The materials sector in Australia comprises of the companies who are into the discovery and processing of raw materials which are used in many other industries. This sector comprises of building products, construction and engineering, forest product, construction materials, transportation infrastructure and containers and packaging.

The materials industry in Australia was going through a troubled period in last year due to the slowing down of the residential and civil construction market. It has been observed that this sector is regaining growth which might be due to the new developmental projects.

According to some media reports, the property sector could regain growth momentum from the year 2020 with a range of major infrastructure development projects and programs. In this article, we are highlighting ASX listed materials stocks with their recent activities.

Let us discuss three material stocks- ORI, PGH, FBU

An ASX listed company Orica Ltd (ASX:ORI) is the world’s largest provider of innovative blasting and commercial explosives systems to the mining, oil and gas, quarrying, and construction markets. The company is a leading supplier of sodium cyanide for extraction of gold and offers ground support facilities in mining as well as tunnelling.

Acquisition and capital raising by ORI-

- The company to buy Peru’s, leader in producing and distributing industrial explosives.

- The acquisition of Exsa amounts to USD203 million (on a cash free, debt free basis) and assuming full acquisition, signifies an anticipated acquisition multiple of 7.0x financial year 2019 EBITDA (post-synergies) which are anticipated to be attained by the third complate year of ownership and 13.9x financial year 2019 EBITDA (pre-synergies).

- Both the acquisition and placement are anticipated to be earnings per share neutral in the initial complete year of ownership and earnings per share accretive subsequently.

- After taking acquisition costs into account in the financial year 2020 EBIT impact from Exsa is expected to be neutral.

Outlook-

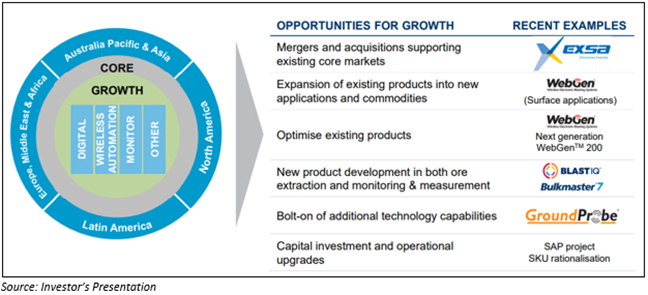

- The company is continuously assessing growth opportunities in its core capital and high growth engines-

- After the recent cyclone in Karratha, Western Australia, the Burrup TAN plant start-up of Orica has been postponed from the beginning to the end of April 2020. Burrup TAN plant would be fully operational in the financial year 2021.

- The company has a strong contract renewal pipeline from the financial year 2022.

- Capital expenditure of the company is anticipated to be approximately $370-$390 million in the fiscal year 2020.

- From Burrup and the SAP project the depreciation and amortisation expense is to be nearly 15 per cent higher as compared to the fiscal year 2019.

Stock Performance-

On 20 February 2020, the ORI stock was trading at $ 21.605, falling down by 3.16 percent (at AEDT 1:42 PM). The market capitalisation of the stock was approximately $8.5 billion, with nearly 380.95 million shares outstanding. The 52 weeks high price of the stock was noted at $24.270. The stock has delivered a positive return of 1.55% on a year to date basis and 5.48% in the last six months.

Pact Group Holdings Ltd (ASX:PGH)

Australia headquartered leading provider of specialty packaging solutions Pact Group Holdings Ltd (ASX:PGH) offers its services in both consumers as well as industrial sectors. The company focuses on the manufacturing and supply of the metal packaging, rigid plastic, co-manufacturing services, materials handling as well as sustainability and recycling services.

Pact Group Holdings updated the market with its half year results for the financial year 2020 (ended 31 December 2019), highlighting the financials and the outlook for FY2020.

- The company’s revenue for the first half of FY20 decreased by 3% to nearly $885 million.

- The statutory net profit after tax of the company was reported to be approximately $35 million.

- EBITDA increased by 2% to nearly $113 million.

- Net profit after tax of the company was about $37 million.

Outlook 2020-

- The company mentioned that the volume challenges would continue in the Group’s Australian packaging and contract manufacturing businesses.

- Due to the disruption related to the coronavirus outbreak and other macro-economic factors, the potential impact on sales and supply chains is uncertain for the time.

- The proposed sale of contract manufacturing services outcome and effects on the earnings of the financial year 2020 not yet known.

Stock Performance-

On 20 February 2020, the PGH stock was trading at $ 2.390 (at AEDT 1:57 PM), slipping by 4.016%. The market capitalisation of the stock was approximately $ 856.54 million, with nearly 343.99 million shares outstanding. The 52 weeks high price and low price of the stock was noted at $3.150 and $2.080. The stock has delivered a positive return of 8.26 in the last six months.

Fletcher Building Limited (ASX:FBU)

Auckland headquartered company Fletcher Building Limited (ASX:FBU) is a significant manufacturer, partner and home builder on construction and infrastructure projects. The company employ more than 16,000 employees in Australia, New Zealand and South Pacific and operates through various divisions- distribution, concrete, building products, construction and residential & development.

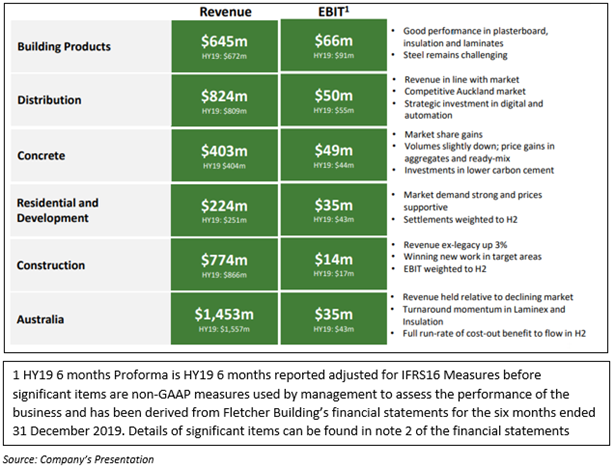

On 19 February 2020, Fletcher Building announced its results for the first half of the financial year 2020 (ended 31 December 2019), the highlights are-

- The company generated revenue of approximately $3,961 million, consistent with market conditions.

- The company has reported EBIT of $219 million before significant items, compared to nearly $248 million in the half year 2019.

- The Net Profit After Tax (NPAT) of the company was recorded at $82 million, compared to $89 million in the prior corresponding period (pcp).

- The balance sheet of the company remains strong, with increased cash flow.

- Fletcher Building has announced an interim dividend of 11 cents/share, which would be paid in April 2020.

- For the financial year 2020 group earnings guidance are approximately $515-$565 million.

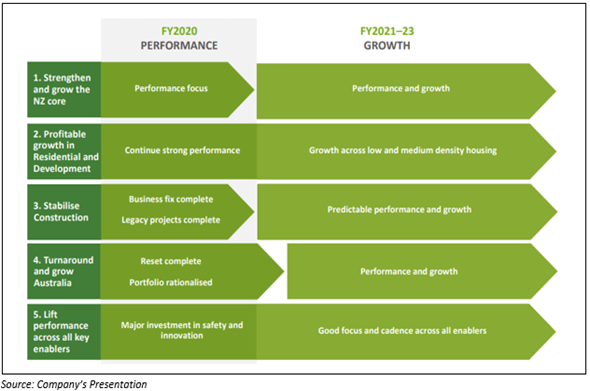

Outlook-

Australia Market Outlook for FY20-

- The Australian residential approvals stabilising and returning to growth in the financial year 2021.

- The non-residential would remain broadly flat for the remaining half of the year.

- The Infrastructure project activity to remain lumpy in the fiscal year 2020.

New Zealand Market Outlook for FY20-

- In New Zealand the residential expected to be like the first half. With continuing trends to smaller and attached dwelling units.

- For the fiscal year 2020, the civil expected to trend slightly lower.

- From the fiscal year 2021 and beyond the infrastructure predicted slightly softer until the renewed infrastructure activity comes onstream.

Stock Performance-

On 20 February 2020, the FBU stock was trading at $5.360 (at AEDT 1:59 PM), up by 2.486%. The market capitalisation of the stock was approximately $4.32 billion, with nearly 825.45 million shares outstanding. The 52 weeks high price and low price of FBU stock were noted at $5.510 and $3.990 respectively. The stock has delivered a positive return of 6.30% on year to date basis and 24.23% in last six months.