Uranium Application: Uranium has good use as fuel in nuclear reactors to generate power (electricity). It contributes around 14% of the worldâs electricity. Through the production of radio-isotopes Uranium has found its usage in Medicine (diagnosis & research), Food processing industry (sterilize fresh products), Industrial sector (industrial X-ray requirements), Space industry, and History & culture (carbon-14 technique). It is a good alternative to the traditional source of energy such as coal, where 1 kilogram (kg) of natural uranium can produce heat as equivalent to 20 tonnes of coal.

Resources Availability: Uranium is present in around 200 different minerals, mostly prevalent in granite and sedimentary rocks. The element is also found in the seawater, wherein, the current data for seawater is estimated to contain an average of 0.003 parts per million (ppm). The Earthâs crust is also estimated to contain the element in the range of 1-4 ppm.

Uranium Outlook: Demand for the uranium is expected to increase due to a decrease in dependence on traditional sources, and less than expected power harness from the renewable sources. Till now, the USA, Russia, Japan, China, and France have been the major consumers of the uranium. The global demand for uranium witnessed a heavy-foothold by the year 2007, and since the Fukushima accident in 2011, the need for nuclear-based power solutions slumped drastically taking the Uranium price to its lifetime low.

In view of weak demand, major uranium producing country such as Kazakhstan reduced the production. At present, the Uranium is again gaining its ground with rising demand for Nuclear reactors in countries such as India, France, China, etc. The global uranium stockpiles are expected to deplete soon, therefore in order to meet the growing uranium demand, various companies around the globe are tightening their belt. With this scenario, the global uranium prices can be expected to bottom out, and a new fresh upside rally may be seen in the coming years.

Three important companies with decent market capitalization and specialization in Uranium exploration, production and development are Paladin Energy Ltd (ASX:PDN), Energy Resources of Australia Limited (ASX: ERA), and Berkeley Energia Limited (ASX:BKY).

Letâs see how the stocks of these companies have been performing based on their recent updates.

Paladin Energy Ltd (ASX:PDN)

Uranium producer, Paladin Energy Ltd (ASX:PDN) recently announced the appointment of Ms Anna Sudlow as a new CEO, effective July 1, 2019. Ms Sudlow will replace Mr Craig Barnes, who will be with the company till September 30, 2019, and help in the successful transitioning process.

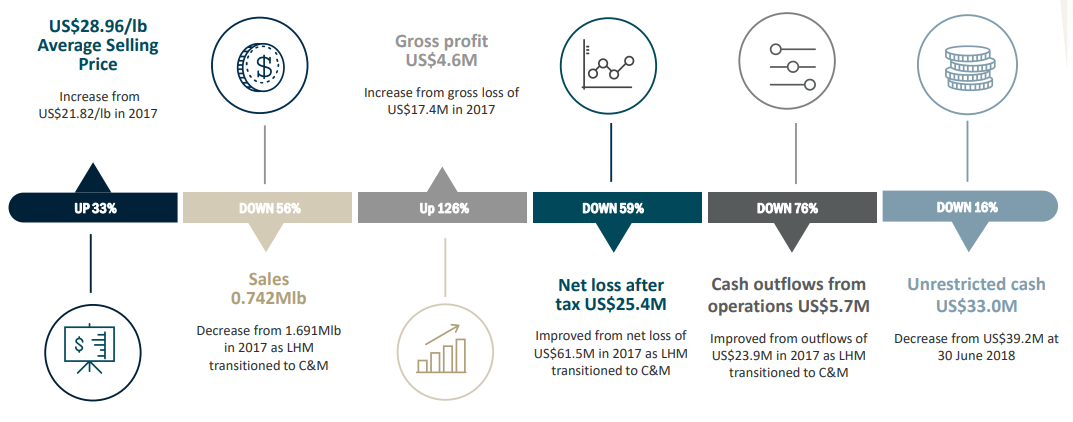

H1FY19 Key Highlights: During the H1FY19 period, the companyâs sales decreased from 1.691Mlb in H1FY18 to 0.742Mlb in H1FY19. PDN reported a gross profit of US$4.6 Mn, as compared to a gross loss of US$17.4 Mn in H1FY18. It was majorly due to the increase in average selling price by 33% to US$28.96/lb as compared to the previous corresponding period.

H1FY19 Key Metrics (Source: Companyâs Report)

On April 23, 2019, PDN notified the market that it was ending market speculation over capital raising.

Stock Information:

On June 14, 2019, the stock of Paladin Energy closed flat at A$0.130, with the market capitalisation of ~$227.77 Mn. Its current PE multiple is at 0.410x, and its last EPS was noted at 0.314 AUD. Today (on 14 June 2019), it made dayâs high at A$0.130 and dayâs low at A$0.130 with a daily volume of 884,299. Its 52 weeks high was at A$0.220 and 52 weeks low at A$0.110, with an average volume of 6,711,013 (yearly). Its absolute return for the last 1 year, 6 months, and 3 months are -28.57%, -30.56%, and -24.24% respectively.

Energy Resources of Australia Limited (ASX:ERA)

Producer of Uranium oxide, Energy Resources of Australia Limited (ASX: ERA) recently provided additional information in relation to the tailings (construction, management and monitoring) facilities at its Ranger mine.

The information will be subject to three levels of governance, where ERA will provide the first level of assurance, with the important points being effective facility design, regular reviews, and comprehensive operational controls. Rio Tinto Limited (ASX:RIO) through its periodic business technical reviews and conformance audits would be providing the second level of assurance. The third party would provide a third level of assurance.

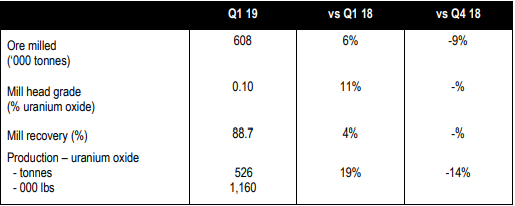

Q1FY19 Key Highlights: ERA produced 526 tonnes of uranium oxide (oxidised-U3O8), in the March'19 quarter compared to 613 tonnes in the December'18 quarter, majorly due to the lower ore milled because of wet season conditions and additional maintenance activities, during the period. Production guidance for 2019 of between 1.4 K to 1.8 K tonnes of uranium oxide remains unchanged.

Marchâ19 Quarter Operation Data (Source: Companyâs Report)

Stock Information

On June 14, 2019, the stock of Energy Resources traded last at A$0.205 unchanged, with the market capitalisation of ~$106.13 Mn. Today, it made dayâs high at A$0.210 and dayâs low at A$0.210 with the daily volume of 145,135. Its 52 weeks high was at $0.495 and 52 weeks low at $0.195, with an average volume of 230,065 (yearly). Its absolute return for the last 1 year, 6 months, and 3 months are -55.43%, -22.64%, and -32.79% respectively.

Berkeley Energia Limited (ASX:BKY)

The clean energy company, Berkeley Energia Limited (ASX:BKY) recently announced the issuance of new 60,000 ordinary fully paid shares, effective June 14, 2019.

In another update, BKY had announced exploration licences granted to it, which will be crucial for the companyâs prospective for battery and EV metals. In the municipal election in Retortillo, the village close to the Salamanca project, Four out of five council seats were won by candidates who were supportive of the Companyâs project.

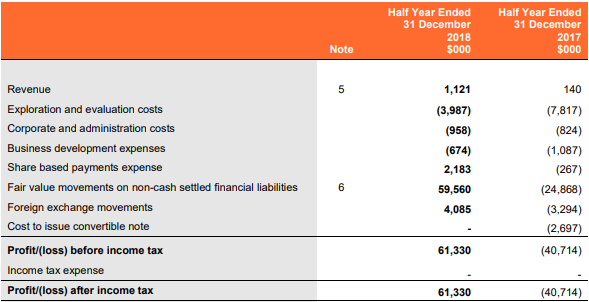

H1FY19 Financial Performance: During H1FY19 period, the companyâs revenue increased from $0.14 Mn in H1FY18 to $1.12 Mn in H1FY19. It reported a profit after tax at $61.33 Mn in the period as compared to a loss after tax at $40.71 Mn in H1FY18.

H1FY19 P&L Statement (Source: Companyâs Report)

On January 23, 2019, the company notified that it had received favourable assessments.

Stock Information

On June 14, 2019, the stock of Berkeley Energia last traded at $0.385 up 4.054% with the market capitalisation of ~$95.61 Mn. Its current PE multiple is at 0.98x, and its last EPS was noted at 0.379 AUD. Today, it made dayâs high at $0.400 and dayâs low at $0.380 with a daily volume of 177,478. Its 52 weeks high was at $0.875 and 52 weeks low at $0.135, with an average volume of 84,631 (yearly). Its absolute return for the last 1 year, 6 months, and 3 months are -54.04%, 117.65%, and -16.85% respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.