Software refers to a set of programs or data or instructions that are used to operate computers. Companies engaged in the development of software are called as software companies.

Two Types:

- System Software (SS): System software, which is designed to run the hardware and application programs, acts as an interface between the user applications and the hardware. OS or operating system is a type of SS.

- Application Software (AS): It refers to a set of programs that is used by the user to complete a task. An example of application software (AS) is spreadsheets.

Like other countries around the world, Australia is also making huge investments in the technology sector to take advantage of the economic and social opportunities that a digital economy can bring.

As per analyst firm Gartner, the expenditure on IT products and services is expected to reach $98 billion in 2020 in Australia. In the descending order, a significant portion of this amount would be used in IT services, then in communication services, software, devices and lastly in data centre systems.

In this article, we would cover three software companies in Australia and look at their recent announcement/s.

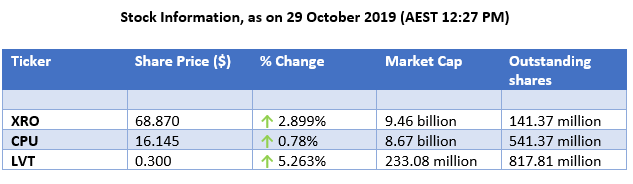

Xero Limited (ASX: XRO)

During the last few days, Xero Limited (ASX:XRO) was under discussion due to the below-mentioned media releases. Letâs look at them.

RSM chose Xero and GreatSoft as Preferred Software Solution

On 17 October 2019, XRO announced its agreement with RSM Australia (RSM) related to the transition of national accounting firmâs tax and compliance work onto Xero. RSM is a leading professional services firm in Australia and its customer base (middle-market) is one of the largest in the country. XROâs agreement with RSM includes the latterâs 30 offices across Australia, and XROâs cloud-based accounting solution would be made available to RSMâs client.

The agreement between XRO and RSM follows the formerâs Australian integration with cloud practice-management solution GreatSoft. The integration would provide mid-tier and large firms with tools to support them in managing their practice while offering advisers and their clients the benefits of Xeroâs platform.

âPayphoriaâ Research Maps out Australian Payday Behaviours

Xero, in partnership with Dynata, conducted a survey during August 2019 with 1,000 Australian workers (geographically nationally representative) to understand how Aussies relate to payday.

The Payphoria Study was performed to coincide with the introduction of Single Touch Payroll for all small business employers, as of 1 October 2019.

Study findings:

- 1 in 3 workers have below $100 in their account in the lead-up to payday;

- 45% of respondents were curtailing on cherished rituals like coffee and eating outside;

- 34% of respondents delay making payments towards their household bills as they wait for their payday;

The study also found that 63% of respondents were facing financial challenges before payday. They depended on short-term solutions to support them ahead of payday. To overcome these challenges, 1 out of 5 Aussies look towards Afterpay, payday loans, overdrafts or credit cards, while 12% ask their friends and family to support them.

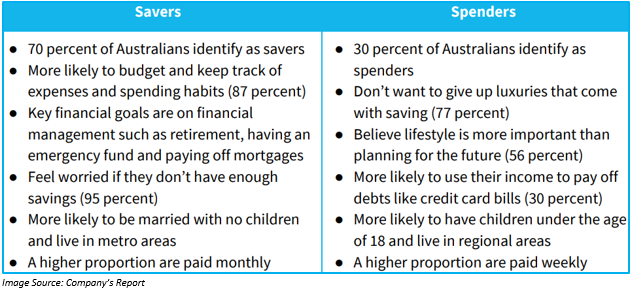

The study was also designed to link the frequency of how often the citizens are paid to their ability to save. Based on the result, it was found that most of the workers who were paid monthly were more likely to save. On the other hand, those workers who were paid every week were more prone to spending. The study also confirmed that people living in the city save more than those living in the rural region.

The study on the payday patterns of Aussies unveiled that they have a huge emotional as well as psychological response to their income.

Xero to Provide Mental Wellbeing Support to 850,000+ Kiwis

As per a media release on 22 October 2019, Xero Limited will provide more than 850,000 Kiwis with free and confidential wellbeing support, in response to the results of the 2019 Small Business Wellbeing Report that was commissioned by Xero in association with the Mental Health Foundation of New Zealand.

Xero expands partnership with GoCardless to North America

On 22 October 2019, Xero announced the expansion of its partnership with UK-based GoCardless to help small businesses in the US and Canada to stay on top of their cash flow.

With the integration of GoCardless and Xero, small businesses would be able to say goodbye to late payments, by using automated clearing house (ACH) debit in the United States and pre-authorised debit (PAD) in Canada to automate payment collection and reconciliation.

With the new âGoCardless for Xeroâ payment solution, which automates the payment process, the admin time will reduce, and online payments would streamline.

Computershare Limited (ASX: CPU)

Buy-Back of Shares:

In the FY2019 result market update, Computershare Limited (ASX:CPU) announced a market buy-back of shares worth $200 million which started on 03 September 2019 and will continue till 02 September 2020 or earlier if the buyback completes before that date. The company holds the rights to vary, suspend or cancel the buy?back at any time.

The company is progressing well with its share buy-back plan.

LiveTiles Limited (ASX: LVT)

LiveTiles Limited (ASX: LVT) is scheduled to hold its annual general meeting on 26 November 2019. The company recently made following key announcements.

LVT Raises $5 Million through SPP

On 16 October 2019, LiveTiles Limited announced to have raised $5 million under the share purchase plan with eligible shareholders. This plan was announced on 19 September 2019, when LVT unveiled to have raised $50 million through a share placement at a price of $0.35 per share.

The funds raised through the placement and the SPP will be used to drive strong customer as well as revenue growth.

Q1 FY2020 Results (ended 30 September 2019)

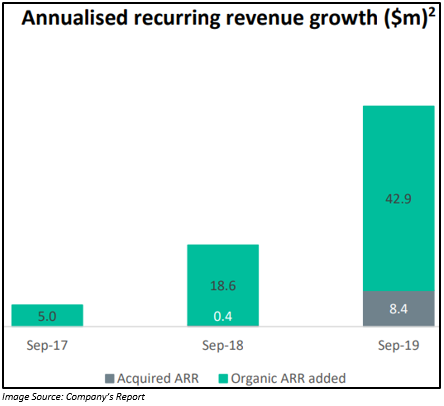

- Annualised recurring revenue reached $42.9 million in Q1 FY2020 compared with $40.1 million in Q4 FY2019.

- Customer cash receipts up 252% year-on-year to $8.5 million.

- The APAC region during the period delivered a strong performance offset by seasonal buying patterns in the United States and European regions.

LVT is pleased with the sales and marketing activity early in Q2 FY2020, backed by a strengthening pipeline along with a more engaged and larger partner channel.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.