In todayâs world, we cannot imagine our life without technology. In almost all the things we do on a daily basis, there is an involvement of technology, right from wearable technology like fitness tracker to the cars that are getting ready for driverless technology. The syncing of technology into human life is giving hopes to the development of artificial intelligence to further accelerate the usage of technology to improve the human standard of living.

It should also be noted that both technology and science are complementary to each other, and they together help to perform any task.

Letâs investigate the recent updates of two technology stocks which are gaining the market participants attention today.

engage:BDR Limited

About the company:

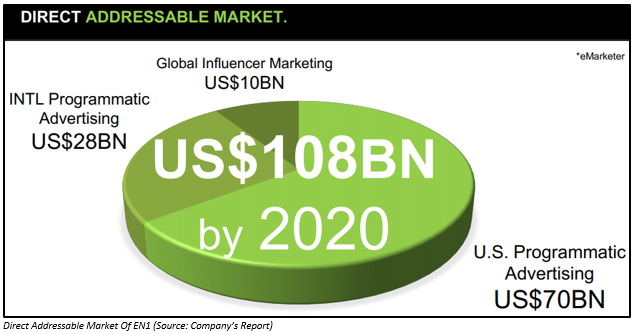

engage:BDR Limited (ASX: EN1) is a premium marketing technology company which offers innovative marketing solutions for brands, agencies, and platforms. It provides advertisers organized and comprehensive answers aiding their campaigns.

Recent Update/s:

On 3 July 2019, the company released the Q2 2019 cash flow report along with the Managementâs commentary for Q2 FY2019 ended 30 June 2019.

During the period, the company reported significant cash outflows that were related to the pre-payments to publishers. The pre-payments are the assets and are completely refundable and would be available to the company at any point of time.

In the Q2 FY2019, there was a net cash inflow of A$267,660 from the operating activities of the company. The primary source of cash inflow was through the receipt from the customers worth A$3,730,613. There were also cash outflows in the form of payment for research and development, product manufacturing and operating costs, advertising and marketing and payment for leased assets. The company also paid staff cost as well as administration and corporate costs. As compared to the previous corresponding period, there was A$2.5 million improvement in the net cash from operating activities.

There was a net cash inflow of A$1,571,905 in Q2 FY2019 from the financing activities of the company. The company raised A$1,664,454 through borrowings.

By the end of Q2 FY2019 on 30 June 2019, the net cash and cash equivalent available with the company was reported at A$2,656,618, an improvement of 328% as compared to Q1 FY2019.

In the month of June 2019, the net cash inflow from the operating activities was A$662,443. The company generated cash worth A$1,444,550 through receipt from the customer.

The estimated cash outflow in Q3 FY2019 would be A$3,195,000.

Stock Performance:

The shares of EN1 have provided an excellent YTD return of 173.33%. EN1 closed the dayâs trade at A$0.042, up by 2.439% as compared to its previous closing price. EN1 holds a market capitalization of A$22.53 million and approximately 549.54 million outstanding shares (Details as on 4 July 2019).

Kyckr Limited

About the company:

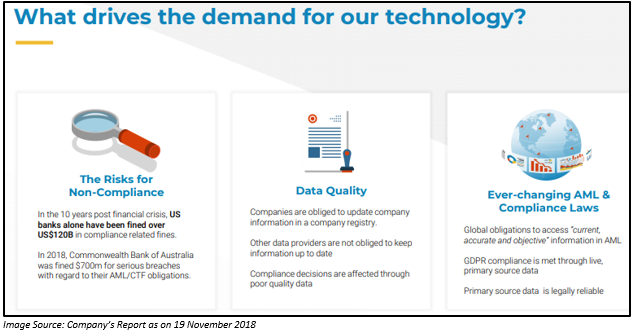

Kyckr Limited (ASX: KYK) is a global regulatory technology (RegTech) business which provides technology solutions. The solutions of KYK are connected to more than 200 regulated primary sources spread across 120 countries and above 170 million legal entities, providing automated technology solutions for improving efficiency as well as the effectiveness of Corporate KYC.

Recent update/s:

On 4 July 2019, the company reported full year unaudited revenue of ~ $2.1 million, registering a growth of 20% as compared to its previous corresponding period (pcp).

The online revenue of the company in FY2019 increased by 41% to $1.5 million on pcp.

The recently launched product of the company in the month of May 2019 is reportedly well received by users, with positive reaction along with strong growth in subscriber. Furthermore, the company stated that, within a period of 30 days, there were more than 9,000 new visitors to the new digital platform that was launched in May 2019.

Other than this, the company also stated that the new website of the company is playing a crucial role in increasing leads, users as well as sales internationally.

During the period, there was a fall in the enterprise revenue by 11% to $0.65 million on pcp. For enhance its FY20 enterprise revenue growth, the company at present is concentrating on collaborating with firms which belong to financial, data and technology space to utilize the expertise of the company as well as its unique access to real-time registry data. The strategy aims to collaborate with those firms who are looking for transforming the quality of their data as well as accelerate the development of automation onto their clients and suppliers.

On 3 July 2019, Kyckr Limited announced that it had entered into an agreement with AXA Insurance Pte Ltd (âAXA Singaporeâ), one of the leading insurance companies in the world. AXA Insurance forms a part of AXA Group, and for the 10th consecutive year, it is recognized as the leading insurance brand in the world with 171k employees who provide services to 105 million customers across 61 nations.

AXA Singapore would be implementing the KYKâs application programming interface (API) for establishing more automation. KYKâs API is an enterprise technology which has the potential to provide real-time direct access to more than 200 corporate registries worldwide through a single user interface.

The underwriting of commercial insurance involves information related to the company, its directors, shareholders as well as credit rating, which allows the underwriters to provide a quotation for insurance. In the present scenario, the collection of information is conducted manually, which is costly as well as time taking for the client, insurer and the intermediaries. However, by using the KYKâs API for direct primary source data, the turnaround time could be shortened to one to three days.

The company would be receiving initial revenue of A$400,000. There would also be further revenue when AXA expand its services across Asia. The company stated that it would be able to realize the revenue in the first quarter of the financial year 2020, as AXA is expected to rollout the project in the first half of FY2020.

Ian Henderson, the CEO of Kyckr stated that the agreement between Kyckr and AXA Singapore is a great achievement for the company. He also stated that it is a great testimony to the companyâs technology.

Further, he also highlighted that in the present scenario, Know-Your-Customer has become extremely critical to companies. Considering this, the company would be working together with leading global firms to deploy the unique registry network and offer the clients with the latest and legally accurate data that is required for customer verification.

Outlook:

The company would be prioritizing the delivery of innovative technology solutions to financial institutions in order to support the growing need of Know Your Customer (KYC) and Anti-Money Laundering (AML).

Other than this, the company would also be focusing on strengthening strategic partners to help drive opportunities for further development.

Further, the company stated that it has confidence in the continuous growth of its online services after the launch of its digital platform, and will continue to provide its customers with advanced products, services and delivery so that they could meet the regularly increasing challenges due to global regulations.

Stock Performance:

In the last one month, the shares of KYK have given a return of 16.28%. On 4 July 2019, KYK opened at A$0054 and recorded a dayâs high of A$0.068. By the end of the trading session, KYK closed at A$0.065, up by 30% as compared to its previous closing price. Around 1,445,453 shares of KYK traded on ASX today. KYK has a market cap of A$7.55 million with ~ 150.96 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.