Invocare Limited reported the financial results for the first half ended 30 June 2019, reporting growth across operating sales and net profits, coupled with an increase in margins. Propel Funeral Partners came up with an update regarding the expansion of its debt facilities with Westpac Banking Corporation to continue its investment strategy. The company also announced the expected date of release for FY19 financial results.

Now let us have a detailed insight into the announcements made by the two companies.

Invocare Limited

Invocare Limited (ASX: IVC) is a provider of funeral services in Singapore, Australia and New Zealand.

Dividend Distribution: The company recently released an announcement regarding the distribution of dividend amounting to AUD 0.175 per ordinary share, to be paid on 04 October 2019.

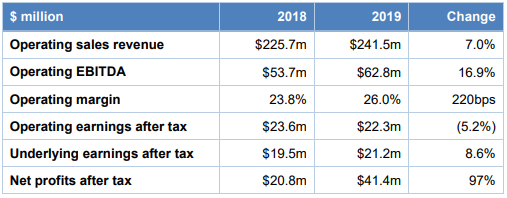

Financial Highlights: During the six months ended 30 June 2019, the company generated operating sales revenue amounting to $241.5 million, up 7.0% in comparison to prior corresponding period revenue of $225.7 million. Operating EBITDA for the period stood at $62.8 million, up 16.9% in comparison to $53.7 million in the prior corresponding period. Operating earnings after tax for the period stood at $22.3 million in comparison to $23.6 million in the prior corresponding period, that depicts a decline of 5.2%. Net profits after tax amounted to $41.4 million, increasing 97% in comparison to the prior corresponding period value of $20.8 million. Operating margin for the period increased by 220 basis points, with the current period operating margin of 26.0% and prior corresponding period margin of 23.8%.

Financial Highlights (Source: Company Reports)

Increase in revenues during the period was attributable to improved case average, contributions from the acquisitions done in 2018 and normalising volumes. Operating margins during the period increased due to the reduction in occupancy and facilities costs upon adoption of AASB 16 leases. Increase in net profits during the period was largely driven by the over-performance of funds under management for pre-paid funerals. Accounting standard changes led to a negative impact on the operating earnings after tax.

Australian Funeral Sales: Sales increased at a rate of 1.6% to $147.9 million, as compared to $145.5 million in the prior corresponding period. There was an increase of 2.3% in the average revenue per funeral case, excluding disbursements and delivered prepaid impacts. This growth came on the back of strong performance by all the brands in the companyâs network. New prepaid contract sold during the period continued to exceed the prepaid services performance by 5%, in comparison to 12% in the prior corresponding period.

Underlying Sales from Australian Cemeteries and Crematoria: During the period, sales were strong as the company recognised deferred revenue on the completion of two major crypt complexes. Operating sales were reported at $55.1 million, declining by 4.2% in comparison to prior corresponding period sales of $57.6 million.

New Zealand Sales: Sales in New Zealand were reported at $22.5 million, up 1.7% in comparison to $22.1 million in pcp. There was a decline of 2.1% in funeral case volumes in comparison to pcp, largely due to the lesser number of deaths in the market.

Singapore Funeral Sales: Sales in Singapore increase at a rate of 41.4%, from $6.7 million in prior corresponding period to $9.5 million in the current period. Growth in the region was attributable to recovery from the temporary closure of the parlours for major renovations. Funeral volumes increased by 22.0% or 141 cases.

Sales from Acquisitions: The acquisitions in New Zealand and Australia contributed $9.8 million of sales, in comparison to $0.2 million in the prior corresponding period. In 2018, the company acquired 11 funeral businesses, which are performing in line with expectations. The company recently acquired Australian Heritage Funerals located in Toowoomba Queensland, which helped expand its presence in the regional market.

The stock of the company closed at a market price of $14.020, down 7.763% on 15 August 2019 and has a market capitalisation of $1.78 billion.

Propel Funeral Partners Limited

Propel Funeral Partners Limited (ASX: PFP) is engaged in the provision of death care associated services in Australia as well as in New Zealand.

Expansion of Debt Facilities: The company recently announced that it had increased its senior debt facilities worth $50 million with Westpac Banking Corporation(maturing in August 2021). The debt facility has now been increased to $100 million. This expansion ensures that the company is sufficiently funded to continue its investment strategy.

Earnings Release: The company recently released another announcement notifying that the full year results for FY19 will be announced on 26 August 2019.

Completion of Acquisitions: The company completed the previously announced acquisitions of Waikanae Funeral Home, the Kaitawa Crematorium and the Morleys Group.

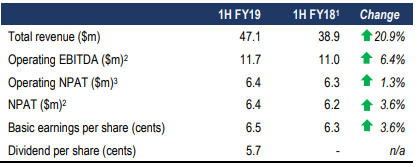

1HFY19 Highlights: During the first half ended 31 December 2018, the company generated revenue amounting to $47.1 million, up 20.9% on the prior corresponding period. Operating EBITDA for the period amounted to $11.7 million, up 6.4% on the prior corresponding period. During the period, operating NPAT amounted to $6.4 million, up 1.3% on guidance and prior corresponding period. The period was also marked by a strong balance sheet with net cash amounting to $10.3 million.

1HFY19 Key Highlights (Source: Company Reports)

Despite low trend death volumes in most of the markets, the companyâs financial results proved resilient during the period. Cash conversion during the period was at an approximate rate of 93%, along with growth across all key metrics. The Board of the company also declared a fully franked interim dividend of 5.7 cents per share, representing 75% of the companyâs Distributable Earnings for the half year ended 31 December 2018. The company paid the dividend on 05 April 2019.

Average revenue per funeral amounted to $5,549 in the first half, up 2.2% in comparison to the prior corresponding period. The company witnessed a growth of 11.7% in the funerals performed during the period, with a funeral volume of 5,644 in 1HFY19.

Acquisitions: The company has committed a total amount of $77.3 million in relation to 9 acquisitions in Australia and New Zealand, since its IPO. The acquisitions are expected to provide annual contributions of $36 million of revenue, 3,550 funeral volumes and 3,100 third party cremations.

Outlook: The company remains well placed to benefit from the acquisitions completed during FY18 and FY19 first half. The proposed acquisitions announced in the first half and subsequent to that will also be a growth driver for the future. In addition, the company will also see benefits coming in from the funeral volumes reverting to long term trends. The company expects the provide financial flexibility to support potential future dividends and growth initiatives through a conservative balance sheet and strong operating cash flows.

The stock of the company closed at a market price of $3.040, down 2.251% on 15 August 2019 (as on 15 Aug 2019) and has a market capitalisation of $306.36 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.