What are Dividend ETFs?

Exchange-Traded Funds are commonly traded financial instruments that are identical to mutual funds due to their functional nature and are traded throughout the day, like stocks. Dividend ETFs facilitate the investment of the investorâs money into the dividend-paying stocks. The fact that the returns provided by the ETFs are largely governed by the diverse assets held by it, makes it similar in terms of characteristic with mutual funds.

Over time, ETFs have become very popular as an investment instrument for investors as they are a low-cost investment vehicle in the managed fund group.

Advantages of ETFs

Following are the advantages of investing in ETFs:

Low-Cost Investment

ETFs have a low operating cost as compared to mutual fund investments, due to which, an investor can buy a larger number of ETFs in a limited budget for investment. Various costs like the management fee, shareholder accounting expenses and services fees like marketing, sales and distribution fees are not incurred in the ETF investment, making it a cheaper source of investment.

Risk Mitigation

The prices for the ETFs fluctuate throughout the day and can be traded like equity thereby inheriting risks of losing money. In addition to this, an investor can face the risk of taxes and other restrictions in a certain sector of investment. The investor can make an investment in a different sector ETF to mitigate the risk involved with the existing portfolio.

Multiple Trades in a day

Unlike mutual funds, ETFs can be traded multiple times throughout the day as per the suitability of the investor. The prices for the ETFs are updated throughout the day; therefore, the investor can make changes in the investment portfolio at any point of time throughout the market hours. The ability to make intraday trading of the ETFs makes them like other stocks in the market.

Tax efficiency

Another benefit of investing in an ETF is that it is tax efficient. The capital gains tax on ETFs is relatively low as it is charged only on the sale of the ETF by the investor. However, the tax situation in case of dividends for the investor depends upon the income taxes incurred on the dividends. The taxes on the dividend can also be advantageous for the investor. Although the operational structure of the ETFs is like the mutual funds, yet, ETFs incur fewer capital gains taxes as compared to mutual funds.

Letâs look at a few ETFs listed on the Australian Securities Exchange:

UBS IQ Morningstar Australia Dividend Yield ETF (ASX: DIV)

The UBS IQ Morningstar Australia Dividend Yield ETF closely tracks the performance of the Morningstar® Australia Dividend Yield Focus IndexTM before fees and expenses. The fund gives investors an advantage to gain access to a diversified portfolio of listed Australian securities in a single transaction. These Australian securities are estimated to offer sustainable income through the distribution of dividends and franking credits.

The company on 2 October 2019 announced the final distribution amount for the quarter distribution (ending 30 September 2019) for UBS IQ Morningstar Australia Dividend Yield ETF. The final cash distribution amount for the fund was 27.2691 cents per unit.

With each unit receiving 10.0847 cents worth of franking credits, the franking level for the 30 September 2019 distribution is 86.29%. In addition to this, the company also announced the issue price of 22.6597 cents per unit as the Dividend Reinvestment Plan (DRP) issue price for the fund.

Post the trading hours on 08 October 2019, DIV quoted $22.12, close to the 52 weeks high price of $22.950 with a daily volume of 24 shares and an average volume of ~2,625 shares. In the last six months, the stock has generated 7.95% as return (as on 4 October 2019).

iShares S&P 500 ETF (ASX: IVV)

Owned and managed by BlackRock, Investment Management iShares S&P 500 ETF is an index ETF that monitors the results from the investment of an index comprising of the large-capitalization U.S. equities. The fund has exposure to large and established U.S. companies for investment.

The fund is tax-efficient and operates at a low cost with access to 500 of the largest capitalized U.S. stocks. Moreover, the management fee of 0.04% (as of current prospectus) is charged by the funds.

In a recent announcement, the company defined the confirmed distribution for each of its Fund. The cash distribution for the iShares S&P 500 ETF (IVV) is 181.668685 cents per unit.

Post the trading hours on 08 October 2019, IVV quoted $438.33, up by 0.3%, close to the 52 weeks high price of $449.450. The stock has a 52 weeks low price of $343.910 with a daily volume of ~ 7,696 and an average volume of ~13,048. In the last six months, the stock has delivered a return of 6.43 % (as on 4 October 2019).

BetaShares Australia 200 ETF (ASX: A200)

A200 by BetaShares aims to provide intelligent investment solutions to help Australian investors meet their financial objectives. A200 provides the facility of instant diversification to the investors by giving them access to the largest 200 companies in one trade.

In addition to this, A200 is the lowest cost Australian shares ETF available on the ASX with the management fees of only 0.07% p.a. (or $7 for every $10,000 invested).

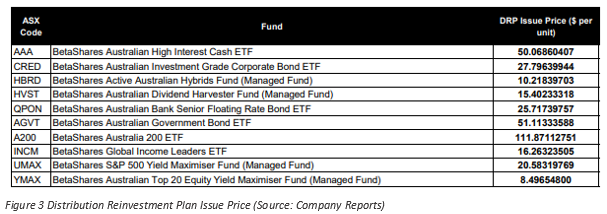

Recently, the company announced the Distribution Reinvestment Plan issue price applicable to the reinvestment distributions for various categories of ETFs. The company announced a price of $111.87 Distribution Reinvestment Plan for BetaShares A200 ETFs.

Post the trading hours on 08 October 2019, A200 quoted $110.23, up by 0.39%, close to the 52 weeks high price of $114.870. The stock has a 52 weeks low price of $90.600 with a daily volume of ~36,572 and an average volume of ~ 59,769. In the last six months, the stock delivered returns of 5.54 % (as on 4 October 2019)

VanEck Vectors Australian Equal Weight ETF (ASX: MVW)

VanEck Vectors Australian Equal Weight ETF facilitates the investors to invest through intelligently designed investment strategies in a diversified portfolio of ASX-listed securities by tracking the MVIS Australia Equal Weight Index. With an objective to provide investment returns before fees and other costs which track the performance of the Index, VanEck is one of the largest ETF traders in the world.

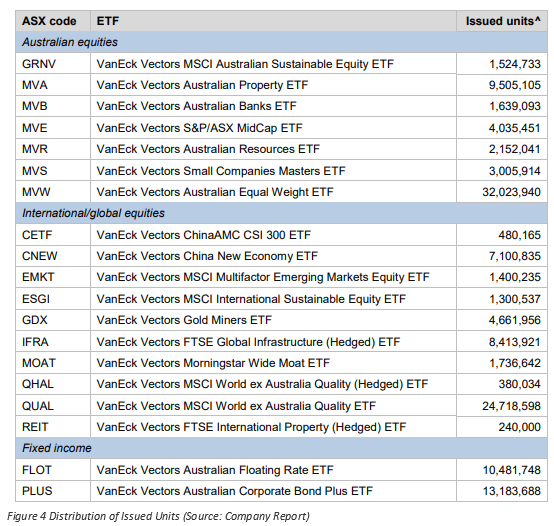

The company recently announced the number of units issued as at 30 September 2019 for each of the VanEck ETFs. The company issued 32,023,940 units of MVW ETFs.

Post the trading hours on 08 October 2019, MVW quoted $30.670, up 0.36%, close to the 52 weeks high price of $31.580. The fund has a 52-week low price of $25.300 with a daily volume of ~32,073 and an average volume of ~57,840. In the last six months, the stock has generated returns of 5.42% (as on 7 October 2019)

Conclusion

As can be seen from the discussion above, all ETFs show a growing trend, close to their 52-weeks high. Investment in the ETFs can be considered as a good option for the investors looking for regular income with low-cost investment, adequate liquidity and minimum risk. Moreover, the investors have the option of investing in multiple sectors through ETFs and trade them like equities in the market.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.