Stock exchange provides a platform for businesses to access capital and boost their public image. Thus, the key reason why a company decides to list on a stock exchange is to raise capital to grow the business and gain more recognition. Generally, listed companies are perceived as more esteemed than unlisted ones. Even though, there are considerable controlling as well as financial costs that a company needs to bear when it plans to get listed on a stock exchange, the advantages outweigh the disadvantages.

The benefits, that most companies listed on the stock exchange enjoy, include increased value, higher profile that is they are highly noticeable and identifiable, ability to raise affordable capital faster by offering more shares to stakeholders, higher returns to investors in the long-term, amongst many others.

Nevertheless, most stock exchanges publish data on regular intervals/ daily basis in price quotations form providing valuable information, that the investors may use to analyse the market and make informed decisions. Mostly, market participants consider listed players as transparent as well as good to deal with.

Let’s look at some of the Australia-based companies, well renowned in their respective sectors, that are planning to debut on the Australian Securities Exchange (ASX) shortly.

ARMnet Limited

Technology company, ARMnet Limited offers global Integration-Platform as a Service (iPaaS) and cloud-based platform as a service for the financial services industry, with a key focus on the non-bank lending segment. From software integration, automation to workflow solutions, ARMnet addresses each processing phase of assets for these financial services organisations, helping them to get the most out of their business.

As per ARMnet, data integration and capturing of workflows empowers a client and ensures:

- A quick, secure and highly scalable solution.

- Elimination of disparate systems and data resulting in cut-back in time and cost.

- Fast deployment plus reduced software coding and reporting to smart devices.

- Deletion of human touch points in stages of processing a product.

- Elimination of data silos which prevents different departments from obtaining critical business insights.

- Tracking, reporting and processing of assets with touch points located across the front, middle and back office.

- Retrieval of flexible reporting metrics, more analysis and business intelligence insights which in turn improves efficiency and consistency across an organisation.

Leadership: The company is led by experienced and distinguished professionals including Nick Brookes as Non-Executive Chairman and David Grey as Managing Director and CEO of ARMnet. The other Non-Executive Directors of ARMnet are Alan Beasley and Brendan Dickson.

Mr Brookes holds experience in successfully managing growth businesses in trusteeship in the areas covering high net worth ?nancial services, superannuation and managed funds at both the Chief Executive and Board levels. Mr Grey holds an experience of more than 30 years across management, corporate and financial services including working on several cross-border transactions in the US, Britain, Germany as well as Singapore.

Subscription Offer: The company is seeking to raise $ 11 million on the Australian Securities Exchange (ASX) through the issue of ordinary fully paid shares at $ 0.20 each with the offer expected to close on 19 February 2020. The shares would trade under the security code AR1 and the proposed listing date is 26 February 2020.

WAY2VAT

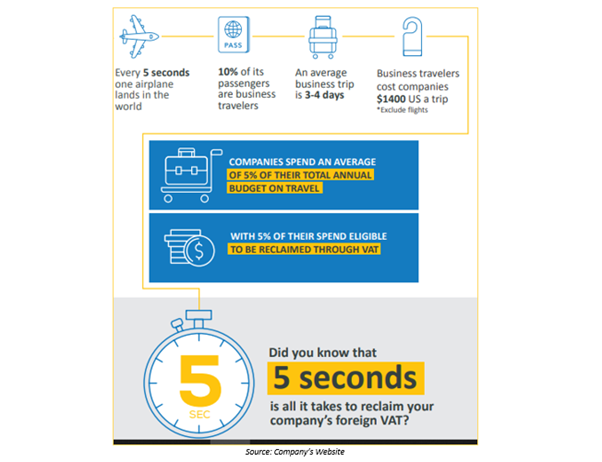

WAY2VAT, powered by its patented and revolutionary artificial intelligence (AI) technology and AIA (Automated Invoice Analyzer) capabilities, offers a fully-automated end-to-end VAT reclaim solution and an expense management ecosystem for invoice capturing, report generation, submission and recovery. This helps in boosting efficiency as well as operational speed, thereby resulting in up to 30 per cent more in reclaimed VAT by businesses. WAY2VAT's service is accessible on both smartphones and web in different languages and across different countries, globally.

The company serves hundreds of customers including Fortune 500 companies across the globe, with 97 per cent success rate recorded so far in VAT reclaims.

Some of the challenges faced by people frequently traveling to foreign countries may include the complicated and manually-processed nature of VAT reclaim, or unawareness about the applicability of VAT reclaim on both travel and goods, difficulty in deciphering VAT receipts and invoices that may be in a foreign language and/or currency, and formatted in unfamiliar and inconsistent ways.

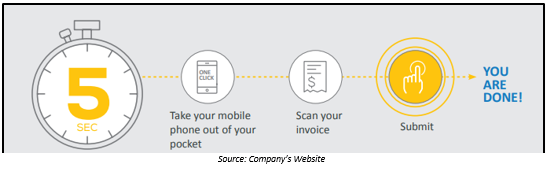

With WAY2VAT’s “One- Click” expense management solution, it takes only 5 seconds to get the job done.

Subscription Offer: The global financial technology company has announced its plans to make a debut on the Australian Securities Exchange (ASX) with its Initial Public Offering (IPO) due next month. As reported by some media houses, the company is aiming to raise as much as $ 15 million with the issue of fully paid ordinary shares at $ 0.20 a share, depicting a pre-money enterprise value of $ 45 million.

Presently, a roadshow is being conducted to promote WAY2VAT to potential investors.

Emerald Clinics Limited

Emerald Clinics is a healthcare technology and services company that operates a network of specialist medical clinics and utilises its purpose-built software and technology to gather clinical data from consenting patients. Consequently, the anonymised data is commercialised as clinical evidence. The company’s mission is centred around learning from the experience of every patient that has exhausted conventional treatments.

Real World Evidence (RWE) is a clinical evidence derived from medical and patient data collected during the routine clinical care of patients, which subsequently helps in assessing the effectiveness of interventions.

Real World Data (RWD) allows for data to be collected across a diversity of diseases, co-morbidities and demographics that are often excluded when it comes to randomised controlled trials (RCTs), which evaluate the efficacy of an intervention, in a carefully selected cohort, rather than RWD which determines effectiveness in a normal population. Thus, RWD and RWE are particularly playing an increasingly important role in healthcare decisions, globally.

Leadership: Emerald Clinics has some really passionate and experienced healthcare professionals on its Board and Management Team. With over 20 years of experience in working with medical technology and biotech companies, Dr Stewart Washer is Executive Chairman at Emerald Clinics and also a current Chairman at Orthocell Limited (ASX:OCC) and Cynata Therapeutics Ltd (ASX:CYP).

Clinician scientist, Sir Professor John Tooke, is a Proposed Non-Executive Director. He has worked as a consultant physician for around thirty years in the industry.

Other Board members include Managing Director Dr Michael Winlo, Executive Director Dr Alistair Vickery, and Non-Executive Director Mr Matt Callahan.

Subscription Offer: Emerald Clinics had lodged a prospectus dated 11 December 2019 with the Australian Securities and Investments Commission (ASIC) to raise around $ 8 million (before costs) through the issue of up to 40 million fully paid ordinary shares at an issue price of $ 0.20 each. The offer was scheduled to close on 17 January 2020. The proposed listing date is 7 February 2020 while the shares would be trading under the security code EMD.