Summary

- The UK government has agreed to buy manufacturing sites to develop Covid-19 vaccines. The government would spend £100 million on Covid-19 vaccine centre.

- WANdisco PLC raised USD 25 million through the issue of new shares.

- WANdisco PLC buoyed on new contract wins with the backdrop of Covid-19.

- Fusion Antibodies collaborated with two new partners in South Korea and India to market companies antibody technologies.

- Fusion Antibodies raised approximately £3.4 million through placing shares and share sale.

Given the above-market conditions, we would review two stocks - WANdisco PLC (LON:WAND) & Fusion Antibodies PLC (LON:FAB). WANdisco is a technology stock, and Fusion Antibodies is a healthcare stock. WAND and FAB were up by 9.8 percent and 15.38 percent, respectively (as on 24 July 2020). Let's walk through their financial and operational updates to understand the stock better.

WANdisco PLC (LON:WAND) – Revenue declined by 4.7 percent to USD 16.2 million.

WANdisco PLC is a LiveData company for machine learning and artificial intelligence. The critical IT assets of the Company are LiveCode and LiveData. The Company provides service to support the IT infrastructure with 25 partners and system integrators. The services provided by the Company include active data backup, disaster recovery, data lake, data migration, multicloud and multisite. WANdisco has 25 patents, and it is included on the FTSE AIM 100 index.

Recent Events

- On 16 July 2020, the Company announced that it won a new contract with one of the leading insurance company. WANdisco would provide the LiveMigrator and LiveData solution to the customer to help him migrate data to the Azure cloud.

- On 1 July 2020, the Company signed a contract worth USD 1 million with a UK based supermarket. The Company would provide technology for on-premise data consistency followed by data migration to Azure cloud.

- On 12 June 2020, the Company raised USD 25 million through the issue of 3.1 million new shares at 650 pence per share. The funds would be used to strengthen the liquidity headroom and provide enough working capital to expedite the growth.

FY2019 Annual result (ended 31 December 2019) as reported on 30 June 2020

In FY19, the Company generated revenue of USD 16.2 million. The licenses and services transferred at a point in time segment reported revenue of USD 12.5 million and services transferred over time segment reported revenue of USD 3.5 million. The adjusted EBITDA loss widened to USD 11.7 million in FY19 from USD 9.4 million in FY18. The loss for the tax in FY19 was USD 28.3 million. The cash overhead was USD 31.7 million that increased from USD 29.8 million in FY18 due to investments in market resources and engineering. The Company launched LiveMigrator that supports data migration and LiveAnalytics that provides access to analytics in the cloud. The Company achieved the status of advanced technology partner with Amazon Web Services. The Company secured a USD 5 million contract in China. In FY19, Wandisco raised USD 34 million through two placements of new shares in the market. As on 31 May 2020, Wandisco had cash of USD 12.0 million, and the Company expects cash cost of approximately USD 37 million in FY20.

FY2019 Financial Highlights

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-24-2020, after the market closed (Source: Refinitiv, Thomson Reuters)

WANdisco PLC stock closed at GBX 560.00 (as on 24 July 2020), up by 9.80 percent. Stock 52-week High and Low were GBX 834.00 and GBX 330.00, respectively. WANdisco had a market capitalization of £286.39 million.

Business Outlook

The Company is hopeful that the service in Microsoft Azure portal would attract customers from different verticals. The Company is on track with the development of the next stage of delivery for Open preview and General availability. The Company would seek short term opportunities and channel partners via raised funding. The Company is working to achieve run-rate breakeven through capitalizing the Microsoft Azure LiveData platform.

Fusion Antibodies PLC (LON:FAB) – Worked on the Covid-19 related antibody library

Fusion Antibodies PLC is a UK based contract research company that provides antibody engineering services for antibodies development that are used in therapeutic drug and diagnostic needs. The Company's patent CDRx™ platform is used to provide antibody engineering services that include antibody humanization, antibody production and antigen expression. Fusion Antibodies has completed over 100 humanization projects, and the clients include large pharma, biotech and diagnostic companies apart from research institutes. The Company was listed in the FTSE AIM in December 2017.

Trading update as reported on 6 July 2020

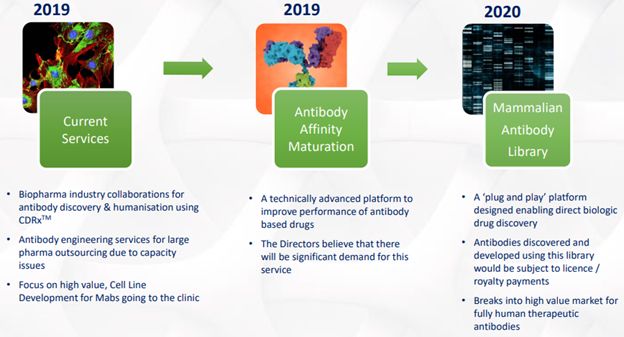

The Company has started work on the Mammalian antibody library discovery platform that is referred to as the library. The Mammalian antibody is al platform that enables direct biologic drug discovery, and the antibodies developed using this library would be subject to royalty or license payments.

The Company performed the synthesis of the antibody library DNA, which is the first achievement for Covid-19 related project. Fusion Antibodies also performed design, expression and validation of the Covid-19 antigens. It has enough quantity of two variants that are used for making antibody-producing cells, which is the second step of the library development programme. The various Covid-19 proteins developed are also given to diagnostic companies for potential development. The Company continued to offer the services during the pandemic working in mixed scenarios worldwide with new challenges and opportunities. The Company generated revenue of approximately £0.975 million for the quarter ended in June 2020. The Company expects to have generated revenue of £3.9 million for the full year ended 31 March 2020, which would be up by 79 percent year on year from £2.2 million a year ago. The Company partnered with A-Frontier, a South Korea based distributor of scientific equipment and research products, to exclusively market the Company's services in South Korea. Fusion Antibodies partnered with BioTickle Pty Ltd for exclusive sale of the Company's patented antibody technologies in India.

Growth Strategies for the Company

(Source: Company Website)

Fundraising to work on the projects

The Company raised £3.0 million through the placement of 3,333,333 new shares at 90 pence per share. Also, the Company performed a share sale of 547,235 existing shares to raise close to £0.4 million. The funds raised would be used for feasibility work on the Mammalian antibody library and working capital expense.

Share Price Performance Analysis

1-Year Chart as on July-24-2020, after the market closed (Source: Refinitiv, Thomson Reuters)

Fusion Antibodies PLC stock closed at GBX 112.50 (as on 24 July 2020), up by 15.38 percent. Stock 52-week High and Low were GBX 230.00 and GBX 55.00, respectively. Fusion Antibodies had a market capitalization of £28.62 million.

Business Outlook

The Company is focused on expanding internationally and has collaborated with two new distributors to sell the Company's services globally. The new partnership would build upon the existing collaboration in South Korea, Japan and China. The Company is hiring new scientists to demonstrate the feasibility of work for the Mammalian Library and SARS-CoV-2 S antigens. The Company would also work on existing oncology targets.