As the British Prime minister sets out to announce the plan for GBP 5 billion infrastructure projects, the FTSE-100 index was trading down by 0.54% at 6,192.20 (as on 30th June 2020 before the market close at 12.01 PM GMT+1).

The other important factors to watch out were:

- As per the BOE report, the British home approvals plunged to the lowest in May as 9,273 loans were approved for home purchases. The home purchase loan approvals were 15,851 in April.

- The household repaid more loan than they took in May, as the net repayment was GBP 4.6 billion.

Given the above market conditions, we will discuss two stocks - Tritax Big Box REIT PLC (LON:BBOX) and NewRiver REIT PLC (LON:NRR). As on 30th June 2020, (before the market close at 11.47 AM GMT+1), BBOX shares were up by close to 1.60% and NRR shares were down by about 2.83%, against the previous day closing price. Let’s walk through their financial and operational updates to understand the stocks better.

Tritax Big Box REIT PLC (LON:BBOX) – Declared quarterly dividend for Q1 FY2020

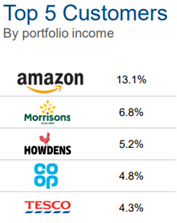

Tritax Big Box REIT PLC is a real estate investment trust and operates large scale logistics warehouses. The Company has 58 assets with a total space of 30.9 million sq ft. Some key customers of the Company include Amazon, Morrisons, Howdens, Co-op and Tesco.

Annual result for FY2019 (year ended 31st December 2019) as reported on 17th March 2020

The net rental income was up by 8.7% to GBP 144.3 million from GBP 132.8 million a year ago. The rental income was driven by the completion of five pre-let projects. The profit before tax was GBP 141.2 million. As on 31st December 2019, the Company had Loan-to-value (LTV) of 30%. The Company had an undrawn credit facility of GBP 500 million. The Company had a planned future capital expenditure of GBP 130 million related pre-let developments.

KPIs for FY2019

The adjusted total return, which is the value return to the shareholder by the Company’s asset portfolio was 5.8%. The dividend payment for FY19 was 6.85 pence per share that reflects the income return to the shareholders. The European Public Real Estate Association (EPRA) NAV per share, which mirrors the ability of the Company to grow the asset portfolio was 151.06 pence. The loan-to-value (LTV) ratio, which reflects the balance between the debt and portfolio asset value was 30.4%, which was below the threshold of 40%.

Customer base and Portfolio

(Source: Company Website) (2) By rental income; (3) By value

Trading Update as reported on 8th April 2020

The Company has a diverse customer base, and some tenents are operating in resilient sectors such as e-commerce and food retail in the current pandemic. Approximately 50% of the rent is collected from the companies operating in the defensive industry. Few customers are facing operational disruption in the unprecedented times, Tritax Big Box is working closely with them to provide some payment relief. By the end of May, the Company is expecting to collect 96% of the advanced quarterly rent that was due on 1st April 2020. The Company declared a quarterly dividend of 1.5625 pence per share for Q1 FY20; however, the Board has withdrawn dividend guidance for FY20, which was 7.0 pence per share.

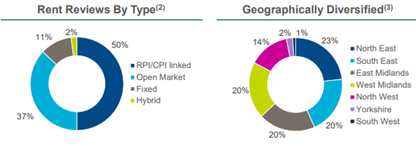

Share Price Performance

6-Month Chart as at June-30-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Tritax Big Box REIT PLC shares were up by 0.63% to trade at GBX 144.30 per share (as on 30th June 2020, before the market close at 10.03 AM GMT+1). Stock 52 week High and Low were GBX 162.60 and GBX 79.00, respectively. The Company had a market capitalization of GBP 2.44 billion.

Business Outlook

As the online shopping demand is increasing amid the current pandemic, the Company’s customers into the online retail business are expected to increase their logistics capacity by renting warehouses with more flexible supply chain and better location. This changing customer preference can be an opportunity for Tritax. However, the risk underlies in deferment of rental payments by the tenants, which can impact the cash flows. The Company would only look at new developments which can be funded without stress on the balance sheet and on a pre-let basis.

NewRiver REIT PLC (LON:NRR) – Suspended dividend payout for fourth-quarter FY2020

NewRiver REIT PLC is a real estate investment trust, which buys, operates and develops retail and leisure properties in the UK. The Company operates shopping centres, retail parks, high street stores, pubs and c-stores. NewRiver has an asset portfolio of GBP 1.2 billion with a total space of 9 million sq ft.

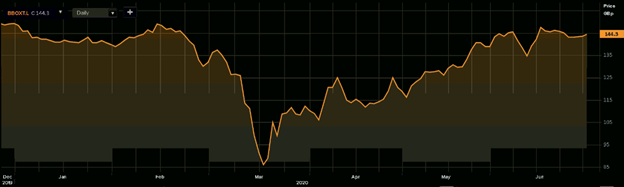

Annual result for FY2020 (year ended 31st March 2020) as reported on 18th June 2020

The underlying funds from operation (UFFO) were GBP 52.1 million, which was GBP 55.1 million in the same period last year. There was an impact of GBP 2.8 million due to lost income and provisions related to COVID-19. The UFFO per share was 17.0 pence. The net property income increased; however, it was offset by the increase in the administrative expense. The non-cash write-down in the asset valuation was GBP 166.9 million, of which 31% was due to COVID-19. The IFRS loss after-tax was GBP 121.1 million primarily due to non-cash asset write down. The total property return was -5.4%; however, better than MSCI-IPD benchmark of -9.8%. The total dividend paid in FY20 was 16.2 pence. The Company suspended the dividend payout for the fourth quarter. The occupancy of the assets was 94.8% at an average rent of GBP 12.66 per sq ft.

The loan-to-value (LTV) increased from 37% in March 2019 to 47% in March 2020. The increase in LTV was significant because of asset write-down. During FY20, the Company acquired eight assets for a total value of GBP 172.8 million (NewRiver investment GBP 102.3 million) of which three assets acquired solely by NewRiver; four acquired in 50:50 JV with BRAVO whereas 10% investment in one asset.

Balance sheet strength

As on 31st March 2020, the Company had a cash balance of GBP 82 million and an undrawn credit facility of GBP 45 million. NewRiver is also eligible for GBP 50 million of funding under the government’s Covid Corporate Financing Facility (CCFF). The Company has suspended all discretionary expenses and marketing expenses in pubs which would save GBP 24 million and GBP 4 million, respectively in FY21.

Performance metrics for FY2020

(Source: Company Website)

Share Price Performance

6-Month Chart as at June-30-2020, before the market close (Source: Refinitiv, Thomson Reuters)

NewRiver REIT PLC shares were down by 2.42% to trade at GBX 64.50 per share (as on 30th June 2020, before the market close at 11.25 AM GMT+1). Stock 52 week High and Low were GBX 218.50 and GBX 47.55, respectively. The Company had a market capitalization of GBP 202.36 million.

Business Outlook

The Company plans to dispose of asset worth close to GBP 80-100 million in FY21, of which the disposal of GBP 30.3 million is under process. NewRiver’s primary focus will be to make all the community pubs functional, and it will also seek the opportunity to dispose of pubs to generate good returns through capital recycle.