Based in Western Australia (WA), Classic Minerals Limited (ASX: CLZ) is a gold exploration and development company. The CLZ prospects encompass together 178 km2 areas across Eastern Goldfields, Murchison and Fraser Range Provinces of WA. The tenements include three projects, namely Forrestania Gold Project, Fraser Range Project and Kat Gap Project, together identified with high-grade nickel, copper, cobalt, manganese, gold, and base metal targets.

The Kat Gap Project: The project is tactically located ~70km south-southeast of the Company's Forrestania Gold project comprising the Lady Magdalene and Lady Ada gold resources. The project poses significant gold mineralisation zones across granite-greenstone contact, and it is down-dip as well as possibly down-plunge at depth besides along strike on the southern side of the Proterozoic dyke.

Drilling Update

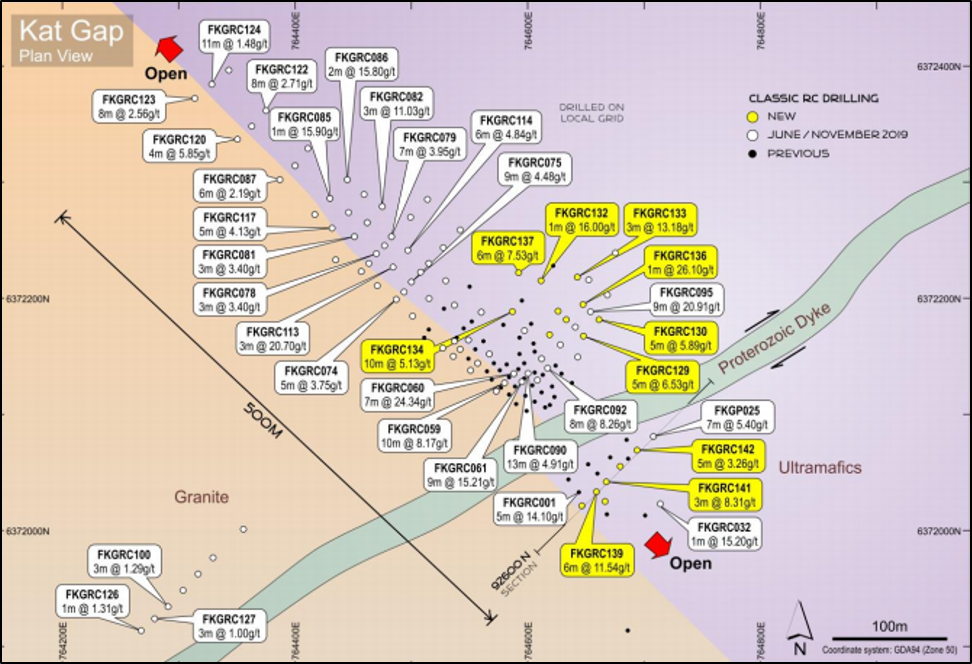

A total of 16 RC holes for 1,653m at the project has been drilled by Classic Minerals, and attractively most of the holes delivered gold mineralisation striking in a northwest-southeast direction. The result remains the same when extended the drilling down dip on the south side of the Proterozoic dyke and presents open mineralisation in all directions.

CLZ aptly uses strategy to drill RC holes relatively close together, covering around 80m of strike instead of drilling expensive diamond holes to reap a better understanding of the plunge direction to the high-grade mineralisation. Where the findings revealed a possible flat shallow dipping shoot structure managed by the roll or flattening of the granite-greenstone contact.

The 12 RC holes i.e. FKGRC128 – FKGRC137 for an overall 1,333m have demonstrated improved results as depicted below: -

- 7m @ 3.37g/t Au from 104m in FKGRC128.

- 5m @ 6.53g/t Au from 108m including 1m @ 11.60g/t Au from 112m in FKGRC129.

- 5m @ 5.89g/t Au from 125m including 1m @ 15.60g/t Au from 127m in FKGRC130.

- 1m @ 16.00g/t Au from 93m in FKGRC132.

- 3m @ 13.18g/t Au from 143m including 1m @ 27.80g/t Au from 144m in FKGRC133.

- 10m @ 5.13g/t Au from 87m including 1m @ 20.50g/t Au from 87m in FKGRC134.

- 1m @ 26.10g/t Au from 127m in FKGRC136

- 6m @ 7.53g/t Au from 100m including 1m @ 32.90g/t Au from 104m in FKGRC137

Interesting Read: Equity Charmer, Gold's 2020 Outlook

Granite-greenstone contact lode on the south side of the cross-cutting Proterozoic dyke:

In the early stage of exploration, the Company has made shallow RC holes over the area which has demonstrated the better result at the north side, resulting in the decision to concentrate the drilling activity there. After several cycles of drilling and improved assay result of high-grade gold mineralisation on the north side, consequently, a decision was made to assess the south side of the dyke.

For the same, 6 RC holes for a total of 320m were drilled and has displayed an improved result, also discovered slight off-set in the granite-greenstone zone contact by around 20- 25m to the west.

- 6m @ 11.54g/t Au from 20m including 2m @ 25.95g/t Au from 22m in FKGRC139

- 3m @ 8.31g/t Au from 26m including 1m @ 13.90g/t Au from 26m in FKGRC141

- 5m @ 3.26g/t Au from 68m including 1m @ 11.10g/t Au from 68m in FKGRC142

Is the drilling result being better than the previous drilling?

The majority of the previous drilling was relatively shallow, i.e. ~ 60m vertical depth below the surface with a strike length of the granite-greenstone contact of approximately 400m. The critical zone of drilling has been focused mostly nearby to both cross-cutting Proterozoic dyke and granite-greenstone contact. In line with the same, a total of 127 holes for 9,391m was completed during May 2018 and November 2019, returning significant enriched high-grade gold intercepts.

Latest and prior Classic RC drilling combined with substantial gold intersections plan view.

Source: ASX Announcement dated 28 January 2020

Nearby Positive Scoping Study of Forrestania Gold Lays Positive Scenario for Kat Gap Project

The Kat Gap nearby deposit, i.e. Lady Magdalene and Lady Ada gold resources are part of Forrestania Gold project. The Forrestania Gold has exhibited both the technical and economic viability of the project with a recent scoping study. The mineral resources are evaluated from these two deposits in accordance to 2012 JORC Code is 7.27 Mt at 1.33 g/t for 311,050 ounces of gold.

Future Kat Gap Drilling Plan

- To continue drilling and testing the northerly and southerly extensions for another 100-200m along strike to assess the primary granite-greenstone contact. The drilling also scheduled to expand deeper to gauge a better knowledge of the plunge component to the high-grade ore.

- Aircore and RC drilling programs are also intended to test the previous 5 km long geochemical anomaly discovered in auger soil sampling in the granite. The program will begin holding its emphasis on assayed high auger values at cross-cutting Proterozoic dyke with a dilational position observed in the north-easternmost area of the geochemical anomaly.

Also, it is worth mentioning that previous drilling at a distance of ~ 100m – 200m line spacings pose the strong potential for additional mineralisation identified near existing historical RC drill coverage.

Further, follow up on RC holes with the drilling plan, is expected to schedule on early February by Classic Minerals.

Stock Price Information – The share price of CLZ increases by 50% post the announcement from the previous close day to $0.003 on 28 January 2020. The next day price corrected to $0.002 on 29th January 2020 with a market cap of $21.05 million.