The US stocks on Thursday, 30 April 2020 declined after the Washington Post released a post that US officials are crafting retaliation actions against China as Trump administration criticizes China for its COVID-19 management. S&P index which closed at 2939.51 points on 29 April 2020 dropped and reached 2912.43 points, representing a drop of ~ 0.93%. Dow Jones Industrial Average fell by 1.17% and ended the day’s session on Thursday 30 April 2020 at 24345.72 points.

Interesting Read:

- S&P 500 and Dow Jones Poised for More Losses? Gauging Future Movement Via Technical Tools

- Dow Jones, Nasdaq, and FTSE 100- What Are the Chartists Looking At?

US President’s Dissatisfaction on Situation Created By COVID-19:

US President, Donald Trump has every now and then stated that it is not satisfied with how China has handled the coronavirus situation that the entire world is struggling with. The infectious disease has a put millions of lives at stake and shaken the global economy. The US fears that China has not shared the complete information surrounding the origin of the virus. On that front, the senior Trump administration officials have asked American spy agencies to look for evidence that the virus originated from the government laboratories in Wuhan.

The President continues to target China and said that it should have stopped the virus spread quickly so that it would not have impacted the entire world.

Current US COVID-19 Stats by John Hopkins University:

As per the data provided by John Hopkins University, as on 1 May 2020, a total of 1,070,032 COVID-19 cases have been reported in the US. 63,019 people have died and 153,947 have recovered from the infectious disease.

Job Losses in the US due to COVID-19:

Due to the impact of COVID-19, there has been a significant increase in the number of US citizens seeking jobless benefits. As per the statistics report published by the Bureau of Labor Statistics, United States Department of Labor released on Thursday 30 April 2020, the US registered around 3.8 million unemployment claims last week.

During March 2020, the unemployment rate was higher as compared to the previous year. There were total 45 such areas where the jobless rate was less than 3% while there were 11 such regions with a jobless rate of at least 10%.

Nonfarm payroll employment grew over the year in 21 metropolitan regions. It dropped in 1 region while remaining unaffected in the other 367 regions.

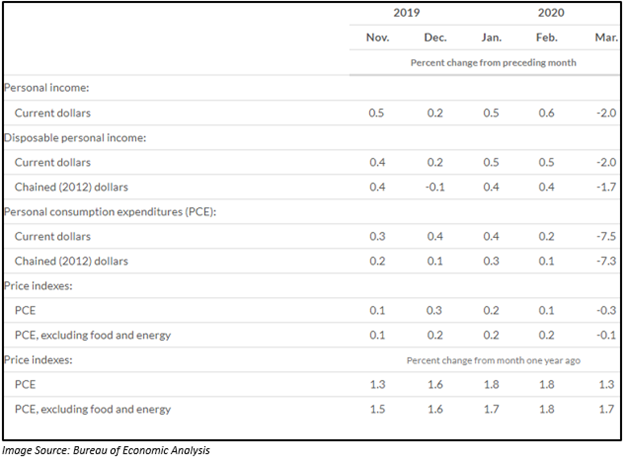

As per the report released by the Bureau of Economic Analysis on 30 April 2020, the personal income had gone down by 2% in March 2020, disposable personal income by 2% and personal consumption expenditures by 7.5%.

The decrease in personal income was due to a reduction in compensation. The drop in the real personal consumption expenditures in March 2020 was because of the decline of US$829.9 billion in paying for services and US$104.9 billion in expenses for goods.

Let us now look at some of the big players in the US market and see the impact of the coronavirus outbreak on their business:

Apple (NASDAQ:AAPL) Reports 1% growth in Revenue:

Apple has posted its Q2 FY2020 financial results for the period ended 28 March 2020 on 30 April 2020. The Company highlighted that its quarterly revenue had gone up by 1% to US$58.3 billion as compared to the previous corresponding period.

Despite the COVID-19 impact, Apple was able to grow during the Q12020 because of an all-time high in Services and quarterly record for wearables.

Apple’s Financial Highlights:

- Generated operating cash flow of US$13.3 billion.

- The net income during the period was US$11,249 million. The number had gone down during the March 2020 quarter. In March quarter 2019, the net income reported by the Company was US$11,561 million.

- Operating income declined from US$13,415 million in March 2019 quarter to US$12,853 million in March 2020 quarter.

- The Board announced a cash dividend of $0.82 per share which would be paid on 14 May 2020.

On 30 April 2020, AAPL shares closed at US$293.80, up 2.11% from the previous close.

Amazon (NASDAQ:AMZN) Reports 26% Increase in its Net Sales

The shares of Amazon on 30 April 2020 closed at US$2,474 on 30 April 2020, up 4.27% as compared to the previous close.

On 30 April 2020, Amazon posted its Q1 2020 Financial Results where it highlighted an increase in the free cash flow of 6% YoY. The free cash flow in the March quarter was US$24,337 million. The net sales during the period increased by 26% to US$75,452 million on pcp.

There was a drop in the operating income by 10% to US$3,989 million on pcp. Net Income slipped by 29% to $2.535 million.

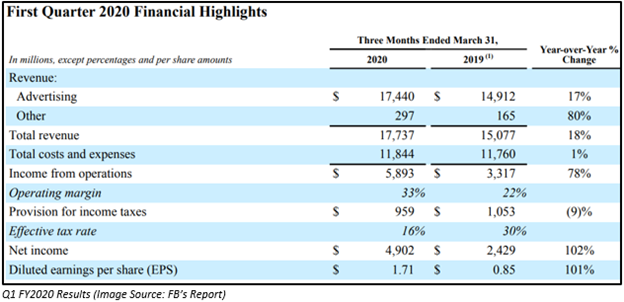

Facebook (NASDAQ:FB), delivers 18% growth in Total Revenue

On 29 February 2020, announced its financial results for the quarter ended 31 March 2020.

Q1 2020 Operational and Financial Highlights:

- Daily active users of FB increased by 11% YoY to 1.73 billion.

- Facebook monthly active users as on 31 March 2020 soared by 10% YoY to 2.60 billion.

- Family daily active people was 2.99 billion as of 31 March 2020. The number represents a rise of 11% YoY.

- Capital expenses, which includes the principal fees on finance leases, was $3.66 billion.

- Cash & cash equivalent plus the marketable securities by quarter ended 31 March 2020 was US$60.29 billion.

- Facebook updated that post the completion of the March 2020 quarter the Company entered into an agreement to invest ~US$5.7 billion in Jio Platforms Limited. FB has paid the settlement amount of US$5 billion due under FB’s modified consent order with the U.S. Federal Trade Commission (FTC).

COVID-19 Impact on Outlook:

The Company expects that business performance would be impacted in the present situation which comprises of tenure and effectiveness of shelter-in-place orders, the efficacy of economic stimuli globally followed by the rise and fall of currencies relative to the U.S. dollar.

On 30 April 2020, FB shares closed at US$204.71, up 5.42% above the previous close.