Amidst squeezed wages, challenging labour market, declining corporate profits with businesses continuously prone to global slowdown fears and fluctuating investment returns, individuals are increasingly becoming conscious of financial independence to meet modern lifestyle necessities, retirement planning, house purchase, educational and travel expenses to name a few.

Financial independence can be expressed as an individualâs position wherein one is able to do what one desires without primarily worrying about money. This breaks down into having enough resources at oneâs disposal to meet expenditures as well as meet future financial goals. What takes one to be financially independent is the right planning, and a discipline to stick to the right plan- which requires strategic thinking, patience, and some sacrifice!

For a majority of people, one of their personal finance goals is to ultimately achieve financial independence.

So, when does one grow to be independent, the financial way?

The answer is simple- when one has saved enough to support his/her current living and spending habits for the remainder of their lives, without having to constantly/ sporadically work again.

It should be noted here that the true meaning of financial independence is different for everyone. For some, it could be the mere ability to purchase property, for the others it could mean transferring wealth to the next generations, while a category of people would see financial independence as a safe and well-supported retirement. What remains constant is the fact that one aims to accumulate sufficient assets to support their goal.

Money experts believe that ideally, the ones making big strides in their working years, and strategically placing plans, have a much brighter future to become financially independent, though some attain it sooner than others.

In todayâs article, we would look at few tips of the trade that could aid in oneâs plan to become financially independent. Let us begin!

Break Down Your Financial Independence Goals

Small and steady steps over time make a big difference. Financial independence is better achieved if one breaks down the big goals into smaller ones, while they do everything that automates savings and makes the financial independence journey easier.

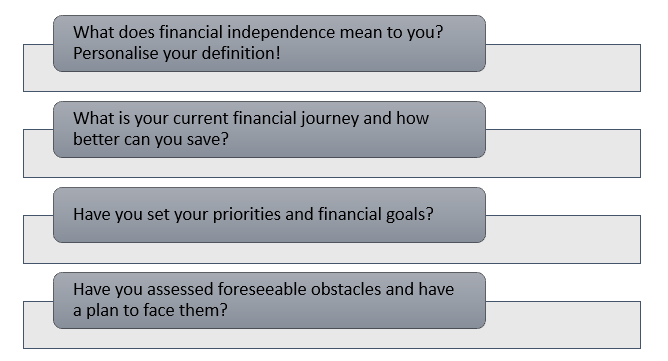

To begin with, one should ideally ask themselves the following questions, and then move onto the tips that we have provided in the later part of this article:

Once you have answers to the above, streamlining the process of financial independence would be relatively easier.

Tips To Become Financially Independent

DISCLAIMER: As there is no dictionary definition of financial independence, and the term has inferences relevant to self, we encourage you to regard the below as tips, and not formulas to success:

A successful retirement is a great example of financial independence, as post retirement one is no longer dependent on regular income from an employer. However, the difference between conventional retirement and financial independence converges to few vital components: timing, planning, diligence, discipline and sacrifice.

So, what one may practice to secure his/ her financial independence?

- Set Financial Priorities

The most crucial step towards ensuring financially independence is to realise and conclude oneâs financial priorities. Periodic amendments and revisions, reviewing of financial plans and goals increase chances of achieving them. Once expectations are known, it gets easier to accumulate funds for them, exclusively.

- Manage Cash Flows

Making good money but spending exhaustively ceases the chances for one to achieve financial independence, because this set of people cannot vigilantly handle their spending.

Managing cash flows refers to spending less money than one makes, and this is when concepts of household budget creeps in. Budgets aid people to become as efficient as possible with every dollar they plan to spend, and once the spending is considerably less, savings gradually fill in the financial independent pocket.

- Invest With Discipline

Discipline in any field results in success and achieving long-term goals. Except for emergencies and uncalled sudden expenses which cannot be ignored and remain an inevitable element of lives, one should ensure to discipline their investments, to accumulate savings and avoid over-spending.

- Avoid Debt

Mounting debt is perhaps the biggest hurdle to attaining financial independence. Having said this, making purchases on credit and paying high interest charges also forms part of debt, when one is on the route to become financially independent. One should therefore be prudent and realistic about what they can afford and avoid assuming unnecessary debt.

- Huge Expense Management

Property, vehicle, education, insurance are huge expenses that if strategically incurred, appropriately managed and reduced as and when possible, gets one much closer to their financial independence goal.

Moreover, experts advise that one should have an adequate financial safety net that can help cope with surprise expenses like car maintenance, home repairs, or health expenses. Investing in a diversified, long-term investment strategy is also advisable as it helps the wealth to build, compound, and ultimately reach oneâs objectives.

One may choose to save in bank deposits or invest in attractive asset classes depending on return expectations and risk profile. Professional help of traditional financial advisors or robo-advisors can be sought for planning assistance.

ALSO READ: Long-Term Financial Independence in Equity Market

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.