Amidst the continuity of the risks due to coronavirus, the S&P/ASX 200 endured through the day’s trade gaining 25.4 points on 04 February 2020 and closed at 6,948.7.

Recent market developments have been quite uncertain and unpredictable, pertaining to the unprecedented risks in the market. Moreover, many companies have been compelled to revise their earnings guidance, and they now forecast lower profits and revenues.

However, recent updates from various companies reflect robust performance. Here we shall discuss two stocks who’s recently reported numbers are making news for the investors

ANO Reports NPAT of $3.366 million

Formed in 1997, Advance NanoTek Limited (ASX:ANO) has grown from its original research-based foundations to the development of a wider array of advanced material opportunities and its core skills now include the development, manufacturing and marketing of innovative products.

Advance NanoTek Limited is predominantly engaged in the manufacturing of the following for the Personal Care Sector:

- Aluminium oxide powder (Alusion);

- Zinc oxide dispersions;

- Zinc oxide powder (collectively ZinClear);

Recently, the Company reported the following figures for the half-year ended 31 December 2019:

- Net profit after tax of $3.366 million;

- Profit before tax of $4.818 million which is 2.77 times greater than the corresponding half-year ended 31 December 2018;

- Sales revenue of $11.307 million compared to $4.743 million for six months to December 2018;

The Company’s ZinClear XP powder sales increased by 4.6 times compared to 6 months ended December 2018, and the Company has received TGA approval on the Brisbane manufacturing facility during the past six months.

The Company reported that the tax expense of $1.452 million for the half-year ended 31 December 2019 shall not be payable in cash due to the utilisation of tax losses in the previous year.

Currently, ANO is in the early stages of a feasibility study to leverage the capture of its CO2 emissions from its zinc oxide production equipment and convert the CO2 into oxygen through the growth in hydroponics, on-site at Shettleston Street Rocklea.

The Company is currently experiencing a decline in its energy consumption with the installation of solar panels that was completed in December 2019 and looks forward to utilising this solar energy and battery storage as part of its hydroponics feasibility study.

Let us take a look at how the financial position of the Company has changed during the period of last six months:

- Net assets of the Group increased by $3,361,168 from 30 June 2019 to $21,689,857 at 31 December 2019;

- The Company’s had obtained a loan from entities connected with Mr Lev Mizikovsky amounting to $1.1 million;

The Company has obtained the loan with a view to aid the Group with working capital requirements and has been repaid in full subsequent to 31 December 2019.

Latest Progress

The Company’s progressed at various ends post the above reporting date for the financial half-year. Let us look at the latest developments for the Advance NanoTek Limited that significantly affected or may significantly affect the operations of the Group.

- The loan owing to entities associated with Mr Lev Mizikovsky totalling $1.1 million was repaid subsequent to 31 December 2019;

- ANO has completed a capital raising on 17 January 2020 where the Company raised $3.945 million and issued 682,444 shares on 24 January 2020;

- On 2 January 2020, the company completed a share buy-back of 6,678 shares for $37,797.48 from employees no longer entitled to these shares in accordance with the terms of the company’s employee share scheme;

With a view to grow sales, improve margin and deliver profitability, including planned capacity increases to bring production to in excess of 3,000 T per annum, the Company has established a solid platform.

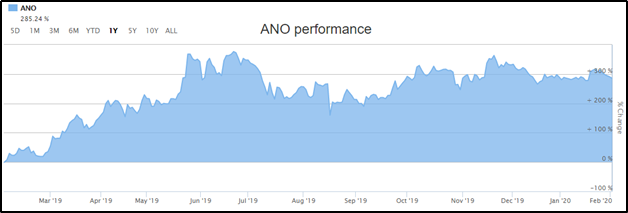

On 05 February 2020, the ANO stock closed the day’s trade at a price of $5.830, up by 0.172% with a market capitalisation of $346.89 million.

Source: ASX

During the last one year, the ANO stock has delivered 288.58% returns as at 05 February 2020.

Let us now look at another stock with 37% growth in 1H FY2020.

BUB Gross Revenue Growth by 37%

Australian Consumer Staples player, Bubs Australia Limited (ASX:BUB) offers Australian made formula, purees, cereals and rusks for consumers from all age groups.

Bubs Building Blocks (Source: Company's Report)

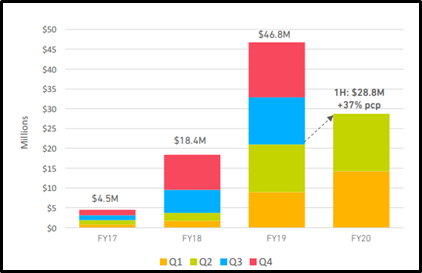

The Company has released its Investor Presentation where it reported an increase in gross revenue by more than 37% during 1H FY2020 ended 31 December 2019 primarily driven by the Bubs® Goat Infant Formula which led to more than double sales for quarter-on-quarter; +118% pcp.

Quarterly Gross Sales Revenue (Source: Company's Report)

Other key drivers for the Company’s portfolio product mix include:

- Increased focus on investing in the growth of high margin products, primarily infant formula;

- Bubs® products accounted for 53% of total revenue in 1H FY20 (66% in Q2 FY20);

- Deliberate reduction in fresh dairy product lines due to poor profitability;

The Company has been experiencing consistent quarterly growth since listing in 2017. Moreover, Goat Milk Powder delivered healthy revenue growth of 30% during 1H FY20 on pcp. However, the complete profile of Adult Dairy portfolio growth was hampered by the removal of loss-making yoghurt products and removal of brand assets of Coach House Dairy®.

Driven by strong penetration in Coles and Woolworths, and launch into Chemist Warehouse, the Domestic sales in 1H FY20 increased +30% pcp.

The Company noted continuous growth month-on-month in its Corporate Daigou Channel with 1H FY20 sales up +52% pcp.

New partnerships established with Alibaba Tmall and Beingmate and deployment of increased marketing resources, there has been strong traction with Chinese consumers. This is reflected by the +19% increase on pcp in the direct sales to China in 1H FY20 with Infant Formula almost doubling in sales revenue up +99% pcp.

In an attempt to meet forecasted demand for refreshed CapriLac® products and fulfil opening orders for Deloraine® product extensions, Adult Goat Milk Powder inventory position increased $5.6 million from July to December 2019.

During the 1H FY20, the Company has been emphasising on the development to continue to drive growth support into the Second Half. The key growth engines of the company include sustainable leadership in vertical supply chain value creation, deepening consumer brand connection to drive scale and improved margin and expansion into new noninfant growth segments and new geographical markets.

1H FY20 has remained focused on development to continue to drive growth support into the Second Half. The Company’s expectations for the 2H FY20 include the following:

- Stronger forecasted demand for infant formula is anticipated in 2HFY2020 across all distribution channels;

- New markets & new product launches scheduled to build on current foundations to drive incremental revenue streams;

- The Company believes that fresh distribution partnerships for Bubs® products in Vietnam and Hong Kong shall provide further growth from Southeast Asian markets in 2H FY20;

- Market investments for the 2H FY20 shall focus on the new domestic multi-media brand campaign launch, new product launches and brand extensions that are anticipated to convert to revenue realisation in Second Half;

At the market close on 05 January 2020, the BUB stock closed the day’s trade at a price of $0.745, with a market capitalisation of $417.42 million. The BUB stock has increased by 44.66% during the last one year as at 05 February 2020.