Generally, companies engaged in mining are susceptible to underlying projects, changing regulations, government interference and volatility in terms of metal prices, among others. The development of projects and commencement of mining takes a long period to convert the process into revenue. The news related to the development of the projects is highly price sensitive and hence, impact the performance of a stock. The earnings are highly dependent on asset/project development. The financials also tend to be highly volatile in terms of operating and net profits and the earnings are highly dependent on the asset/project development. Here, letâs discuss two stocks, OGC and WSA with their recent updates.

OceanaGold Corporation (ASX:OGC)

OceanaGold Corporation (ASX: OGC) is engaged in the production of gold, with assets spread in the US, New Zealand and the Philippines. On the North Island and South Island of New Zealand, OGC operates the Waihi Gold Mine and Macraes Goldfield (the largest gold mine in the country). OGC also operates the Haile Gold Mine, which is a high-margin asset situated in the US.

The Nueva Vizcaya Governor ordered the local government to prohibit any activities of OGC. As per the order, a local government unit prohibited a truck to access the mine site on 1st July 2019. Although the operation is continuing, OGC stopped the movement of the truck to alleviate the further escalation of the matter. However, the company updated that this prohibition has not disturbed the shipments of copper concentrate supply.

The company recently negated the rumour related to the halted operation of Didipio Mine. The company clarified that in the month of March 2018, it had applied for the renewal of Financial or Technical Assistance Agreement with the Government of the Philippines, which was confirmed on 20th June 2019. OGC also stated that it intends to operate the mines as per the regulations and laws, and will fulfil its role and responsibilities within its pact with the Philippine government.

The company in another update informed investors about the change of interest for its substantial holder, Van Eck Associates Corporation, which has reduced its voting power from 12.52% to 11.51%.

Highlights of FY18 Performance: OGC in FY18, generated operating cash flow of $346 million, which also included $96 million in 4Q. The company generated ~$121 million of free cash flow during the period with a cash balance of $108 million, an increase of 47%. The net debt on the balance sheet declined 59%, depicting a strong cash flow. The annual turnover for the period stood at $773 million, posting a growth of 7% as compared to the prior period. FY18 EBITDA stood at $364 million, with an adjusted net profit of $124 million. The company saw an EBITDA margin of 47% for the period and is achieving positive returns on the invested capital.

The company announced its first dividend for 2019 of $0.01 per security with a total distributable dividend of ~$6.2 million. The payment of the dividend was made on April 26, 2019.

Going forward, OceanaGold anticipates the Horseshoe Underground Project to begin the production in late 2020 or early 2021.

At market close, the stock was trading at $3.550, down 11.692% during the dayâs trade on 5th July 2019. The stock is available at a price to earnings multiple of 14.180x, with an annual dividend yield of 0.76% and market capitalization of $2.5 billion. The stock has given a negative return of ~22% on a YTD basis and a positive return of ~10% in the last one year.

Western Areas Limited (ASX:WSA)

Western Areas Limited (ASX: WSA) handles the mining, processing and sale of nickel sulphide concentrate. The company very recently updated that the initial capital works at the Odysseus Project are finished as per the plan and budget. With this, the company is on track to deliver its first nickel ore in the early part of 2023.

The company recently updated the market about the laboratory assays for Phase I of 2019 drill program for the Mt Alexander Project. The company revealed about the findings of further thick intercepts of high-grade nickel-copper cobalt-PGE sulphide mineralisation.

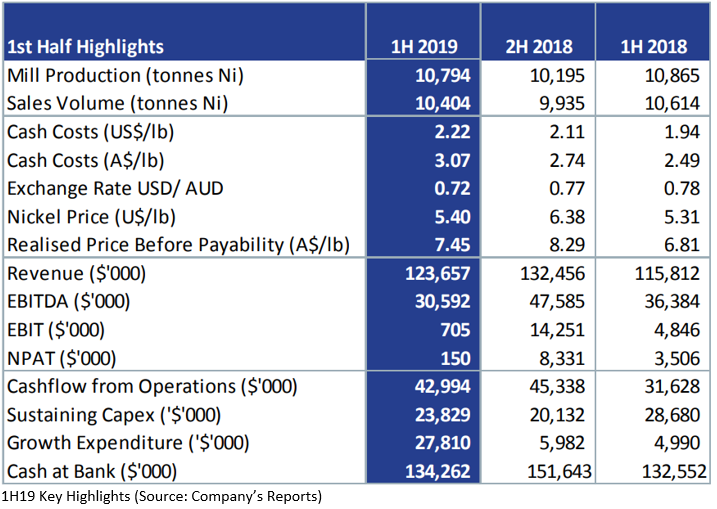

1H19 Performance Highlights: The company delivered excellent production growth from the Forrestania operations, which is progressing well for the Odysseus Project after the release of DFS (definitive feasibility study). The period was quite unstable in terms of nickel prices and the anticipated rise in the unit cost of nickel production was broadly similar to the guidance given for FY2019. WAS enjoys the debt free status on the balance sheet, which provides further space for funding its active growth projects like Odysseus, along with exploration in the near term.

Top line for the company came in at $123.7 million with an average realised price of nickel increased by 9% to $7.45/lb. The company, for the period, reported NPAT (Net Profit After Tax) of $150k. Operating cash flow for the period stood at $43 million with cash at bank of $134.3 million.

Guidance for FY19: Along with the 1H19 results, the management reaffirmed the guidance given earlier. Nickel tonnes in Concentrate Production is expected to be in the range of 20,500 to 22,000 tonnes. Unit Cash Cost of Production (Nickel in Concentrate) is forecasted to come in the range of $2.80/lb to $3.20/lb. Capital expenditures related to sustaining and mine development is expected to be between $32.0 million to $36.0 million. The expansion projects and feasibility is projected to be between $23.0 million to $25.0 million. The projection of early works related to Odysseus comes in at $24.0 million to $28.0 million, with exploration to be in the range of $12.0 million to $15.0 million.

At market close, the stock of the company was trading at $2.030, with a market cap of $530.68 million on 5th July 2019. The stock is available at the price to earnings multiple of 62.580x, with an annual dividend yield of 1.03%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.