On 26th June 2020, Australian equity market settled in green. The benchmark index S&P/ASX200 settled at 5904.1, indicating a rise of 86.4 points or 1.49%. Most of the sectors on ASX closed in green including S&P/ASX 200 Consumer Discretionary (Sector), which moved up by 20.8 points to 2,408.6. S&P/ASX 200 Materials (Sector) ended the session at 13,278.6, reflecting an increase of 1.78%. All Ordinaries stood at 6011.8, reflecting a rise of 1.41%.

On ASX, the share price of IOOF Holdings Limited (ASX: IFL) gained 8.475% and ended at $5.120 per share. The stock of G.U.D. Holdings Limited (ASX: GUD) inched up by 6.642% to $11.560 per share.

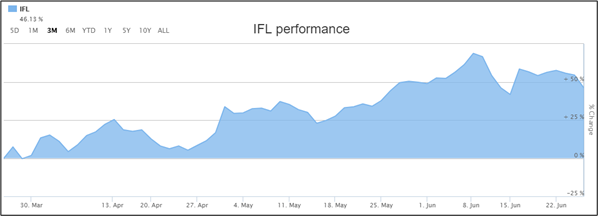

The following image gives an idea as to how the share price of IFL has trended in the span of past 3 months:

Stock Performance (Source: ASX)

S&P/NZX50 experienced a rise of 0.03% and closed the session at 11,129. The share price of TIL Logistics Group Ltd (NZX: TLL) mounted up by 17.46% to NZ$0.740 per share. Wellington Drive Technologies Limited’s (NZX: WDT) stock witnessed a sharp gain of 10.59% to NZ$0.094 per share. On the other hand, the stock of JPMorgan Global Growth & Income plc (NZX: JPG) went down by 8.44% to NZ$6.400 per share.

Recently, we have written some important information on Calima Energy Limited (ASX:CE1), and the readers can view the article by clicking here.

IOOF Holdings Limited Rose 8.475% on the Australian Securities Exchange.

IOOF Holdings Limited (ASX:IFL) recently announced that it has reached an agreement for the class action which was commenced in April 2019 against it in the Supreme Court of New South Wales to be discontinued with no order as to costs. It needs to be noted that the settlement needs Court approval. During Q3 FY20, Funds under Management, Advice and Administration (FUMA) witnessed a growth of 34.2% to $195.6 billion. The acquisition of the P&I business has added $77.1 billion to FUMA. IFL added that the proprietary platforms witnessed net inflows amounting to $180 million, and in financial advice, the company experienced no significant outflows. IFL has total debt facilities of $675 million, out of which $355 million has been drawn as at 31 December 2019.

G.U.D. Holdings Limited Ended in Green on 26th June 2020

G.U.D. Holdings Limited (ASX:GUD) recently notified the market that Marathon Asset Management LLP has made a change to its substantial holdings in the company on 23rd June 2020 with the current voting power of 10.19% as compared to the previous voting power of 9.99%. The company has renewed its debt facilities in January 2020 involving $150 million for the next four years, a further $50 million for 8 years and $25 million of short-term facilities that are reviewed every January. Following the payment of its FY20 interim dividend, net debt to underlying EBITDA of the company stood at 1.8x. Considering the uncertainty regarding the potential demand impact for GUD products, the company has suspended its FY20 guidance. The anticipated demand impacts are likely to be more acute in New Zealand in the short term.

.jpg)