Summary

- Bring corona-hit, the country plans a huge bond sale drive

- Business loans unsustainable: report by the Recapitalisation Group

- Banks request government to create suitable vehicle for cleaning bad business debt

- A close look at Barclays, HSBC, Lloyds, and RBS

The UK Debt Management Office (DMO), the official agency to carry forward the government’s debt operations, announced on 29 June 2020 that it will be holding thirty three gilt auctions between July to August this year. Through this activity, it will be selling out government bonds worth £275 billion. British government has already raised £181 billion via bond sales since April 2020. Government needs this money to pay for its mounting borrowings due to the devastating impact of the coronavirus pandemic.

The country’s total public debt had surpassed the size of its Gross Domestic Product (GDP) by the end of May 2020, reaching a level of £1.95 trillion or 100.9 percent of Britain’s GDP, which is quite worrisome.

With a lockdown in place beginning March 23, 2020, the business activity shrank to very low levels across Britain. Demand for most goods and services, except the essential ones, had dropped abysmally. With supply chain disruptions making even production operations very difficult, many large, medium and even small scale companies saw drying up cash reserves and were unable to pay salaries to their employee. Many even went bankrupt.

Various Government Support Schemes

The UK Government has been running two main schemes to support employee salaries across businesses namely the Coronavirus Jobs Retention Scheme and the Self-Employment Income Support Scheme.

(Source: HM Treasury, Government of UK)

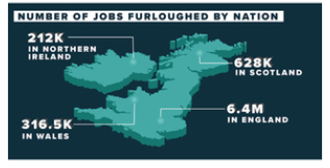

Till 31 May 2020, a total of 7.6 million jobs have been furloughed in the United Kingdom, under the government’s job retention scheme. This constitutes of 6.4 million jobs in England, 628 K in Scotland, 212 K in Northern Ireland and 316.5 K in Wales. The sectors which have claimed the highest number of furloughed employees under the scheme are the wholesale and retail sectors. It was followed by the accommodation and food service industries. The total number of claims made under the furlough scheme in the UK was £17.5 billion.

While under the self-employed scheme, the total number of claims made was 2.3 million across the entire nation, summing up to £6.9 billion till May end this year.

On the other hand, government has been running schemes to directly support ailing businesses by offering them loans. The two main schemes in this regard are the Coronavirus Large Business Interruption Loan Scheme (CLBILS) and Coronavirus Business Interruption Loan Scheme. The total value of loans approved under the former scheme was £10.53 billion, and £2.10 billion under the latter, on 21 June 2020. Another important loan scheme, called the Bounce Back Loan Scheme saw an uptake of £28.09 billion by the same date.

However, an interim report by the Recapitalisation Group has cautioned that around £36 billion worth of government backed business loans could be un-sustainable by March 2021, given the unprecedented economic crisis the country is undergoing. Businesses may not be able to pay these loans back to the government. The final version of the report is expected to be out by July 2020.

The main large banks involved under the UK government’s business loan schemes are Barclays, HSBC, Lloyds, and RBS.

Let us take a closer look at these.

Barclays plc (LON:BARC) is a multinational investment and banking services firm, based out of London. The bank started to offer the business loans to large companies under the CLBILS from April 2020. This debt was fully backed by a UK Government guarantee. It offered a debt of up to £50 million to companies with a turnover more than £250 million per annum. The lending has been offered by way of term loans and revolving credit facility. In its latest lending towards the scheme, Barclays offered loan worth £5 million to Giggling Squid, the UK-based Thai restaurant chain. The bank has also launched the Barclays Back to Business’ program to support SMEs get back in shape, and effectively fight the coronavirus pandemic.

The company shares (LON:BARC) traded at GBX 114.04, down by 0.40 percent, on June 30 at 8.31 am. The 52 week low/high range was recorded at 80.24 / 192.46. The year-to-date return was negative at (38.17) with an earnings per share of 0.14. The market capitalisation was worth £19.9 billion.

HSBC Holdings Plc (LON:HSBA) is global banking and financial services company. Recently, HSBC UK and Santander UK collectively provided a loan worth £100 million to the Mitchells & Butlers group, under the government CLBILS scheme. Mitchells & Butlers is one of the largest hospitality chains in the country. Multipanel UK, an aluminum panel manufacturer also secured a £5 million loan from HSBC under the scheme.

The company (LON:HSBA) stock traded at GBX 376.90, down by 2.05 percent on June 30 at 9.25 am. The 52 week low/high range was recorded at 370.10 / 672.50. The year-to-date return was negative at (35.34) with an earnings per share of 0.30. The market capitalisation was worth £78.4 billion.

Lloyds Banking Group (LON:LLOY) The banking group is ramping up its insurance and wealth divisions, and will soon come up with a suitable diversification strategy in this regard. It had approved more than 6000 CBILS applications worth £944 million by 12 May 2020. It also lent Bounce Bank Loans worth £2.4 billion by the same date. Fearing that some of the business loans may get toxic, due to the ongoing economic crisis, the Group’s Chairman Norman Blackwell called upon the UK government in June to set up an appropriate vehicle to takeover the loans from companies which may not be able to repay the same.

The company (LON:LLOY) stock traded at GBX 30.75, down by 1.62 percent on June 30 at 10.08 am. The 52 week low/high range was recorded at 27.73 / 67.25. The year-to-date return was negative at (50.94) with an earnings per share of 0.04. The market capitalisation was worth £22.1 billion.

Royal Bank of Scotland Group Plc (LON:RBS) is the semi-government owned British bank and insurance firm. The group has also requested government to create a suitable vehicle to clear business bad debts that might never be repaid.

The company (LON:RBS) stock traded at GBX 120.75, down by 0.37 percent on June 30 at 10.46 am. The 52 week low/high range was recorded at 101.75 / 261.00. The year-to-date return was negative at (50.39) with an earnings per share of 0.26. The market capitalisation was worth £14.7 billion.

Finally, the Government is ramping up its bond issuance to pay for its rising loans and battle the coronavirus pandemic. However, with complex and dynamic market forces in place, only time will tell by when this pressure on government borrowing starts to reduce and the UK economy is able to get out of the recessionary times.