

Offtake Agreements

BlackEarth Minerals is currently in negotiations with several interested parties for offtake agreements. As part of these efforts, in mid-October 2019, the Company dispatched concentrate samples from the Maniry graphite project to potential offtake partners in China, who intend to conduct test work on the sample to confirm suitability for use in the key end use markets, including high-end refractory, expandables and battery anode.

Based on successful results from the testing, the company is expecting to enter a memorandum of understanding with suitable offtake partners, prior to proceeding to binding offtake arrangements.

The companyâs plan is to complete the feasibility study during 2020 and start project commissioning in 2021.

Razafy Graphite Deposit

Three regional domains of graphite mineralisation at the Maniry Project are:

- Razafy Domain - The exploration target for this domain, including the existing drilled and estimated Razafy mineral resource, is 85-125Mt with grades ranging from 7 per cent to 8 per cent TGC;

- Haja Domain - The exploration target for this domain, including the currently estimated Haja lens, is 140-180Mt with grade ranging from 6 per cent to 7 per cent Total Graphitic Carbon (TGC);

- Ivan Domain - The exploration target for this domain is 35-75Mt with grade ranging from 6 per cent to 7 per cent TGC.

The Razafy resource is part of a mineralised graphite system (much larger), which was defined by exploration programs performed in an extensive and detailed manner. Airborne geophysical surveys, geological mapping, trenching, drilling and rock chip sampling were performed to define the system.

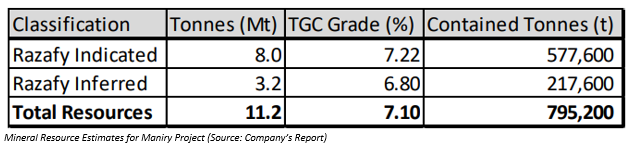

Razafy contains an indicated and inferred resource, containing 11.2Mt at the rate of 7.10 per cent TGC. These estimates are the culmination of the companyâs 74-hole, 5,371-metre diamond drilling program, concluded earlier in the year and resulted in the foundation of scoping study activities.

During the financial year ended 30 June 2019, the company received exceptional assay results from trenches excavated at the Razafy NW Prospect, in addition to encouraging trench results from the south east of the existing Razafy delineated resource.

Stock Performance

The BEM stock was trading at AUD 0.049 on 21 November 2019 (AEST:3:19 PM), with a market cap of AUD 5.53 million and approx. 113 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.