Summary

- As per the industry experts, the job vacancies in the UK's financial sector declined by 60 per cent, in the quarter to end-June.

- The FTSE All-Share Index was down by 17.12 points and was trading at 3,458.71 (as on 16 July 2020, before the market close). The market sentiments were downbeat due to the acceleration of new Covid-19 cases, escalating US-China tension after the Trump administration regarding visa restrictions on Chinese firms, and surprise plunge in China’s retail sales.

- NCC Group expects FY2020 revenue and adjusted EBIT to be better than the market consensus.

- NCC Group highlighted that the impact of the pandemic would weigh down the Group's performance in FY2021.

Given the above market conditions, we will review a technology stock - NCC Group PLC (LON:NCC). As on 16 July 2020, before the market close at 3.49 PM GMT+1), the stock price of NCC was down by 2.11 per cent, against the previous day closing. Let's walk through the financial and operational updates to understand the stock better.

NCC Group PLC (LON:NCC) – Net debt lowered to less than £5 million at the end of May 2020

NCC Group PLC is a UK based cybersecurity advisor and operates under Assurance and Escrow business segment. Assurance business provides services, such as Technical Security Consulting, Risk Management Consulting, Managed Detection and Response. Escrow business maintains critical software and applications. The Group offers services in the UK, North America and Continental Europe. The Group employs around 2,000 people in 12 countries. It has global footprint, knowledge and experience to tackle the evolving cyber risk faced by the business entities. The Group continually invest in research and innovation to develop the next generation support for cyber attacks. As per Adam Palser (Chief Executive Officer), the Company is successfully weathering the storm of Covid-19 and is in great position to take advantage of opportunities as the global pandemic subsides. NCC Group is included in the FTSE All-Share index of the London Stock Exchange.

Trading Update as reported on 23 June 2020

The Group faced cancellations and delays in business operations since Q3 FY20 that continued during the pandemic. As on 31 May 2020, the Group had net debt of lower than £5 million, which was £20.8 million in November 2019. The net debt declined due to cost-saving measures. The revolving credit facility of £100 million is due for renewal in June 2024. The Group took benefit of tax deferral programme under the government scheme; the total tax deferral benefit in FY20 is close to £5 million, which is expected to reverse in FY21.

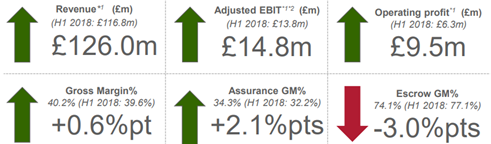

H1 FY2020 results (ended 30 November 2019) as reported on 23 January 2020

For six month period, the Group generated revenue of £132.7 million; which increased by 5.3 per cent year on year. Assurance division and Escrow division generated revenue of £114.3 million and £18.4 million, respectively. Assurance revenue increased by 6.7 per cent; however, it was offset by a decline of 2.6 per cent in Escrow revenue. The statutory operating profit was £10.5 million, whereas the earnings per share were 2.4 pence. NCC Group paid the interim dividend of 1.5 pence per share in H1 FY20.

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-16-2020, before the market close (Source: Refinitiv, Thomson Reuters)

NCC Group PLC's shares were down by 2.55 per cent against the previous day closing and trading at GBX 166.05 (as on 16 July 2020, before the market close at 12.50 GMT+1). Stock 52-week High and Low were GBX 236.00 and GBX 125.40, respectively. The Group had a market capitalization of £475.32 million, with a dividend yield of 2.73 per cent.

Business Outlook

The Group expects the FY20 revenue and adjusted EBIT to be better than the market consensus of £243.0 million and £22.3 million, respectively. The revenue in FY20 is expected to be better than the FY19 data; however, adjusted EBIT would be lower than the previous year due to measures taken by the Group. The Group expects the impact of the pandemic to weigh down on demand through FY21. The Escrow business is expected to provide some relief as the segment has a substantial amount of recurring revenue. The Group remains confident over long-term opportunities in the cyber market.