The need for raising additional equity generally arises in situations when the company anticipates growth and expansion through acquisitions and needs to meet the fund requirements. Through equity fund raising, the company is able to raise funds (in cash generally) in exchange for a part of the companyâs ownership.

The extent of ownership in the company is directly proportional to the number of equity shares held by the investor. A company can raise additional capital through debt financing. However, equity financing has its own advantages in raising additional capital.

Letâs learn further about the advantages of raising capital through equity.

Advantages of equity raising

- Everlasting funding solution

Money once raised through equity issuing is an everlasting solution for the financial needs of an organisation. Having raised the finance for smoothening the company operations, the company managers are able to plan for the allocation of funds and develop fresh plans to achieve company objectives.

Unlike debt financing, there is no repayment involved in equity fund raising, and the money once raised can be utilised to add value to the overall organizational performance. As a result, the managers are able to focus on other activities of the company.

- No burden of Repayment

Raising funds by means of issuing equity induces lesser burden of repayment on the company. As compared to debt financing, equity financing does not involve any fixed monthly loan payments to set off the loan burden.

Issuing equity is generally beneficial for the companies which are unable to generate profits in their initial stages of commencement. Plus, start-ups with persistent negative cash flows during their inception can raise funds through issuing equity for a safer side.

- Room for debt financing

Financial leverage ratio or the debt-equity ratio of a company reflects the proportion of financing equity and debt. Having raised funds solely through the issue of equity, the company is at an advantage of leveraging its capital by issuing debt.

No debt issued, or good creditworthiness of the company improves the prospects of raising additional capital through debt.

- No Mandatory dividend payments

With the issue of equity shares, a part of the companyâs ownership is transferred to the shareholder on the basis of his/her holdings of the companyâs shares. The equity shareholders, as the owners of the company, are at an advantage of getting higher returns in the form of dividends under the circumstances where the company makes a profit and are simultaneously at the risk of bearing losses.

- Creation of Reserves

As a long-lasting source of funding, equity funding facilitates the generation of profits for the company, which can be further allocated to finance the increased working capital needs and other growth projects.

A part of profits generated through equity capital can be set out as general reserves, to fund the losses and expenses, and special reserve, to fund a specific project of the company.

Recently, Atomos Limited and Karoon Energy Ltd have come up with updates regarding equity raising. Letâs take a look at these updates.

Atomos Limited (ASX: AMS)

Being a global video-tech company, Atomos Limited (ASX: AMS) has been delivering award-winning, simple to use monitor-recorder content creation products that provide content creators with a faster, higher quality and more affordable production system.

Based in Australia, Atomos operates globally with its distribution partner network spanning worldwide and offices in the USA, Japan, China, UK, France and Germany.

Trading halt for AMS Stocks

As per the recent announcement, the securities of Atomos have been kept in a trading halt at the request of AMS, pending it releasing an announcement regarding a proposed capital raising and acquisition.

Atomos requested the trading halt with immediate effect in respect of its ordinary shares, pursuant to ASX Listing Rule 17.1. As per the announcement of AMS, in accordance with Listing Rule 17.1, the reasons for the trading halt request is

âto facilitate an orderly market in the Company's securities pending an anticipated announcement by the Company regarding a proposed capital raising and acquisitionâ

Adding to the above, AMS announced the following in line with Listing Rule 17.1.

- AMS wishes the trading halt to remain in place until the earlier of such time as it makes the announcement, or the commencement of trading on 25 October 2019;

- AMS is not aware of any reason why the trading halt should not be granted, or of any information necessary to inform the market or ASX about the trading halt;

In the month of July 2019, AMS raised $7,500,000 by issuing 7,500,000 fully paid ordinary shares at $1.00 per share through an Institutional Placement. AMS anticipates utilising the proceeds from the placement in strengthening AMSâs balance sheet while it continues to chase opportunities for market development and towards fast-track growth.

As per ASX, AMS stock last traded at a price of $1.415 with a market cap of around $225.63 million and total outstanding shares of 159.46 million.

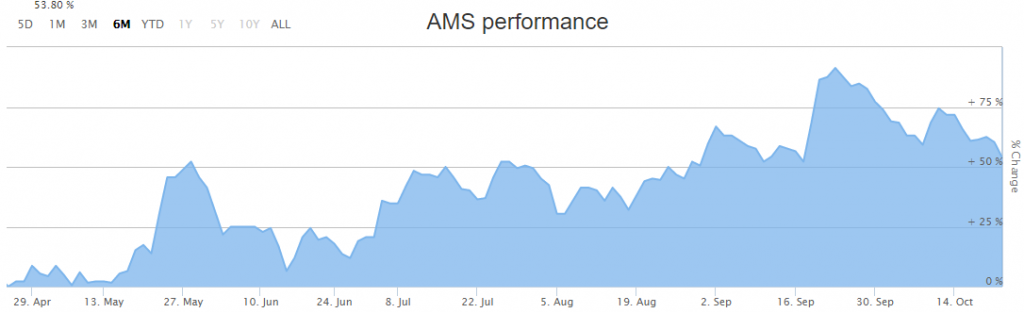

AMS Six months Stock Performance (Source: ASX)

The 52 weeks high price of the stock is $1.820. Over a period of last six months, AMS stock has increased by 53.80%.

Karoon Energy Ltd (ASX: KAR)

The principal strategy of Karoon Energy Ltd (ASX: KAR) is the discovery of offshore initial phase exploration breakthroughs that carry huge potential targets in basins with proven Petroleum Systems.

In the long-term, KAR strategizes to retain residual equity interests in the assets and attempts to create shareholder value through the geotechnical work-up of the acreage.

KARâs ~$284 million equity issue

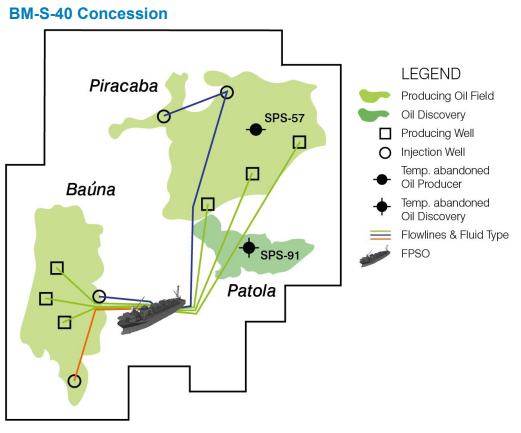

On 23 October 2019, Karoon announced undertaking of a fully underwritten equity raising of ~$284 million. KAR looks forward to fulfilling the requirements of funding its Baúna oil field acquisition and to fuel its future growth initiatives.

BM-S-40 Concession (Source: Company's Reports)

KARâs equity raising comprises of raising $67 million through institutional placement and approximately $217 million through a 1 for 1.06 pro rata entitlement offer. The offer price of the placement and entitlement offer shall be $0.93 per share, which shall include

- 9.3% discount to TERP; and

- 16.6% discount to the last traded price of $1.115 per share prior to the announcement of the equity raising.

KAR stocks in a Trading halt

Prior to the above announcement, the securities of KAR were put on a trading halt at the request of Karoon to ASX for granting immediate trading halt with respect to its ordinary shares in accordance with Listing Rule 17.1. With respect to Listing Rule 17.1, KAR furnished the following information:

- The trading halt is requested pending an announcement by Karoon in relation to an impending equity raising;

- Karoon wishes the trading halt to remain in place until the commencement of trading on Friday, 25 October 2019;

- Karoon is not aware of any reason why the trading halt should not be granted, nor is it aware of any other information required to be provided to the market or ASX in relation to the trading halt;

As per ASX, KAR stock last traded at a price of $ 1.115 with a market capitalisation of ~$275.85 million.

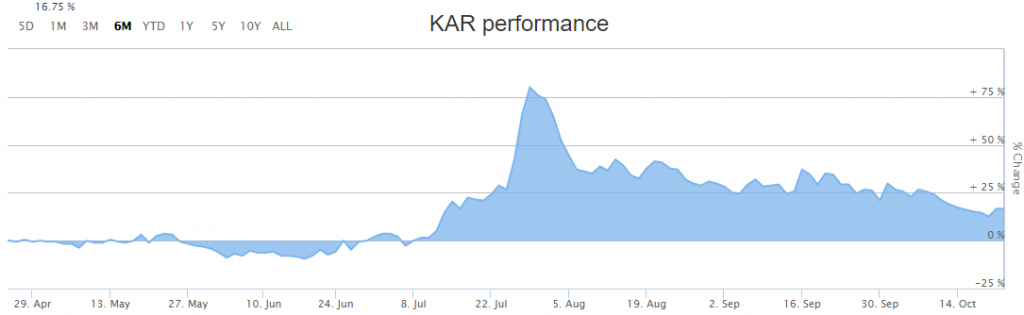

KAR Stock Six months Performance (Source: ASX)

The 52 weeks high price of the stock is $1.810. Over a period of last six months, KAR stock has increased by 16.75%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.