Raiden Resources Limited (ASX: RDN)

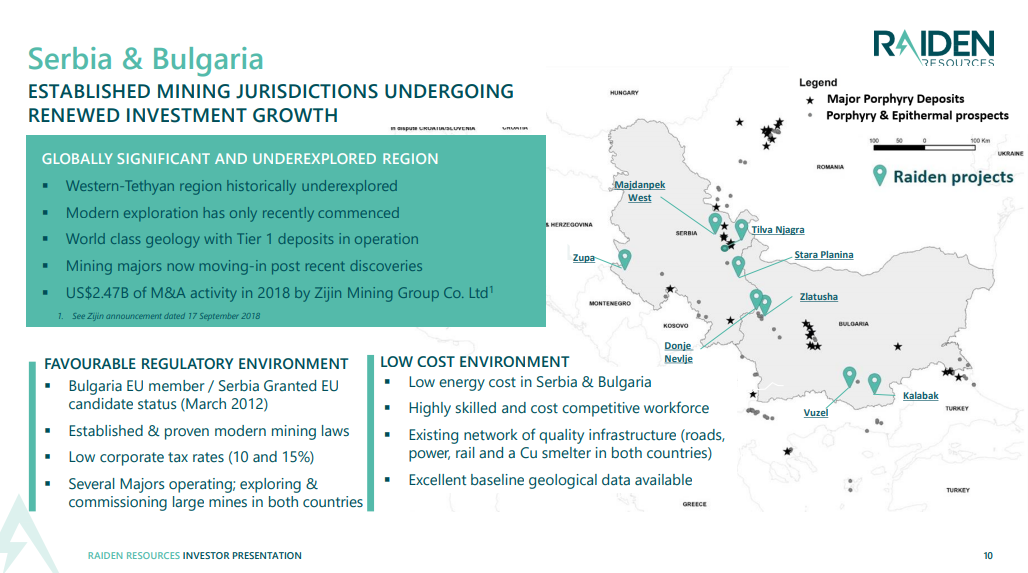

Copper-gold exploration company, Raiden Resources, operates in Eastern Europe. Its tenements are located in Serbia & Bulgaria, which remains a low cost, mining friendly jurisdiction with relatively underexplored areas. The company has a market capitalisation of ~A$3.69 million, with approximately 410.43 million shares outstanding.

Mining Jurisdictions (Source: Companyâs Presentation)

On 20 August 2019, the company released a presentation titled âGrowth Story in a World Class Copper-Gold Beltâ. Accordingly, the company holds approximately 694km2 ground holding in one of the most prolific copper-gold belts with 8 projects secured across Bulgaria and Serbia. Besides, most of the projects are in prolific Tertiary & Cretaceous belts which are dominated by majors, and additional opportunities are under review and applications have been filed.

Growth Strategy

Reportedly, the global Mineral Exploration spending has declined by nearly 70% since 2012, and major companies despite their cash positions have all but stopped their exploration programs. Meanwhile, Exploration refocussed on brownfield settings, delivering only small incremental resource increases.

Besides, greenfields exploration is the main generator of Tier 1 discoveries and has been almost reduced to zero since 2012. The copper supply would be in the deficit from 2021 onwards, and junior companies now account for 70 percent of global discoveries.

More importantly, the Tethyan Belt in Eastern Europe has some of the lowest discovery costs for gold and for copper comparing against global discovery costs. Western Tethyan, in Eastern Europe, is ranked as one of the top metal endowed belts globally. Exploration expenditure for metals has been at an all-time low.

Further, the peak discoveries occurred several years prior to peak spending, due to the huge competitive advantage early movers have in terms of securing quality ground and skills, and Raiden is positioning itself for belt-scale strategic acquisitions in the near term.

Kalabak Project (Bulgaria)

Reportedly, the company has the option to earn 75% at the project level, and it is located at 191 km2 in prospective & underexplored porphyry/epithermal belt. Besides, Ada Tepe (Dundee precious Metals â in production) and Rozino (Velocity Minerals) gold deposits both within 10km of license. Further, the company has identified at least two unexplored epithermal gold and porphyry copper prospects.

Now, the company would conduct soil sampling, mapping and phase 1 geophysics, and target scale geophysics to define drill targets in 4th Q19 period.

Vuzel Project (Bulgaria)

Reportedly, the company holds an option to buy out 100% of the project (26.5km2), and the advanced epithermal gold target has been defined by the historical drilling & channel sampling. Besides, the main target zone remains untested by drilling, and it represents significant potential for a large gold mineralised system. Now, the company is awaiting final permits by the Ministry of Energy to commence work at the project.

Zupa (Serbia)

Reportedly, the project includes 85km2 exploration permit in an emerging Pb-Zn-Cu district, which is wholly owned by Raiden. Besides, the project area is considered as highly prospective for polymetallic skarn and manto-type replacement mineralisation. The project is located in a belt, which is experiencing a revival with new high-grade discoveries in Bosnia. Further, the company is targeting skarn/replacement mineralisation on the contact zone with porphyry intrusion and mantos overlying blind intrusives.

Now, the soil program is underway while results are expected in Aug/Sept 2019, and the geophysical survey would define the drill targets, which is expected before the end of the year.

Stara Planina (Serbia)

Reportedly, the project is a Joint Venture between Raiden and local company, and the company has an option to buy 100% for â¬0.3 million. It includes two high-priority targets, Aldinac & Gradiste. Besides, the company is targeting structural and intrusion related mineralisation, and reconnaissance drill program was completed, which returned anomalous grades of gold and copper within a large alteration & deformed zone.

Now, the company intends to undertake the follow-up program, including mapping & trenching designed to understand structural controls on mineralisation, and the follow-up drill campaigns have been planned.

Majdanpek West (Serbia) - Rio Tinto JV

Reportedly, the project includes 76 km2 exploration permit adjacent to the high grade Coka Marin deposit and the operating Majdanpek copper mine. In Q3 2018, Rio Tinto completed a helicopter electromagnetic survey (VTEM) covering the entire permit - where several drill targets were defined. Besides, Phase 1 Drilling was completed by Rio Tinto while results are pending, and the company has a free-carried interest in the project.

Western Srednogorie Setting

Reportedly, Western Srednogorie Volcanic Belt has an analogous geological setting to the Timok and Panagurishte districts. The district hosts several outcropping porphyry and epithermal prospects in Cretaceous Volcanics. Besides, no systematic application of modern geochemistry or geophysics has been conducted to date, and the last exploration was in 90âs. The company is currently the largest landholder in the district, and it holds the bulk of the available and prospective geology in the district.

Zlatusha Project (Bulgaria)

Reportedly, the company could earn up to 75%, and the project has 195 Km2 exploration permit. The project hosts highly prospective Cretaceous geology â seven known epithermal & porphyry occurrences with positive historical drilling. Besides, no modern exploration has been conducted since the â90âs - no airborne geophysics or systematic modern geochemistry has been conducted over the permit.

Now, the company is undertaking data reviews, field program planning, and work would commence following final approvals from the Ministry of Energy.

Donje Nevlje Project (Serbia)

Reportedly, the project is located in 74 km2 exploration permit under renewal (100% Raiden). The historic mapping & magnetic survey suggests comparable geology to the Cretaceous Timok Magmatic Complex (TMC). Besides, the Yugoslav State had completed two scout holes in the 1960s, both returning anomalous Cu values, and there is significant potential for porphyry & preserved epithermal mineralisation.

Meanwhile, the company defined IP -chargeability targets in March 2019, and 1,150m drill program was completed in 1H19 period, targeting epithermal & porphyry mineralisation under cover (Cukaru Peki Model). Subsequently, the company intercepted Cu -Au mineralisation & alteration at the end of the hole, and drilling was suspended due to excessive ground water inflow.

Now, the company is working on drill result interpretations, phase 2 drilling/further geophysics & targeting work.

On 21 August 2019, RDNâs stock last traded at A$0.01, zooming up by 11.11% from the previous close. The stock of the company has given a negative return of 55% in the last one year. Besides, it has generated a negative return of 18.18% in the last three months. However, the stock has given a positive return of 12.5% in the year-to-date period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_20_2025_02_57_35_613912.jpg)