Mining and exploration company, Kingwest Resources Limited (ASX: KWR) having primary focus on gold exploration, announced to have received firm commitments from professional and sophisticated investors to raise ~$3,500,000 (before costs).

Placement – Key Highlights

Under the placement, around 21,212,121 ordinary shares (Placement Shares) would be issued at an issue price of $0.165 each. The issue price per Placement Share represents a discount of 17% to the last traded price and a 10% discount to the 10-day volume weighted average price (VWAP).

A fee of 6% on all funds raised would be paid out to Cannacord Genuity (Australia) Limited and Peloton Capital Pty Ltd, who were the joint lead managers to the Placement.

The Company is pleased to have received strong support from sophisticated and institutional investors. It is noteworthy that a significant major North American precious metals investment fund has also increased its stake above pro rata in this raise and the company has welcomed their support.

The Placement Shares are expected to be allotted on or about 27 February 2020 under the Company’s existing placement capacity:

- 14,976,879 shares to be issued under the Company’s ASX Listing Rule 7.1 capacity; and

- 6,235,242 shares to be issued under the Company’s ASX Listing Rule 7.1A capacity.

Thus, the Funds raised from the latest placement have been indicated to be directed towards:

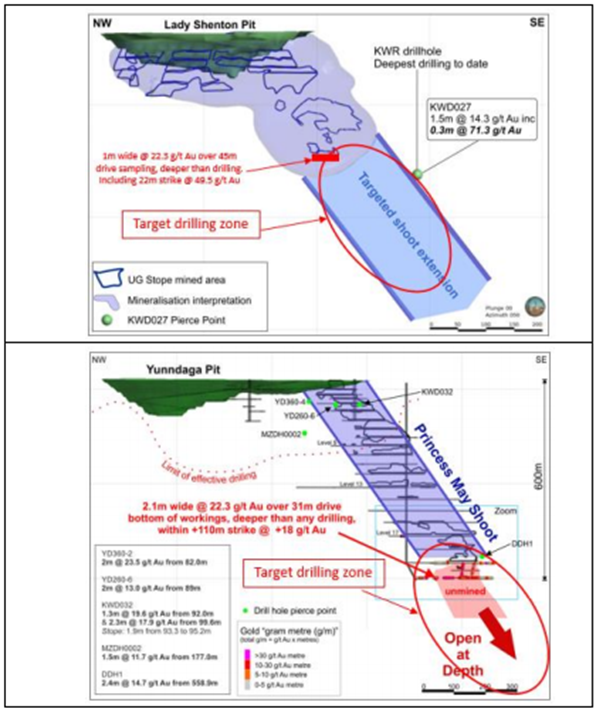

- Driving exploration drilling activities at the Menzies Gold Project targeting high-grade extensions to the existing known mineralisation (referring to Figures 1 and 2 below) which is expected to commence on 24 February 2020.

- Cover the costs of Placement and working capital.

In the highly prospective Eastern Gold Fields Region of Western Australia, Kingwest Resources recently acquired the Menzies and Goongarrie Projects from Horizon Minerals (formerly called Intermin Resources) at a value consideration of ~$ 8 million (mix of cash and shares). The Company’s primary focus remains developing the highly prospective Menzies Project which has multiple prospects. In addition to that, it also aims to undertake aggressive gold exploration across other advanced, intermediate, and greenfield projects within this district.

On 7 February 2020, the Company informed to have appointed Challenge Drilling (Kalgoorlie) to conduct Reverse Circulation (RC) drilling at Menzies. In the initial programme, drilling is planned to be conducted for more than 12,000 metres of combined RC and diamond core at this project. Kingwest Resources also added that historic high-grade producers such as Yunndaga and Lady Shenton, as well as new targets identified in recent aeromagnetic surveys would be the Company’s priority for drilling. Depending upon the results from the initial programme, additional follow up drilling will be planned.

READ: Pericles Gold Resource Nearly Doubles at Menzies Gold Project; High-Grade Gold Mineralisation Open at Depth at Menzies Gold Project

Stock Information: Kingwest Resources’ market capitalisation stands at around $ 20.12 million with approximately 100.58 million shares outstanding. On 20 February 2020, the KWR stock closed at $ 0.180 with ~ 322,936 shares traded. KWR has delivered impressive positive returns of 17.65% Year-to-date and 21.21% in the last one month.

_01_09_2025_07_01_12_631371.jpg)